How to Retire Early with Bitcoin (BTC): Experts Reveal Key Strategies

Cryptocurrency, in particular Bitcoin (BTC), has often been presented as having the potential to provide massive gains to investors. However, many now believe that Bitcoin could also be the key to retiring early.

With its impressive growth and the promise of long -term value, Bitcoin offers a unique opportunity for those looking for financial independence. Thus, some experts have described several strategies to obtain retirement through Bitcoin investments.

How many bitcoin do you need to retire with $ 100,000 per year?

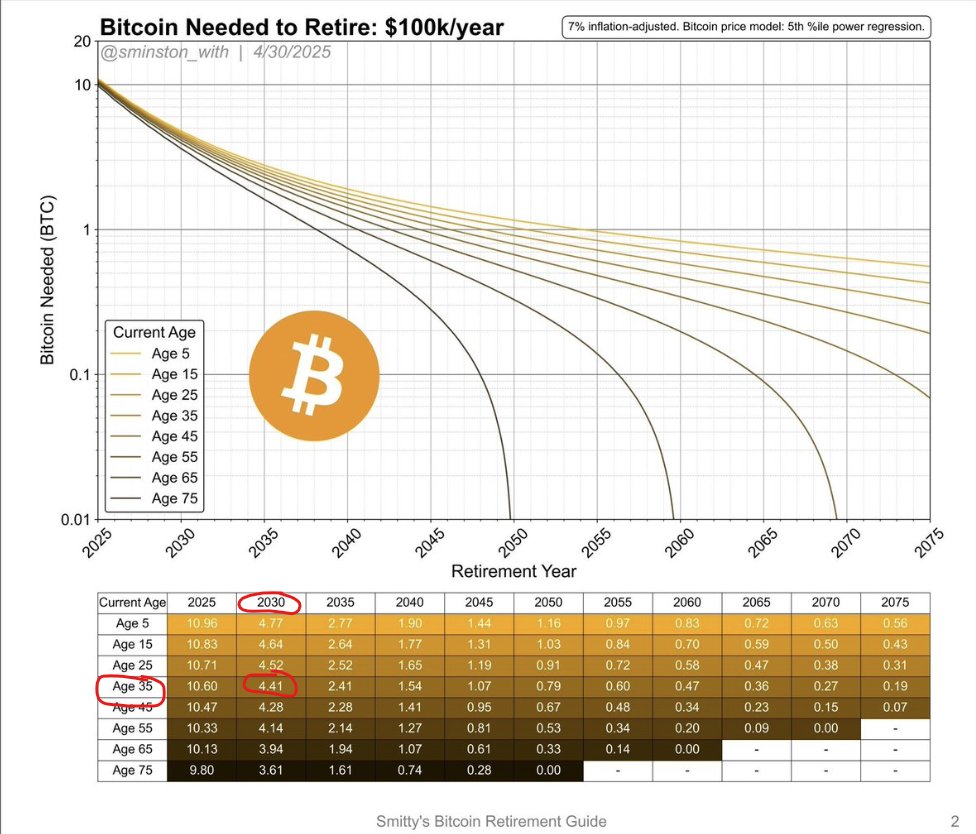

David Battaglia, a cryptocurrency analyst, recently shared a detailed analysis on X. He presented a model that estimates the amount of bitcoin required to retire with $ 100,000 per year taking into account two key elements.

First, an annual inflation rate of 7% is taken into account, which adjusts to the increase in the cost of living and to the reduced value of money over time. Second, the model uses a Bitcoin price model based on a power regression of the 5th centile. This provides a prudent estimate of the future Bitcoin value.

The data show that the number of BTCs necessary for retirement is influenced by the year when the retirement and age of the individual begins. The higher the retirement date, the more the BTC is necessary.

For example, a 35 -year -old person and planning to retire in 2030 would require around 4.41 BTC ($ 460,000 at current prices).

“This implies that the price of Bitcoin in 2030 would be high enough for 4 BTC to be worth an amount which, when invested or spent gradually, would provide you 100,000 per year,” said Battaglia.

Battaglia explained that if investors withdraw 4% or its equivalent adjusted by inflation each year (common in financial independence, retire early), these 4 BTC should be worth at least $ 2,500,000 in 2030. This means that each BTC should be worth $ 584,112 in 2030.

