HBAR Traders Eye $0.199 as Bullish Sentiment Grows

The resurgence of wider market activity in the last 24 hours has triggered an increase in bullish prejudices towards Hedera (Hbar), traders more and more on other price gains.

The long / short ratio of Hbar climbed to its highest level last month, signaling a change in the positioning of traders.

Haussiers bets push hbar to the territory of escape

Hbar’s long / short ratio is currently 1.09, its highest level in the last 30 days. This indicates a strong increase in the demand for long positions among merchants derived from Hbar on Wednesday.

The long / short ratio of an asset measures the proportion of its long positions (Paris on price increases) to short positions (Paris on price reductions) on the market. A report lower than one means that there are more short positions than long.

Conversely, as in the case of Hbar, a long / short ratio reading above one indicates that traders are mainly optimistic about Altcoin and open bets in favor of an extended price rally.

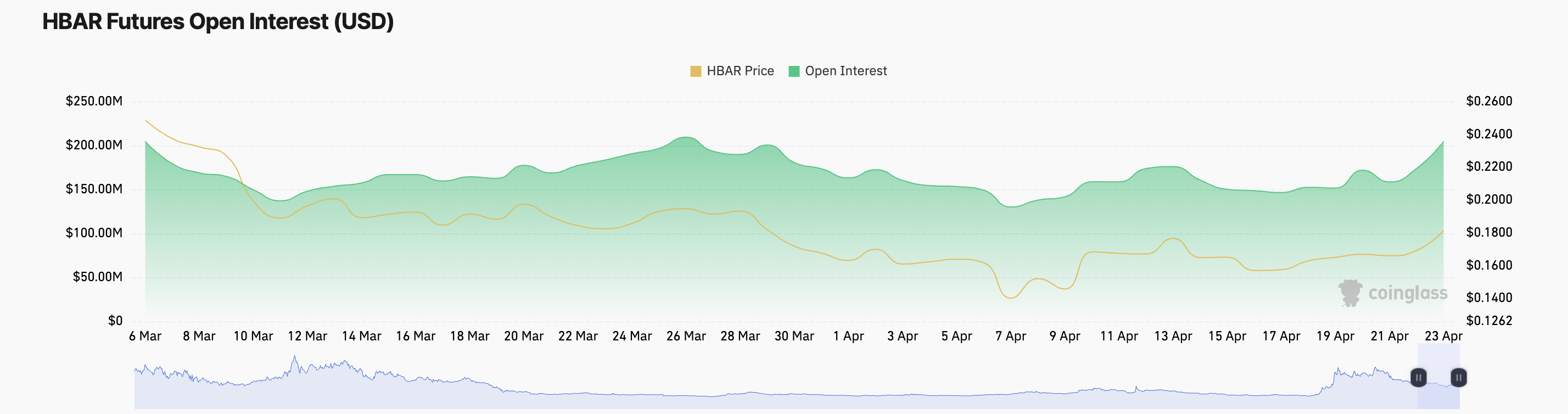

In addition, the rise of Hbar in the long term open confirms the renewed request for Altcoin. At the time of the press, it was $ 205 million, climbing 18% in the last day. The value of Hbar is up almost 10% during the same period.

The open interest refers to the total number of current contracts in progress which have not been settled. When open interests increase next to the price like this, this indicates that new funds enter the market to support the upward trend. This trend signals a strong condemnation behind the upward movement of Hbar.

Can Hbar explode? Traders look at $ 0.199 as the next key level

To date, Hbar is negotiated at $ 0.187, resting above the resistance formed at $ 0.190. If demand is strengthened and Hbar Bulls changes this price level in a support floor, the token could prolong its upward trend and climb $ 0.199.

On the other hand, if Hbar Bears regains market control, this bullish projection will be invalidated. In this scenario, the token could lose its recent earnings and fall to $ 0.153.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.