Hedera (HBAR) Stuck in Range as Market Uncertainty Grows

Hedera (Hbar) increased by 3.3% in the last 24 hours, bringing market capitalization to $ 8.06 billion and its negotiation volume to almost $ 127 million. Despite the short -term price bump, technical indicators have a mixed image.

The BBTREND has again become strongly negative, while the RSI rebounded in a neutral area after the recent volatility. Hbar continues to be negotiated in a tight range, and its next movement may depend on whether it can break the resistance at $ 0.193 or maintain support almost $ 0.184.

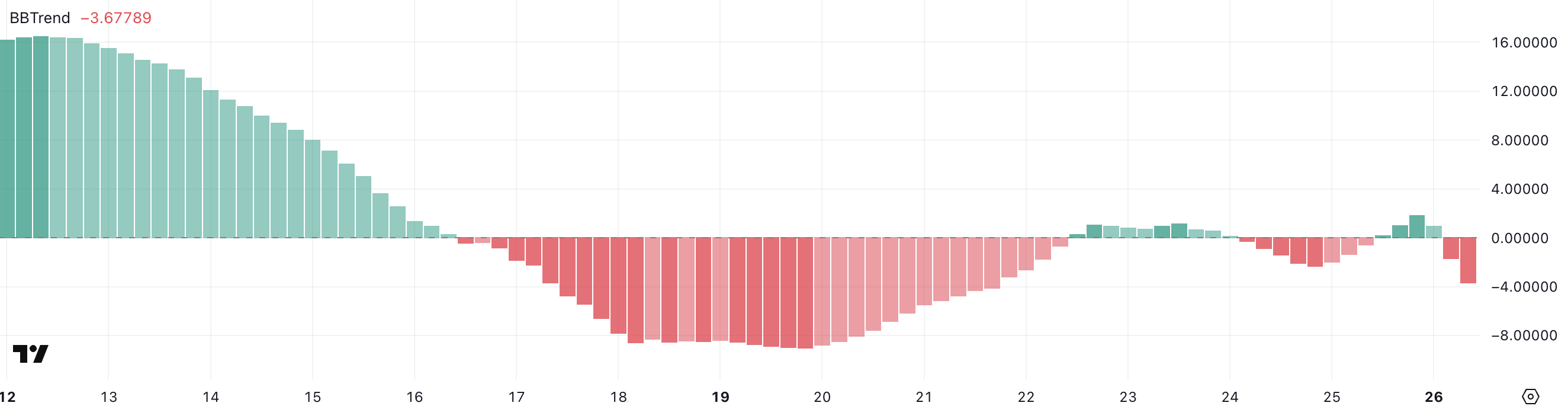

Hbar Bbtrend becomes negative again: what it means

Hedera Bbtrend is currently at -3.67, signaling a downward pressure renewed after a brief recovery.

The metric had climbed to 1.84 yesterday, reflecting a short -term momentum before turning suddenly on a negative territory.

This volatility suggests that the feeling of the market around Hbar remains unstable, with rapid changes in the positioning of traders and potential uncertainty around the short -term price department.

Bbtrend, or Bollinger Band Trend, measures the strength and direction of the price movement compared to the Bollinger bands. The values above +2 generally indicate a strong upward momentum, while the values lower than -2 reflect strong lower trends.

A bbtrend reading of -3.67 suggests that the Hbar price is considerably leaning towards the lower Bollinger group, often interpreted as a persistent drop momentum.

If the feeling does not change soon, it can involve continuous sales pressure or a possible remedy for recent support levels.

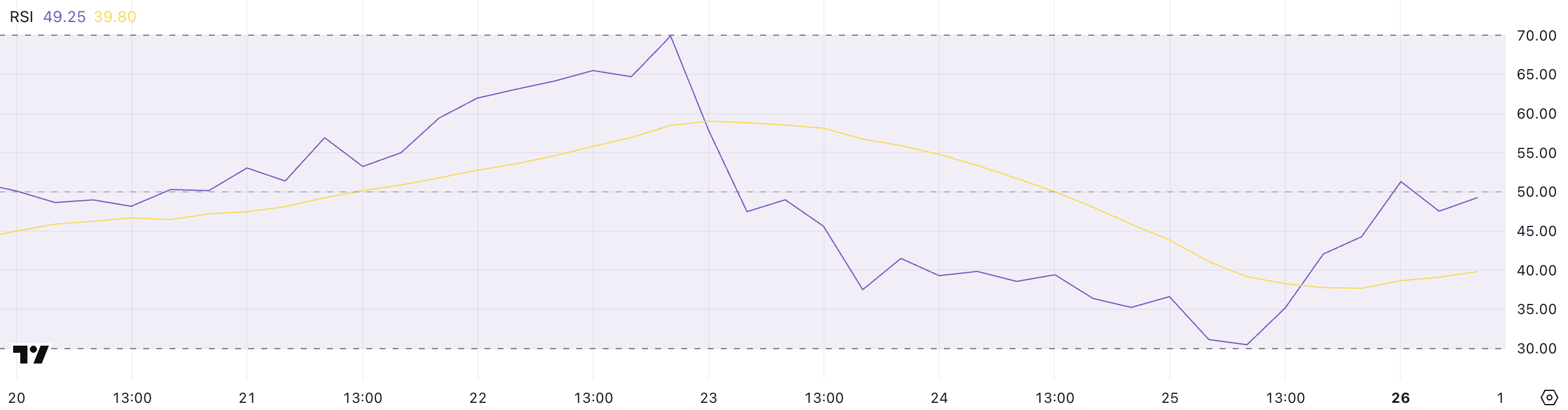

Hedera RSI recovers the neutral area after a volatile swing

The Relative resistance index of Hedera (RSI) is currently at 49.25, recovering from a minimum of 30.46 just a day ago.

This rebound occurs after the RSI has almost reached over -rascal levels at 69.91 four days ago, highlighting a volatile momentum.

The recent rebound in the territory close to the Oversed to a more neutral area suggests that the downward pressure has been held, but the conviction among buyers remains limited for the moment.

RSI is a momentum oscillator which measures the speed and variation of price movements on a scale of 0 to 100.

Readings greater than 70 generally indicate over -rascal conditions, while the values less than 30 suggest that an asset is occurred and may be due to a rebound.

The Hbar RSI at 49.25 signals a neutral position on the market – neither strongly optimistic nor Baisans – by impressive that the following directional movement could depend on wider market signals or future catalysts.

Can Persport Prix: Can the bulls break the barrier of $ 0.20?

In recent days, Hedera has consolidated in a narrow range between $ 0.183 and $ 0.193, showing limited volatility but pointing out potential accumulation for break.

If the bullish momentum returns, Hedera Price could go out above the resistance level of $ 0.193, opening the path to $ 0.20.

A sustained rally could push the price further at $ 0.209 and, in a stronger rise, perhaps up to $ 0.228 – levels that have previously acted as resistance areas.

However, the EMA lines currently offer little directional information, reflecting the indecision of the strength of trends.

If the sale pressure increases and Hbar does not hold the level of support of $ 0.184, the token could decrease around $ 0.169, a level which would represent a deeper retirement.

Until a breach or clear ventilation occurs, the action of Hbar prices should remain linked to the beach, merchants closely monitoring any confirmation of the trend.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.