How Bitcoin Miners Could Drive a New All-Time High For BTC

The Bitcoin price has regularly increased, climbing approximately 4% in the last seven days. This trend reflects the improvement of market feeling and growing optimism among investors.

As the Momentum is built, key indicators on a chain point out the possibility of a rally supported during the next negotiation sessions.

Bitcoin minors hold tight

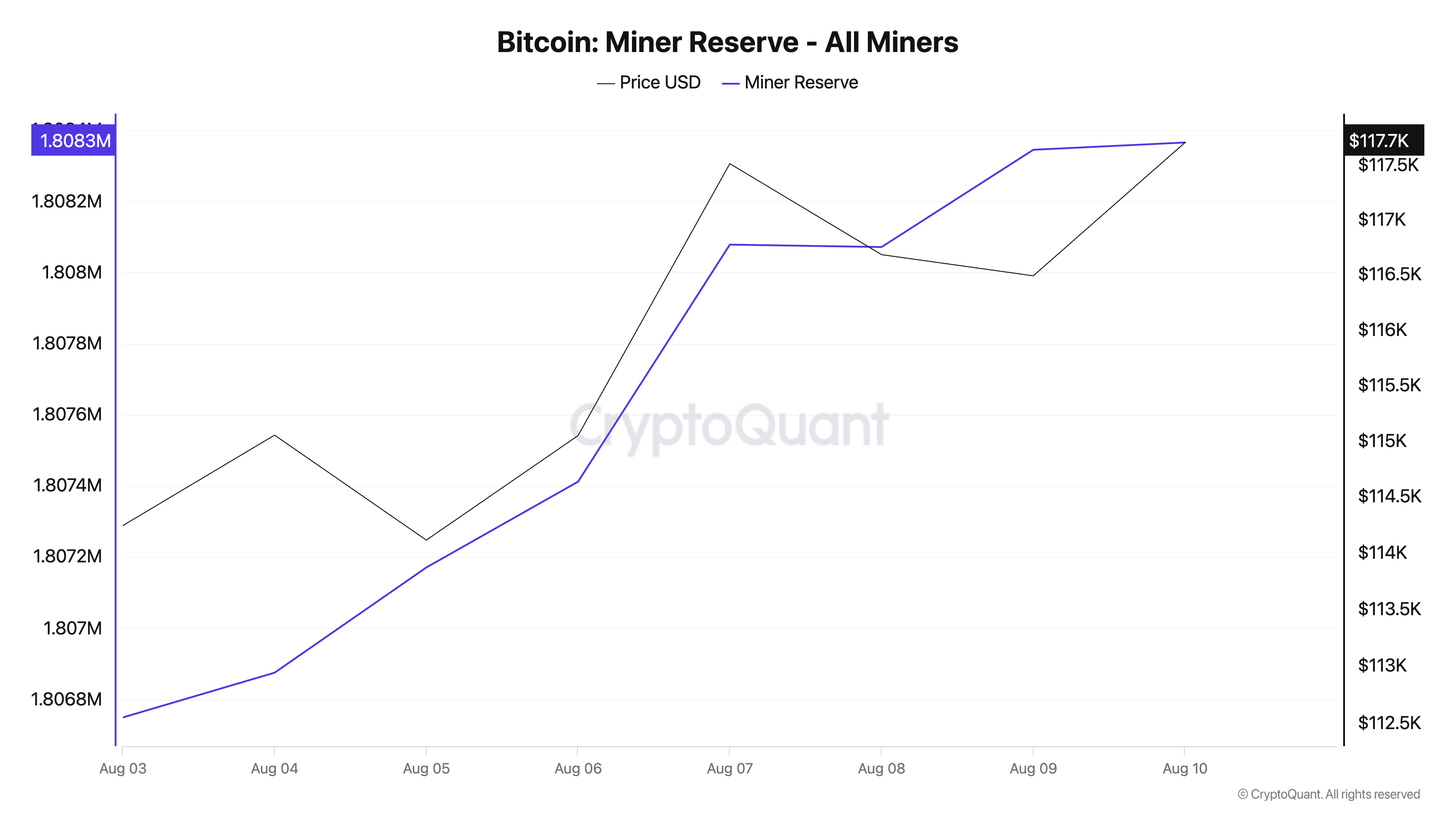

Bitcoin minors have resumed the accumulation, the minor reserve of the part reaching a weekly summit of 1.8 million BTC.

