Housing Regulators to Test Bitcoin Mortgages

Welcome to the morning briefing of the US Crypto News – your essential overview of the most important developments in the crypto for the coming day.

Take a coffee for an interesting reading, because the crypto could come to your mortgage. The American housing regulator now explores how Crypto could be qualified as a guarantee in mortgage requests, signaling a potential upheaval in the way the Americans buy houses in the digital age.

Crypto News of the Day: Us Housing Regulator to study the mortgages supported by Bitcoin

Beincryptto’s recent Crypto News coverage highlighted the growing Bitcoin call compared to treasury bills or obligations. Now, regulators are considering crypto for mortgage guarantees in America.

Bill Pulte, director of the United States Federal Housing Finance Agency (FHFA), announced that the regulator will start to study how cryptocurrency titles could be used to be qualified for mortgages.

While Pulte’s commitment reports a change in potential policy, the details on the implementation remain vague for the moment.

However, with mortgages supported by Crypto, borrowers can use digital assets like Bitcoin as a guarantee instead of selling them for Fiat. In practice, the borrowers drop their crypto from a lender, who locks them for the lending time.

In return, the borrowers receive a Fiat mortgage to buy a house, the crypto as a secure support. The borrowers keep the property of the cryptography if the reimbursements are made in time and the value of the guarantees is valid.

Notwithstanding, this decision represents a notable change for FHFA, which oversees the main entities such as Fannie MAE, Freddie Mac and federal real estate loans.

The famous defender of cryptography and investor Anthony Pose-Possiano praised the move as intelligent, given that he could bring bitcoin and stablecoins in the evaluations of the consumer housing credit.

In particular, as Poseliano, Pulte is also a supporter of vocal cryptography. Recent financial disclosure indicates a portfolio between $ 5001 and $ 1 million Bitcoin and Solana.

Michael Saylor offers a microstrategy bitcoin credit model to guide mortgage risk assessment

However, volatility remains a key risk. If Bitcoin or another asset used as a guarantee drops considerably prices, the borrower can face a “margin call”. This would force them to recharge their warranty to avoid liquidation.

“OMI, stablecoins should absolutely be considered as equity for potential mortgage candidates. Volatile assets should probably not be,” a user disputed.

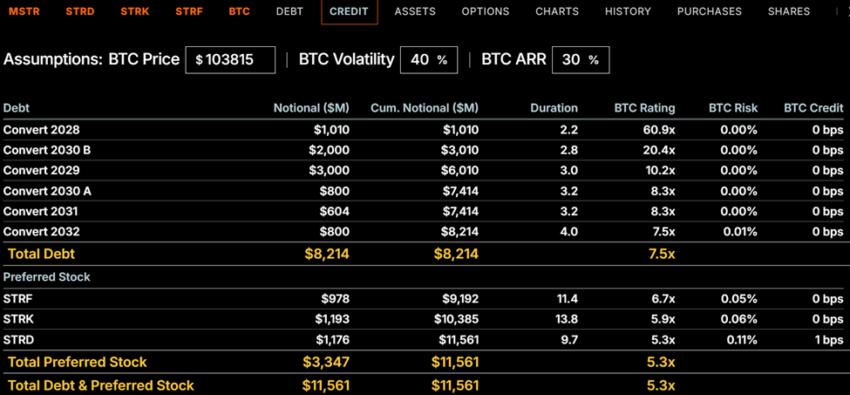

In this context, Michael Saylor proposed the Bitcoin credit framework of Microstrategy (now strategy), aware of this risk-reversal model.

Offering to share the Bitcoin credit model owner of your company with Pulte FHFA, Saylor stressed that several factors are taken into account when generating BTC statistical risks and BTC credit dissemination.

Based on the Saylor position, the Bitcoin credit model from Microstrategy calculates the credit risk using the volatility of Bitcoin prices and the duration of the loan, among other factors.

This model could transform the eligibility for mortgages to crypto holders, which can go around Fannie MAE and Freddie Mac restrictions, as indicated in a study in 2024 of the Journal of Financial Regulation.

Meanwhile, and traditionally, the use of crypto for a house purchase requires selling assets, which triggers a taxable event in the United States.

The sale of Bitcoin or Ethereum leads to a tax on capital gains, up to 37% for the best employees when they include federal and state taxes, especially in states like California. Buyers can avoid making gains and posting taxes using crypto as a guarantee instead of selling it.

It should be noted that Coinbase already allows users to borrow USDC using Bitcoin as a guarantee, avoiding asset sales and tax implications.

