HBAR Whales Accumulate Over 60 Million Tokens: Why the Price Still Isn’t Responding

The Hedera Hbar token is up almost 2% today, but the broader trend still seems fragile. During last week, Hbar fell by almost 10%, and its overall structure continues to raise questions.

Despite the layer 1 network, designed for business quality applications, showing light bulls and an accumulation of heavy whales, the price has not managed a convincing movement up.

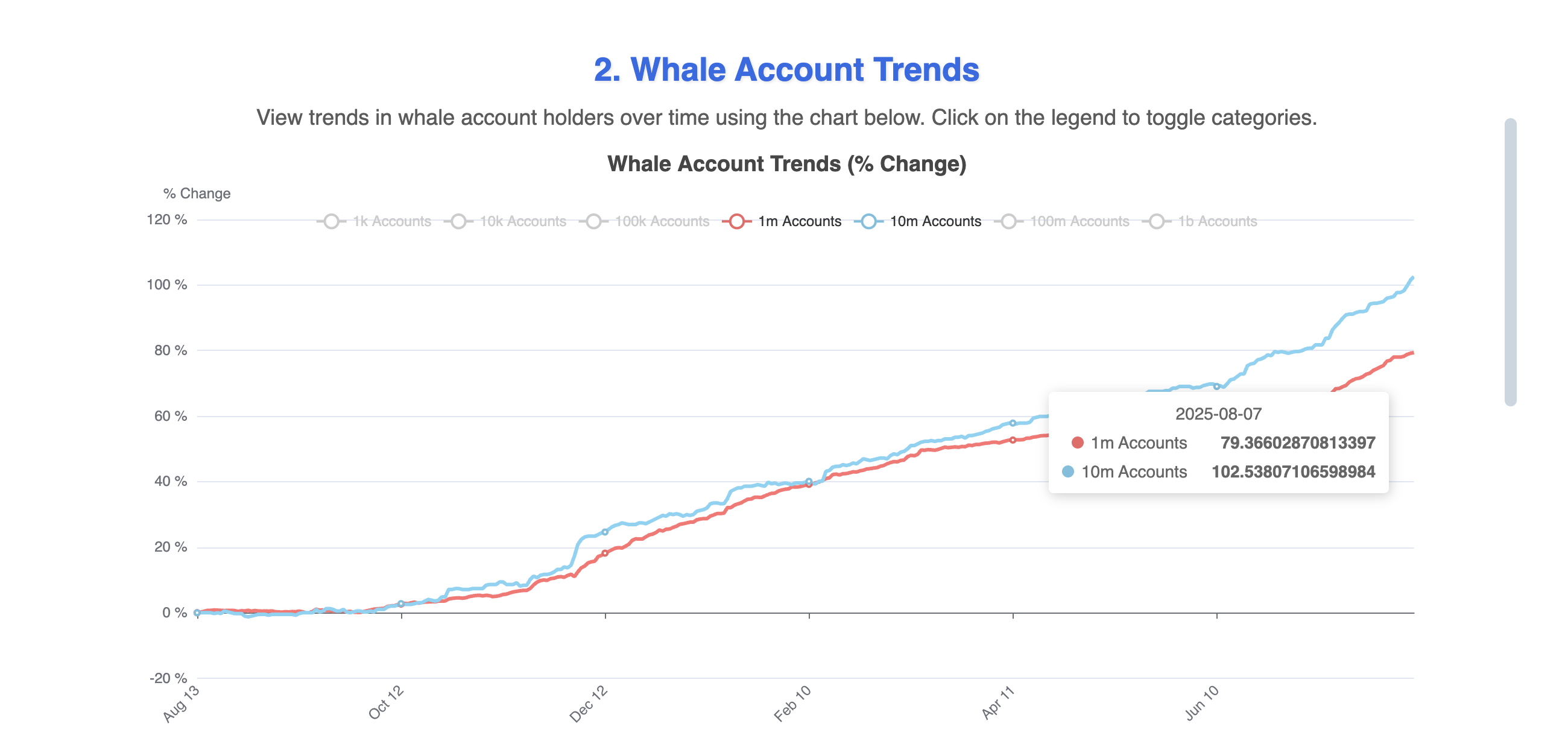

Whale wallets continue to grow, but Hbar price stands

In the past three weeks, whale wallets holding between 1 million and 10 million Hbar have regularly increased. From early August, these cohorts of wallets went from 77 and 96 to 79 and 102, respectively. This alone represents a minimum of 62 million tokens impregnated with the food in circulation, assuming the lowest maintenance threshold by wallet.