Do you want more symbolic information like this? Register for the publisher Daily Crypto newsletter Harsh Notariya here.

Bitcoin Miner Reserve follows the number of parts maintained in the miners’ wallets. It represents the reserves of coins that minors still have to sell. When he decreases, minors move coins from their portfolios, generally to sell, confirming the growth of the lowering feeling against the BTC.

Advisersly, when he rises, minors keep their extracted pieces more, which generally reflects confidence in the future assessment of prices and a bullish perspective.

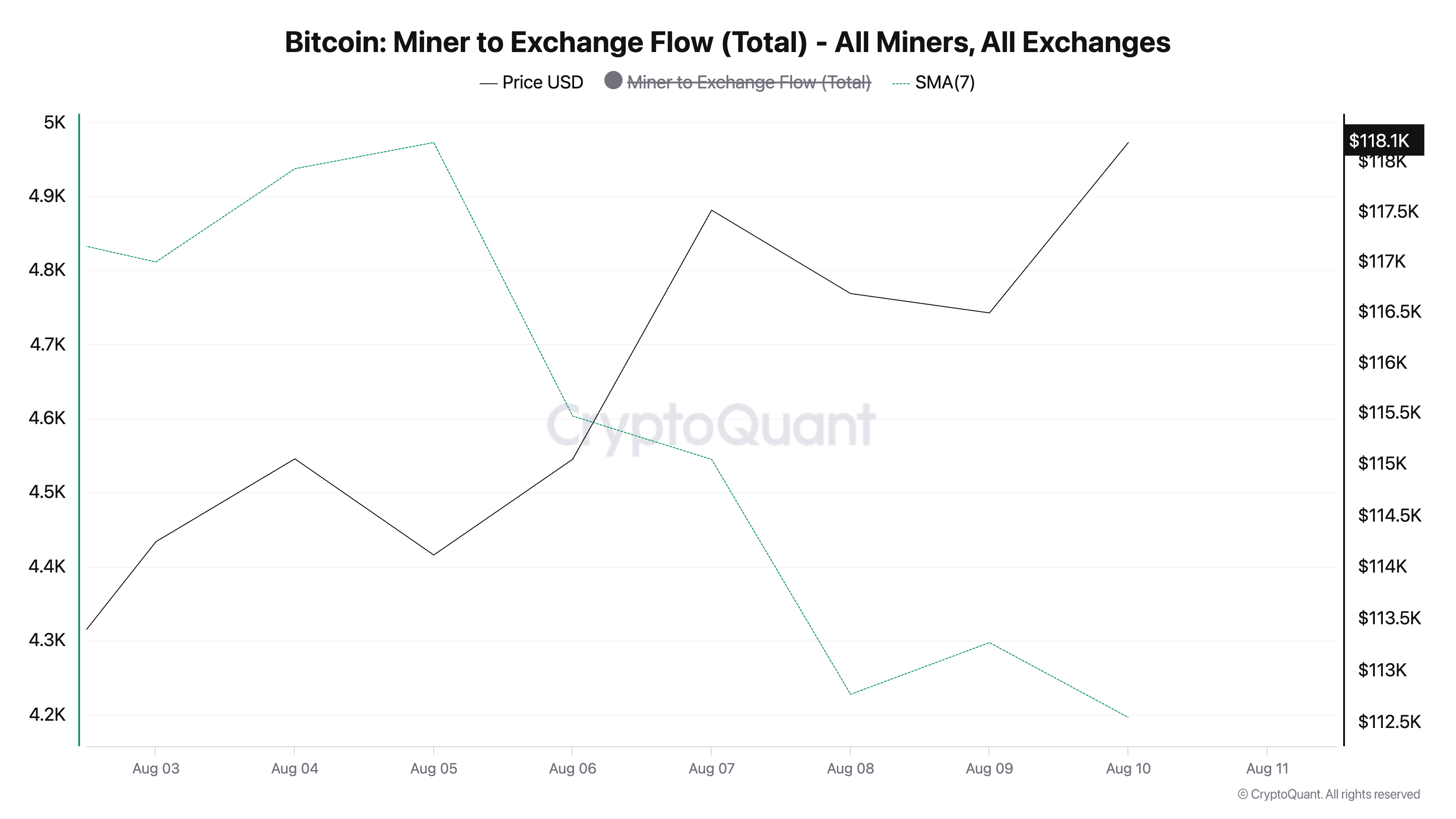

In addition, the drop in the flow of minors to the exchange of BTC highlights the accumulation trend in minors on the network in the last seven days.