If FHFA approves the inclusion of crypto holders in mortgage assessments, it could gain popularity among investors with high shuttle, potentially legitimize crypto as a financial active in federal housing policy.

“When I bought a house last year, I provided a portfolio summary in Debank as proof of funds. No bank would accept such a document, but real estate agents will accept the document for cash offers,” said the same user.

More closely, for retail, this decision could unlock new ways so that they participate in the American dream without sacrificing their long -term investment positions.

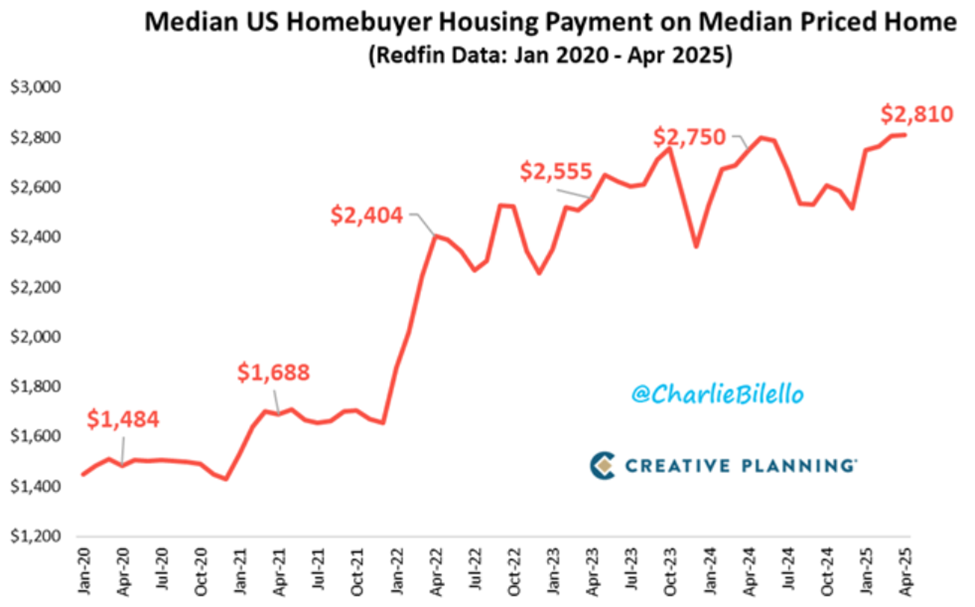

Elsewhere, investor Charlie Bilello stressed that monthly mortgage payment for the purchase of a house at median prices in the United States has increased by 89% in the past five years.

Graphic of the day

Alpha the size of an byte

Here is a summary of more news from crypto in the United States to follow today:

- Israel stops three suspects in an alleged Iranian spy plot involving cryptographic payments.

- Circle’s market capitalization reached $ 63.89 billion, exceeding its USDC supply, signaling investors’ confidence in its broader fintech ambitions.

- Metaplanet will inject $ 5 billion into its American subsidiary to accelerate Bitcoin purchases, targeting 210,000 BTC by 2027.

- Bitcoin minors sell assets while BTC has trouble maintaining upward dynamics in an increasing uncertainty of the market.

- TIA jumped 11% after the confirmation by the co-founder Mustafa al-Bassam with a treasure of $ 100 million, guaranteeing six years of operation.

- Arthur Britto, co-founder of the XRP LEDGER, broke a silence of 14 years on X with a cryptic emoji, fueling speculation in the cryptographic community.

- The activity on the Ethereum chain has dropped, the daily active addresses lowering 26% in the midst of increasing geopolitical tensions.

- OKX Europe is developing in Poland, recognizing its strong adoption of cryptography, its informed population and its favorable regulatory environment under Mica.

- The retail BTC entries in the Binance exceeded 25% on June 15, signaling a transition to trading in the middle of geopolitical uncertainty.

- Japan offers a reform of cryptography to allow FNB Bitcoin and the cryptographic taxes of Slash.

Presentation of the actions of the crypto-actions

| Business | At the end of June 23 | Preview before the market |

| Strategy (MSTR) | $ 367.18 | $ 373.00 (+ 1.59%) |

| Coinbase Global (Coin) | $ 307.59 | $ 312.98 (+ 1.75%) |

| Galaxy Digital Holdings (GLXY) | $ 18.47 | $ 18.70 (+ 1.25%) |

| Mara Holdings (Mara) | $ 14.18 | $ 14.55 (+ 2.61%) |

| Riot platforms (riot) | $ 9.27 | $ 9.47 (+ 2.16%) |

| Core Scientific (Corz) | $ 11.35 | $ 11.70 (+ 3.08%) |

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.