At the same time, net exchange flows remained negative throughout the month of August and even half of July. This generally indicates a crunch of supply while tokens move from exchanges in self-degusting wallets. However, the price did not respond to this bullish behavior.

A possible reason? These outings can be fully focused on whales. In other words, whales can run Hbar exchanges in cold storage; Accumulation, yes, but without a new demand from the market. No participation in detail, no price lift.

For TA tokens and market updates: Do you want more symbolic information like this? Register for the publisher Daily Crypto newsletter Harsh Notariya here.

Retail and smart money are still not convinced

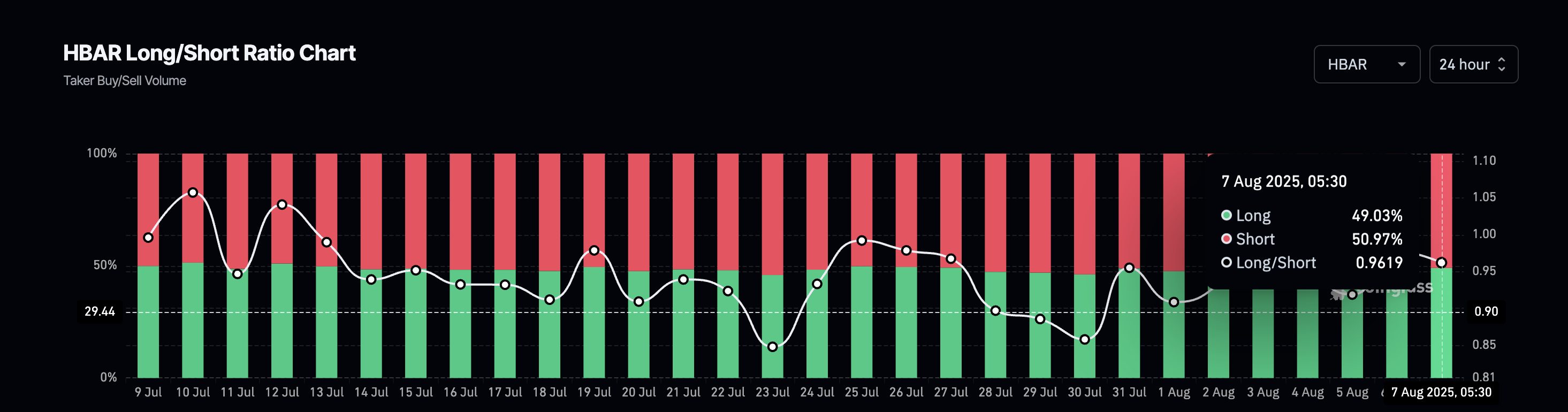

This theory checks when you look at the broader feeling. The long / short ratio shows that 50.97% of the positions are still in short hbar. This short bias is minimal, but it still means that the market is betting against the price increasing.

Without a clear rotation of traders who return for a long time or new buyers working, Hbar continues to fight for the momentum. Even with bruising supply signals, the feeling remains lower. Until the short -term conviction, the retail trade can sit on the sidelines.

CMF divergence adds pressure to the upward triangle and at the Hbar price

Technically, the Hbar price is still held above the ascending trend line visible on the graph of 2 days. But there are cracks that are formed. The monetary flow indicator of Chaikin (CMF), which measures the dynamics of financing entries, has printed lower summits, even if the price has attempted higher peaks.

This divergence suggests discoloring the purchasing force, a red flag. And that aligns with the lack of retail and the participation of smart money.

If the price fails to exceed the resistance zone of $ 0.26, the reason could lose steam. A movement less than $ 0.23 would invalidate the current structure, confirming that intelligent money does not advance Hbar despite the accumulation led by whales.

However, if the upper trend line of the triangle is raped, followed by the Hbar price recovering $ 0.30, we could expect all the lowering feelings to disappear in the air. This would also trigger the possibility of a new Hbar price rally.

Post-Hbar whales accumulate more than 60 million tokens: why the price still does not respond to Beincrypto.