How Privacy Coins Are Outperforming in 2025’s Crypto Chaos

In one year marked by market turbulence and geopolitical assembly tensions, confidentiality parts have become the most efficient sector of cryptocurrency space.

Analysts and defenders of privacy argue that it is not a coincidence. In fact, some believe that outperformance signals the first stages of a larger change in global financial dynamics.

Why the confidentiality parts are the best interpreters of a fear market focused on

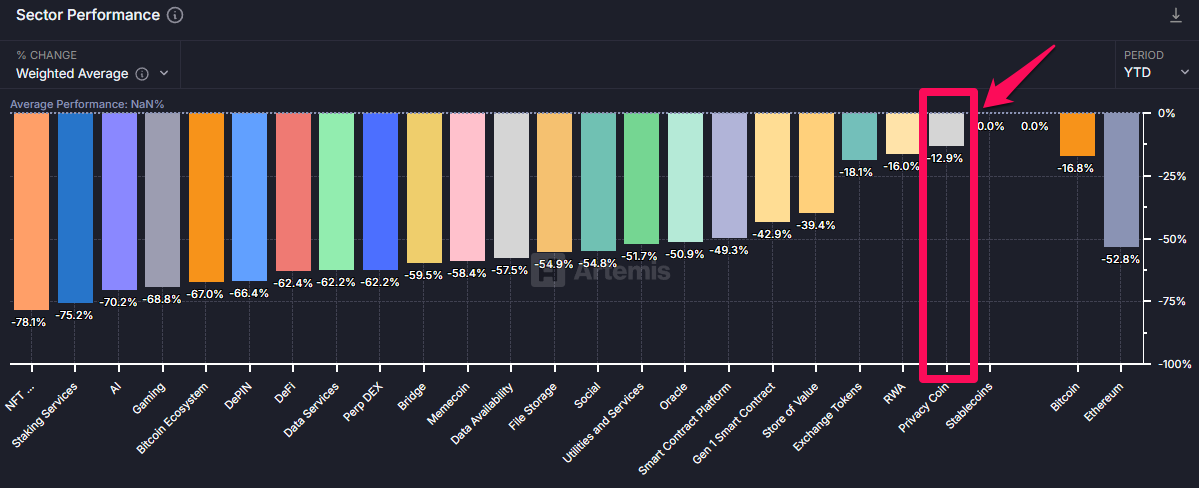

According to the latest data from Artemis, cryptocurrencies focused on privacy have dropped by 12.9% since the start of the year, the smallest decline among all sectors of cryptography.

In comparison, Bitcoin (BTC) experienced a drop of 16.8%. In addition, Ethereum (ETH) also depreciated 52.8% per up to date (YTD).

Beincryptto data showed that over the past month, the main parts of confidentiality have successfully completed the BTC. Monero (XMR) fell 8.1%. In particular, ZCASH (ZEC) experienced a modest increase of 9.1%. However, with Bitcoin, the losses are slightly higher. During the last month, the largest cryptocurrency lost 9.8% of its earnings.

In fact, confidentiality parts have also outperformed the wider market of cryptocurrencies in the last 24 hours. The privacy sector experienced a drop of 7.0%, while the global cryptography market dropped by 8.3%.

Patrick Scott, responsible for growth at Defillama, attributed this outperformance to wider macroeconomic changes in a recent post on X (formerly Twitter).

“Parts of confidentiality were the most efficient cryptographic sector during the crash. It is not a question of media threw. It’s macro,” he wrote.

Scott stressed that countries are increasingly economically isolated due to increasing prices and potential capital controls. He argued that the capacity of confidentiality parts to resist censorship and operate in private would make them more important, going from a “story” to a practical necessity.

“Surreformance is not random. It is an early reaction to a changing world regime and the rupture of international order after the Second World War,” said Scott.

Meanwhile, many industry leaders echo a similar feeling. Vikrant Sharma, founder and CEO of Cake Investments, expressed strong support for confidentiality -oriented solutions.

“I am a maximum .. a maximum confidentiality. This is why I take care of confidentiality and tools like XMR, Zano, silent payments and I pay for BTC, LTC-MWB, and yes, I think ZCASH is too,” he published.

Others, like Mike Adams, the founder of Brighton, also stressed the importance of privacy in transactions.

“Use the confidentiality crypto, the folks. Monero, Zano, Firo… not BTC, which is completely transparency and has no confidentiality, “said Adams.

In addition to these factors, the demand for confidentiality parts is fueled by their growing use in illegal activities. A recent Beincrypto report underlined the domination of confidentiality documents in illicit transactions, where they are preferred for their ability to hide the details of transactions.

While Bitcoin and Stablecoins are always used in such activities, parts of confidentiality like Monero gain ground due to their higher anonymity characteristics.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.