“The key is the inflation and growth in Bitcoin prices: the model adjusts the value of $ 100,000 for an annual inflation of 7%, which means that the purchasing power of $ 100,000 in 2030 will be lower than that of 2025. In addition, the price of bitcoin increases according to the regression model, which reduces the amount of BTC required over time (the lines of time),” he added.

He suggested two main methods to access this income: gradually selling bitcoin over time or entrusting assets to an institution for an annual payment fixed.

However, he warned against third -party childcare risks. Battaglia also underlined the importance of the tax strategy, recommending the residence in a zero tax jurisdiction like Paraguay to maximize yields.

“What is clear is that we get closer to the point where the price of Bitcoin will provide financial independence to holders of the rest of their lives. The bad news is that there is not enough bitcoin for those who do not act in the years to come. We also assume a very modest Bitcoin price for 2030,” he said.

Completing the approach of Battaglia, an analyst who goes through the pseudonym Hodl Hodl has developed a Bitcoin calculator inspired by the fire model used in traditional finance.

This tool incorporates various compound annual growth rate models (TCAC) adapted to unique bitcoin market cycles. The calculator allows users to project the future Bitcoin value and determine the sustainable withdrawal rates according to different growth scenarios.

“This is an excellent retirement planning tool for Bitcoins.

For example, model 6, which uses a conservative midline of the power law, balances prices growth at an early stage with decreasing yields in recent years, guaranteeing realistic projections for retirement planning.

This tool helps investors estimate the amount of bitcoin they need and how to withdraw funds without exhausting their wallets. By smoothing annual yields with CAGR, HODL’s calculator provides a practical framework for long -term retirement planning with crypto.

Could Bitcoin lead to an early retirement? Mark Moss explains his 5 -year plan

Meanwhile, Mark Moss offers a distinct strategy focused on tax efficiency and the preservation of assets. In a YouTube video, Moss described a “5 -year retirement plan”.

It is a question of accumulating bitcoin, taking it from the loan franchise loans and using the growth of the assets to generate wealth without exhausting the principal.

“The rich use of debt to take advantage of investments and create additional income flows. Although the average person uses debt to buy things that make the rich wealthier. Do not do so. We want to be able to buy assets that make us richer. Okay, let’s talk about the cheat code. Now the cheat code is Bitcoin,” said Moss.

Moss argues that this method allows the Bitcoin wallet to continue to assess while providing a constant flow of income. He claims that this approach can lead to retirement in as little as five years, because the funds borrowed can cover subsistence costs while the underlying assets increase in value, potentially leaving an inheritance for future generations.

“We believe that at the end of this break in about 5 years, Bitcoin will be about the same size of world assets of store value as gold. Bitcoin and gold will be roughly peer, about 20 billions each,” he said.

However, not everyone agrees with the Crypto retirement potential. Sibel, a crypto trader, argued that it was almost impossible to “withdraw” from the crypto.

“You cannot” retire “crypto. Have you ever seen someone from our industry who did and left? Except people who had to run away. Even these people have put back with newly created accounts. You have become too attached to the game at some point that it is impossible to leave,” she noted.

She stressed how high -level characters who have made millions of people have briefly left the industry, to return to search for more wealth and influence. Sibel suggests that the crypto space works as an endless casino, where individuals can never free themselves completely from the trading cycle, no matter how much they won. The attraction of profit and recognition maintains people attached to industry, whatever their initial intention to retire.

In conclusion, Bitcoin offers a unique opportunity for early retirement through various strategies, from the model adjusted to David Battaglia’s inflation to mark Moss’ tax approach.

Tools like Bitcoin calculator also help investors plan their retirement. However, as Sibel points out, the addictive nature of the cryptography market can make it difficult for some to move away fully. Although Bitcoin can provide a path to financial independence, it requires careful planning, market understanding and discipline.

Non-liability clause: This article is for information only and does not constitute financial advice. The strategies discussed are speculative and may not materialize as planned. Investments in cryptocurrency are very volatile and involve significant risks. Always carry out in -depth research and consult a financial advisor before making investment decisions.

The post how to retire early with Bitcoin (BTC): experts reveal that key strategies appeared first on Beincrypto.