Hedera Slumps After 40% Drop – Can HBAR Recover?

Hedera (Hbar) exceeded $ 0.21 in the past 24 hours. However, he always tries to recover from a 40% correction in the last 30 days. Despite this short -term rebound, the technical indicators suggest that the bearish momentum remains under control.

ADX readings indicate that the current trend lacks strength, while the configuration of the clouds of Ichimoku reinforces this dominant resistance. The EMAs always pointing out a downward structure, Hbar faces key levels that could determine if it continues to recover or risk more.

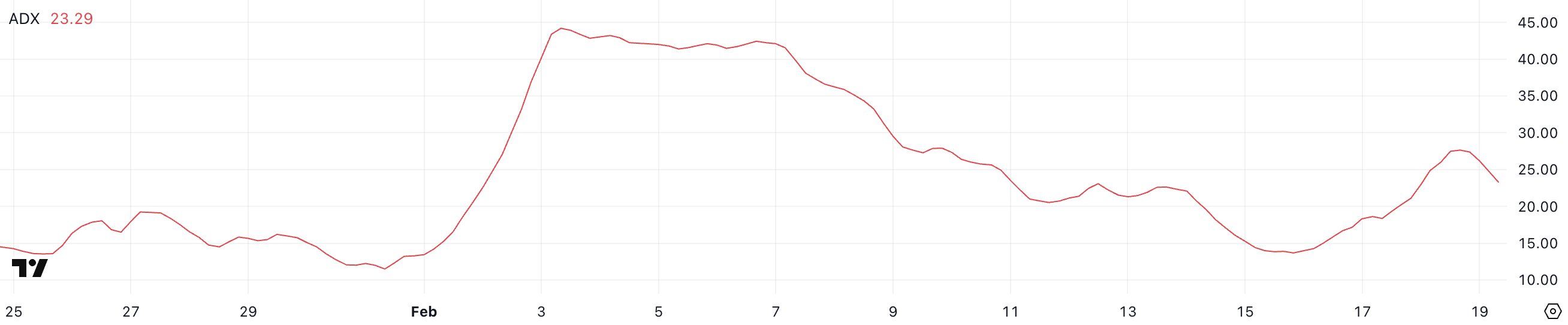

Hbar Adx shows that the current trend is not so strong

The Hedera ADX is currently at 23.2, compared to 27.4 yesterday after reaching 13.8 only four days ago. This recent point, followed by a slight decrease, suggests that the strength of trends has increased but now loses a certain momentum.

ADX measures the overall strength of a trend, not its management. While Hedera has tried to drop from a downward trend in an upward trend, the current decrease in ADX indicates that this transition is not yet firmly established.

For a strong upward trend to develop, ADX should hold above 25 and continue to increase.

The average directional index (ADX) Manage therapy resistance to trend on a scale from 0 to 100. Readings above 25 indicate a strong trend, while values below 20 suggest a low price action or linked to the beach .

Hedera Adx at 23.2 places just below the threshold of a strong trend, which means that even if a momentum has accumulated, it has not yet confirmed a final change towards an upward trend. If ADX begins to climb and goes beyond 25, this could point out that the purchase of pressure is strengthened and that the overthrow is gaining ground.

However, if he continues to decrease, this may indicate that the recent attempt to get out of the downward trend is to lose steam, leaving Hbar vulnerable to additional consolidation or even a renewed drop.

The Hbar Ichimoku cloud shows a downstream configuration

The Ichimoku cloud table for Hedera remains in a downstream configuration, with the price below the red cloud. These signals continued the momentum. The cloud (kumo) is thick and projected to remain red, indicating strong resistance to come and suggesting that the downward trend is always intact.

Tenkan-sen purple (conversion line) is now positioned under the Kijun-Sen orange (basic line). This reflects the absence of a confirmed bullish reversal.

However, the price managed to climb over Tenkan-Sen Violet. This signals a short -term recovery attempt, although it remains insufficient to confirm a change of trend.

The Green Chikou Span (offset line) remains well below the price and the cloud, showing that the Hbar market is always faced with the residual lower pressure of the action of previous prices.

For a significant tendency reversal, the price should break above the Kijun-Sen orange and possibly move to the cloud, reducing the influence of the lower momentum. If Hbar can go beyond the cloud and turn it over in green, this would indicate a potential change towards an upward trend.

Until it happens, the configuration of Ichimoku suggests that Hbar is still struggling to gain in force. Thus, any ascending movement requires additional confirmation before reporting sustained recovery.

Hedera can fall by an additional 42% if the downward trend is strengthened

The EMA lines of Hedera suggest a lower configuration, with short -term mobile averages positioned below those in the long term. This strengthens the current tendency in progress.

This alignment indicates that the sale pressure remains dominant, which makes Hbar difficult to establish a significant recovery unless the momentum changes. The price is currently close to a key support level of $ 0.17. If this level is tested and lost, Hbar could face a deeper decline to $ 0.12, marking a potential correction of 42% compared to current levels.

EMAs always tend to decrease, all short -term rebounds should be encountered by sustained purchase pressure to question the existing downward structure.

However, if the price of Hedera can reverse the trend and the short -term EMAs start to cross the longest, this could resume the bullish momentum.

In this case, the first major resistance to watch is $ 0.25. If this level is broken, Hbar could continue to climb to $ 0.35.

A sustained rise trend could even push Hbar to $ 0.40, which was last seen in mid-January. This would represent a 90% increase in current prices.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.