Hedera (HBAR) Turns Bullish as Bearish Pressure Eases

Hedera (Hbar) has increased by more than 6% in the last 24 hours while trying to recover the market capitalization of $ 8 billion. Its negotiation volume jumped from 19% to almost $ 176 million, showing a renewal of interest.

Key indicators are mixed. The Bbtrend remains lower, but the RSI and Ema lines suggest an increasing upward impulse. A golden cross could soon be formed, and Hbar is approaching key resistance levels. Its next movement could confirm whether a break or a withdrawal arrives.

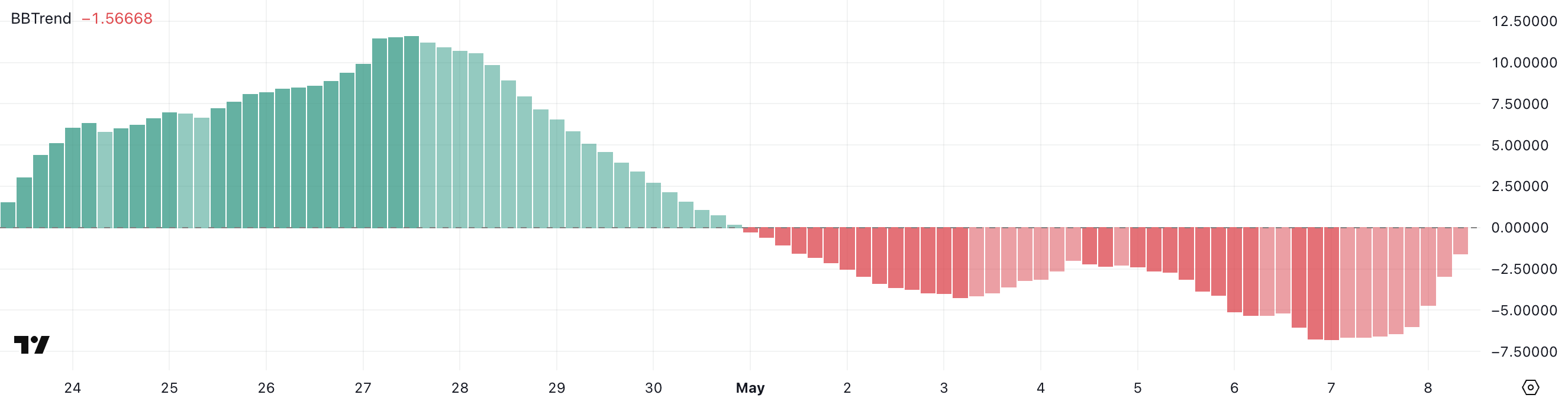

Hedera Bbtrend remains negative – is the worst?

The Bbtrend indicator of Hedera is currently at -1.56 and has remained in negative territory since May 1. He reached a hollow of -6.76 yesterday, marking the most lower reading in more than a month before bounced slightly today.

This negative trend in progress suggests that the downward momentum has dominated the market, even if short -term sales pressure shows signs of relaxation.

The BBTREND, or Trendy indicator of the Bollinger strip, measures the positioning of the prices compared to the Bollinger bands to determine the strength and the direction of a trend.

The values higher than +1 suggest a strong bullish momentum, while the readings below -1 indicate strong lowering conditions. A neutral beach between -1 and +1 often reflects consolidation or low trend conviction.

With Bbtrend de Hbar at -1.56, there remains a lower territory, although the rise in the extreme of yesterday suggests that the sale could lose steam.

If the Bbtrend continues to increase and crosses -1, it could point out a transition to prices recovery or at least a break in the downward trend.

Hedera approaches the excessive area after a strong rebound

The Relative resistance index of Hedera (RSI) increased to 66.2, up 31.41 barely two days ago.

This rapid increase reflects a strong change of momentum, taking hbar surveillance conditions in an area which signals an increasing upward pressure.

Such a decision often indicates that buyers intervene aggressively, reversing recent weakness and potentially preparing the way for short -term escape if the trend continues.

The RSI is a common momentum indicator which varies from 0 to 100. Readings less than 30 suggest occurring conditions and a potential rebound. The values above 70 indicate that the assets can be exaggerated and due for a decline.

Readings between 50 and 70 show an increasing force in an upward trend. The Hbar RSI is now 66.2 – closed to too hidden, but not there yet. This signals more upward potential if the momentum continues.

However, traders should monitor any signs of exhaustion if RSI crosses 70 in future sessions.

Hbar Next Move: 38% rally or 33% upcoming correction?

The EMA Hedera lines are tightening and a golden cross could be on the horizon as the short-term mobile averages approach a crossing over long-term.

This configuration is generally considered to be optimistic, which suggests that the upward momentum could soon be strengthened. If the Golden Cross confirms and hedera the price exceeds resistance levels of $ 0.191 and $ 0.199, the following targets could be $ 0.215 and $ 0.258.

A gathering at these levels would represent a potential at 38% of current prices.

However, if Hbar fails to unravel the resistance zone of $ 0.19, it could face a withdrawal.

A drop to support at 0.175 would be the first test, with deeper drops possible to $ 0.160 and $ 0.153 if the sales pressure is intensifying.

Hbar could fall as low as $ 0.124 in a high downward trend, marking a possible correction of 33%.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.