How They Impact Bitcoin Prices

At the end of July, traders and investors will keep an eye in August. They will do it Look at several American economic signals that could influence their portfolios.

This week’s American economic signals are particularly important with Bitcoin (BTC) looking at the $ 120,000 threshold.

American economic indicators who may have an impact on Bitcoin this week

The cryptography market is increasing today, Bitcoin leading the charge when it comes close to $ 120,000. However, if this optimism is sustainable depends on how the American economic signals of this week take place.

Consumer confidence

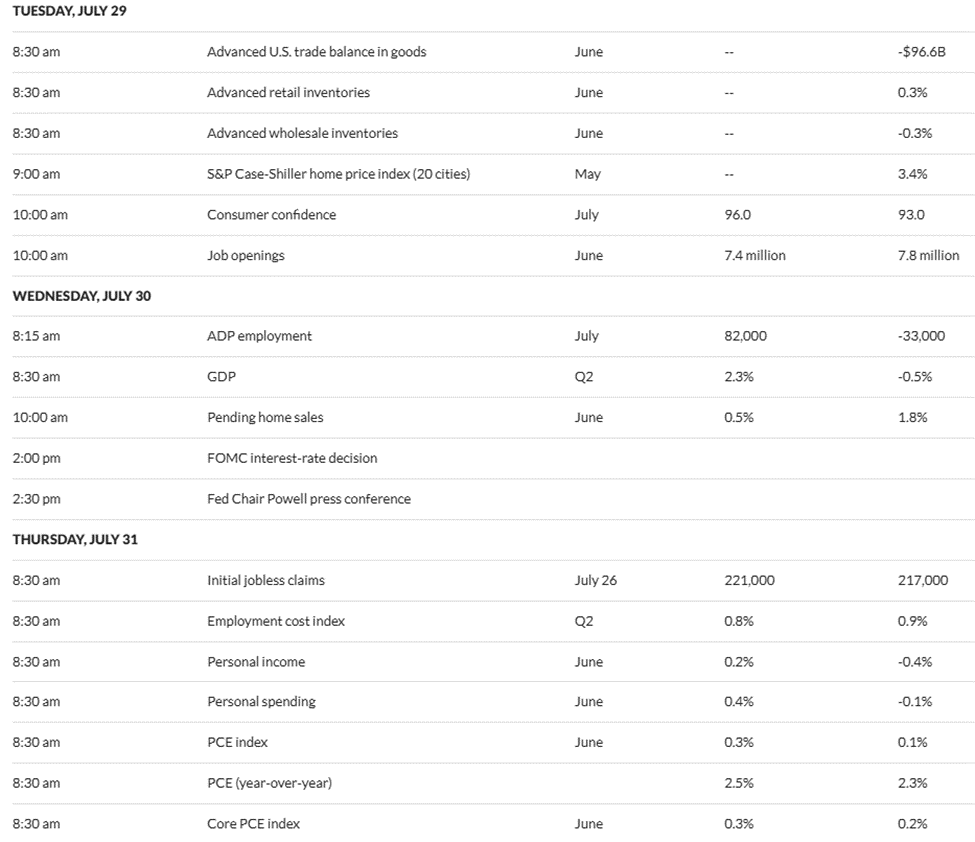

The consumer confidence report begins the American economic signals of this week, which owes ownership on Tuesday. The Conference Board consumer confidence index dropped to 93.0 in June 2025, a decrease of 5.0 points compared to May (98.0).

According to Marketwatch data, the median forecast is 96.0, which suggests that economists are more optimistic for July. However, consumers express growing concerns in the midst of Trump’s prices.

“It is unlikely that consumers will find their confidence in the economy unless they feel assured that it is unlikely that inflation gets worse, for example if commercial policy will stabilize in the foreseeable future,” said Reuters, citing Joanne HSU, director of consumer investigations.

This confidence erosion suggests a reduced risk appetite. Pessimistic consumers are less likely to invest in speculative active ingredients such as Bitcoin, promoting safer options such as obligations or species.

If the consumer confidence in July goes beyond expectations, it could strengthen the risk of risks, potentially increasing the crypto.

Job reports

US work data is one of the most important macro-factors in Bitcoin in 2025. This week’s American economic signals will present several job reports, positioning Bitcoin for volatility.

The report on the job offer and the work renewal report (JOLTS) and job offers are due Tuesday and will be published by the American Labor Statistics Bureau (BLS).

