Hong Kong hoses down stablecoin frenzy, Pokemon on Solana: Asia Express

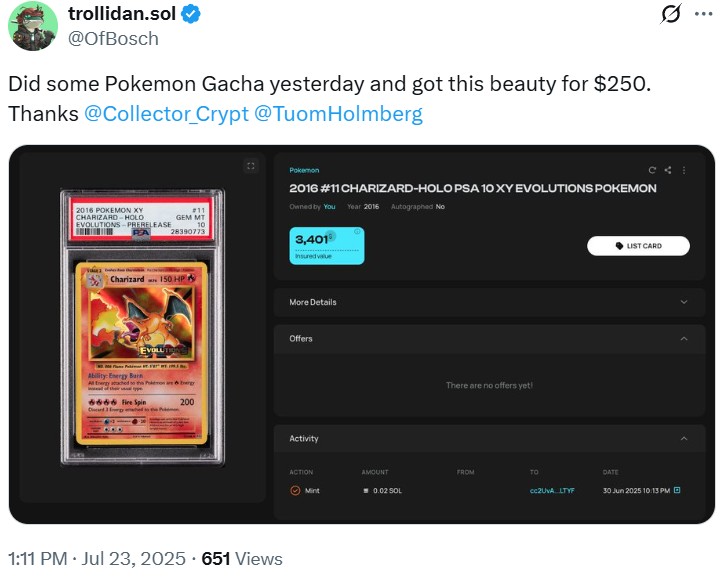

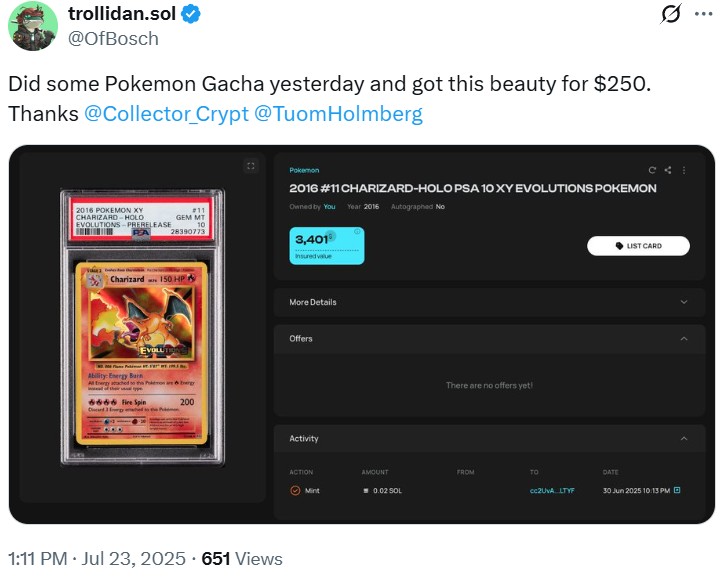

The Pokémon tokenized card market is gaining momentum in Solana

The tokenization of physical collector objects is quietly growing, with Pokémon cards based on Japanese game and the world’s popular animated franchise emerging as a case of out -of -competition use. On Solana, a new wave of platforms transforms active active people (RWAS) such as Pokémon cards into non-buttons (NFTS).

One of the main platforms of this niche is collector Crypt, which treated almost $ 95 million in total volume in less than a year, according to a dashboard of an analytics by the user X Zkayape. The platform specializes in the Pokémon cards of tokenizing in NFT, each of which is claimable to be exchangeable for their physical counterpart. A large part of the activity is motivated by its Gacha Numérique feature, inspired by the automatic distributors of Japan capsules, where users test their luck by exchanging a fixed sum of money for randomized items.

These platforms work like the onchain versions of Japanese oripa stores (abbreviation of “original pack”), which combine the game of blind boxes with instant resale opportunities. The blockchain versions improve this model by offering automated redemptions at 80 to 85% of the value of the card, allowing collectors to pursue rare cards with almost instant liquidity.

“The activity of the secondary market also increases and although it is even smaller than Gacha, it recorded market volumes totaling up to $ 440,000 as a sector,” said Zkayape on X.

“Emporium recorded sales of $ 11.3,000 for the Mario Pikachu card and a better sale of $ 9.3,000 has also been recorded on Collector Crypt for a recently Pikachu Poncho card.”

FTX creditors in China can go to a backpack to recover their money

Backpack Exchange launched a complaint sales channel for FTX creditors in China, offering an alternative route to access funds in the middle of delays in formal payments.