According to Cryptochant, this metric, which measures the total quantity of parts sent from minor portfolios to exchanges, plunged 10% during this period.

When the flow of minors in the exchange of BTC falls, minors do not hold and prevent their exchanges. This has reduced sales pressure indicates growing confidence in the BTC price and can help strengthen its rally.

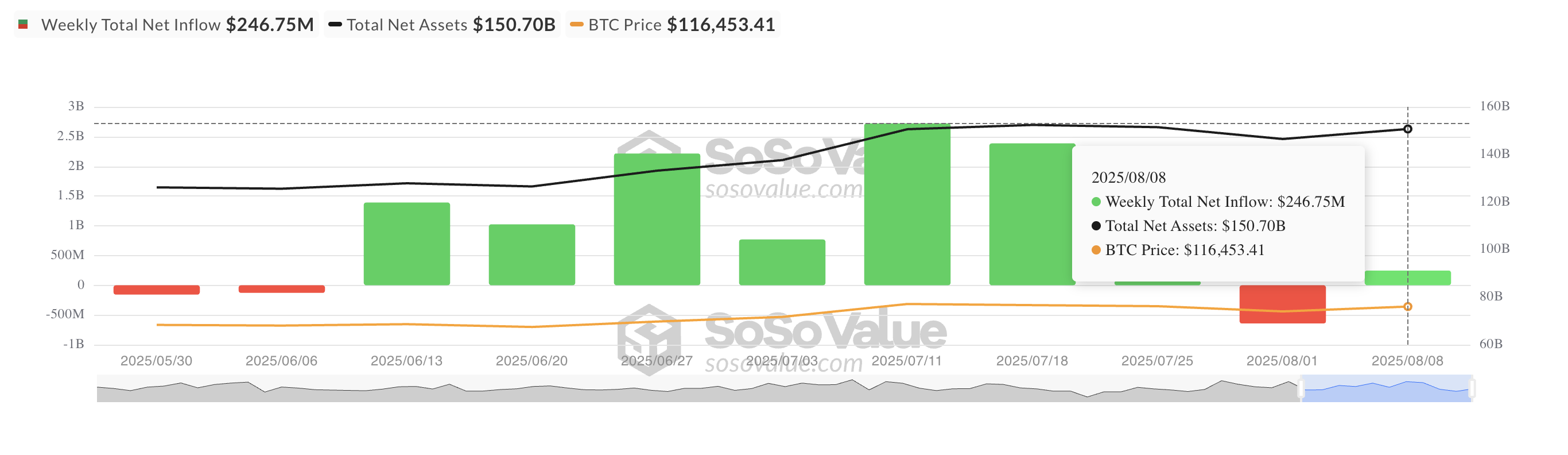

In addition, last week, the weekly entries in the FNB Bitcoin Spot became positive, reversing the negative outings recorded the previous week. According to Sosovalue, between August 4 and 8, capital entries in these funds totaled $ 247 million.

This change reports has renewed the interest in institutional purchase and a change in market bias towards the BTC. Institutional investors remain convinced that the play will extend its earnings and increase their direct exposure through FNB.

Can the BTC exceed $ 118,851 at $ 120,000?

This combination of renewed institutional demand and the confidence of minors strengthens the case of short -term BTC yield at more than $ 120,000. However, for this to happen, the king’s medal must first exceed resistance at $ 118,851.

On the other hand, if the accumulation is in stands, the room could resume its decline and fall around $ 115,892.

The message on the way Bitcoin minors could lead a new summit of all time for BTC appeared first on Beincrypto.