Shake

The June JOLTS report, due on Tuesday, is expected to be less than 7.8 million recorded in May. According to economists interviewed by Marketwatch, data on job offers, hires and separations in the United States could reach 7.4 million.

Despite the expected decline, a reading of 7.4 million would still exceed the lowest of 7.192 million people recorded in March. Notwithstanding, it remains the main highlight of this week American economic indicators.

ADP employment

Another point of data on the job market to watch this week is the JULY ADP employment report. The BLS report, which is more complete and widely considered to be the official measure, said that the employment of the private sector has dropped 33,000 jobs in June 2025.

The figure was significantly lower than that of the expectations of economists of an increase of 95,000 jobs, the decline suggesting a slowdown in hiring. Marketwatch data show that economists have projected 82,000 job increases in July, which would still be below the previous reading.

Initial unemployment complaints

On Thursday, another characteristic of labor market data among American economic signals is the first complaints of unemployment. These weekly data on jobs highlight the number of American citizens who have requested unemployment insurance the previous week.

The first unemployment complaints were recorded at 217,000 in the week ending on July 19, but economists anticipate better prospects for the week ending on July 26 and predict up to 221,000 requests.

An increase in unemployment claims can report economic weakness. This would increase the probability that the Fed will adopt a more accommodating monetary position.

Such a change could lead to a lower dollar, improving the attractiveness of Bitcoin as an alternative intake. However, if the increase in complaints is considered a temporary fluctuation, the impact on bitcoin can be limited.

Meanwhile, analysts say that a resilient labor market, associated with sticky inflation, could allow interest rates to remain high. However, signs of a cooling work sector could temper the Fed path.

Non -agricultural payrolls

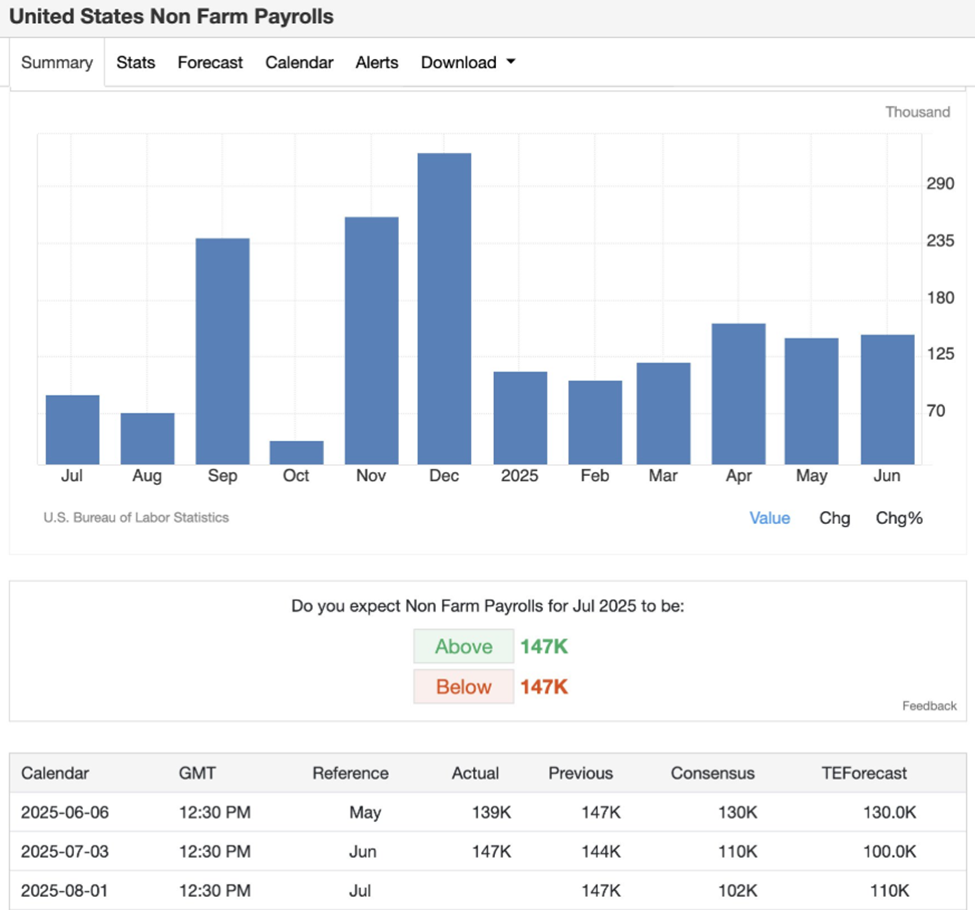

The US employment report, or non -agricultural payrolls (PNF) for July 2025, is expected to be published on Friday. The economy added 147,000 jobs in June after 139,000 jobs in April. Meanwhile, the unemployment rate fell to 4.1% in June after 4.2% in May.