The Backpack canal operates independently of the bankruptcy procedure in the FTX domain. Instead of treating the buyouts, the backpack allows creditors – in particular those facing restrictions confronted with restrictions – to sell their complaints to an “independent institutional buyer”.

On July 2, the FTX Recovery Trust filed a request by freezing the payments to the creditors in a list of 49 “limited” jurisdictions, including China.

FTX Franc, Sunil Kavuri’s creditor, said that around $ 470 million in complaints belong to these limited courts, Chinese investors representing the majority of the pie with $ 380 million. About 70 objections were deposited against the attempted succession to retain payments, mainly Chinese creditors.

Since the announcement of Backpack on July 18 which launched its complaint sales portal, users have shared screenshots showing successful withdrawals of funds which have been inaccessible since the collapse of the FTX. A user said his recovery had reached a 10%discount.

Backpack used similar strategies to attract former FTX customers. In May, the exchange opened complaints for FTX UE users, which allows them to buy the sales in euros after finishing the verifications of Know-You-Customer (KYC). The backpack acquired FTX in January 2025.

The next series of official distributions from the FTX creditor is expected to start on September 30.

Read

Features

The `Deflation ” is a stupid way to approach tokenomic … and other sacred cows

Features

Banking the Unbanked? How I taught a total foreigner in Kenya on Bitcoin

Tokenize to leave Singapore after the degree refusal

Another exchange of cryptocurrency is to get out of the increasingly selective Singapore regulatory regulation. The Times Straits reported on July 20 that Tokenize Xchange closes operations by September 30, after the monetary authority of Singapore (Mas) refused to grant him a crypto license.

Tokenize raised $ 11.5 million in 2024, intended to extend its workforce. However, all of his Singapore team of 15 people will now be released.

Tokenize joins an increasing list of companies leaving the city of Lion, moving staff and resources in Malaysia. The company would also have said that it would request regulatory approval from the World ABU Dhabi market of the United Arab Emirates (Water).

The Central Bank set a deadline of June 30 for all cryptography companies to be under license, even if they only served users abroad and refused service to local users.

The local point of sale estimates that around 500 cryptography professionals will move from Singapore to more permissive jurisdictions like Hong Kong or the United Arab Emirates.

Hong Kong’s euphoria must calm down

Only a few transmitters will be authorized under the new Hong Kong regime, said the city’s de facto central bank, warning investors not to fall into excessive, wave proposals or fraud.

With the stable prescription which should take effect on August 1, the best financial regulator in Hong Kong rings the alarm compared to the euphoria of the assembly market and the disinformation surrounding the stablecoin license regime of the city of the city.

In a blog post of July 23, Eddie Yue, managing director of Hong Kong Monetary Authority (HKMA), said that many proposals for stalcointes received so far remain “too idealistic” and lack of concrete use, technical skills or viable implementation plans. While dozens of institutions have contacted HKMA to express their interest in becoming approved issuers, Yue said that only a few privileged people would cut.

Read

Features

Cleaning the crypto: how much app is too much?

Features

Cryptographic whales like Humpy are Dao Gaming votes – but there are solutions

“Earlier, we clearly declared that, in the initial stadium, we will give the most a handful of stable issuer licenses. In other words, a large number of candidates will be disappointed,” wrote Yue.

Caution intervenes in the middle of a growing trend in listed companies using stablecoin waves to increase stock prices and the volume of negotiation. Yue said that some companies have seen overvoltages in stock activity simply by declaring plans to explore Stablecoin’s affairs, even without clear roadmaps.

He urged investors to “stay calm and exercise an independent judgment” in the evaluation of these market news, warning that speculative behavior could turn against him. “The quantity of Stablecoin emission business can contribute to the short-term profitability of the company is somewhat uncertain,” he said.

Yue added that the HKMA observed fraudulent diets disguised as promotions of Stablecoin, which have already caused public losses. Under the stable prescription, offering a stablecoin (FRS) referenced without license (FRS) to retail investors or marketing it from the public of Hong Kong will become illegal from August 1.

Get down

The most engaging can be read in the blockchain. Delivered once a week.

Yohan Yun

Yohan Yun has been a multimedia journalist covering the blockchain since 2017. He has contributed to Crypto Media Outlet Forkast as an editor and covered Asian technological stories as an assistant journalist for Bloomberg BNA and Forbes. He spends his free time cooking and experimenting with new recipes.