Marketwatch data show that economists anticipate an increase of 4.2% in the American unemployment rate compared to a slowdown in jobs to 102,000. This drop or slowdown reflects the potential economic impacts of President Trump’s prices.

Strong employment growth can lead the Fed to maintain its current position on monetary policy or even to consider tightening, which could strengthen the US dollar and potentially remove bitcoin.

However, if the underlying economic concerns encourage Fed to adopt a more dominant approach, Bitcoin could benefit because investors are looking for other value reserves.

Analysts say that difficult employment conditions in the United States come as employers seeking to clarify the White House’s trade policy to gradually face frequent adjustments to time and schedules.

FOMC interest rate decision

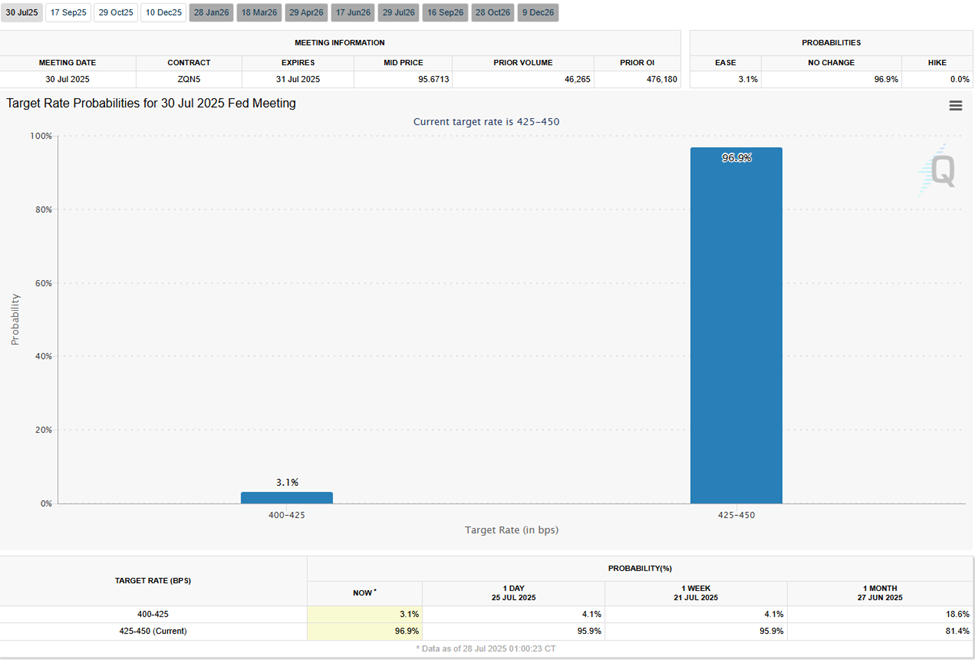

Meanwhile, this week’s American economic signals highlight the FOMC interest rate decision decision on Wednesday. This economic indicator occurs after the American IPC (consumer price index) has shown that inflation has increased to 2.7% in June.

FOMC’s minutes on July 9 suggested rate reductions this year, the decision-makers that inflation were established but remained “somewhat high”. In addition, uncertainty around the prospects had decreased, but had not disappeared.

However, it remains to be seen if the Fed will reduce interest rates on July 30. Data on the CME Fedwatch tool show that betting of interest see a probability of 96.9% that the Fed will maintain the interest rates unchanged between 4.25% and 4.50%.

“What is more interesting is Powell’s press conference. A few days ago, Trump met Powell, and he expects the Fed to be dominant. Some other Fed governors also call for low interest rates, so this press conference will be essential,” said a user.

Indeed, beyond the FOMC interest rate decision, merchants and investors will closely examine the speech of the president of the Fed, Jerome Powell, for the signals from the future prospects of the Fed.

If Powell refers to rate drops in September, it could inspire optimism on the market. However, if it sounds like the latest FOMC meetings, the cryptography market could see a strong correction.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.