How Will $163 Billion FOMO Accumulation Affect Bitcoin’s Price?

Bitcoin recently experienced a laterally important movement, while King Crypto has trouble crossing key resistance levels.

Despite this, Bitcoin is actively exchanged, with short -term buyers and new buyers on the market. However, this influx of new capital could pose both opportunities and risks.

Bitcoin investors have been occupied

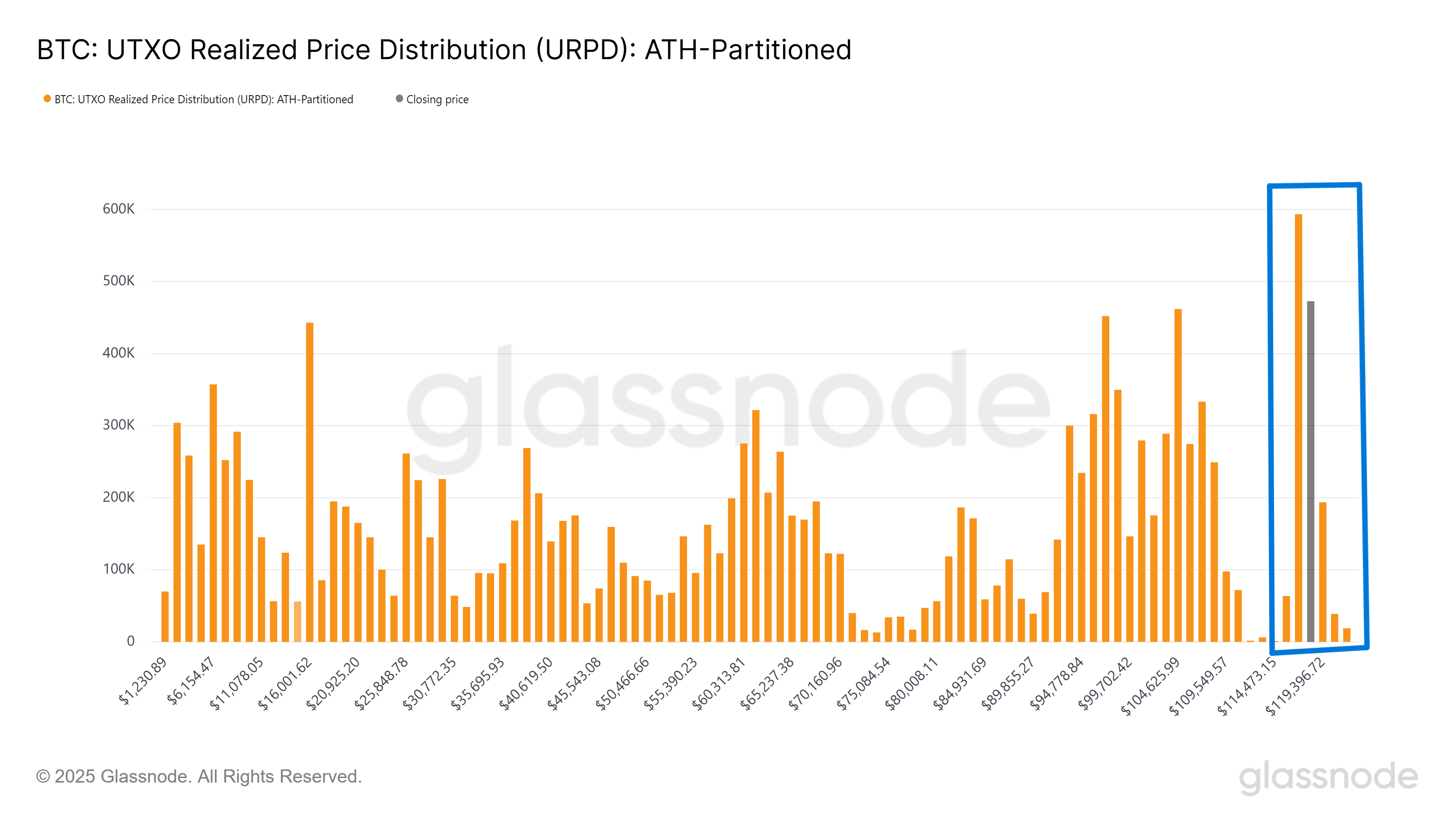

Recent data from URPD (UTXO Reails Refalied Price Distribution) suggest that more than 1.38 million BTCs, worth more than $ 163 billion, were accumulated between the range of $ 115,500 and $ 120,000. This accumulation has occurred in the past two weeks, a relatively short time, which indicates that many of these purchases come from short -term holders or new investors.

These buyers are likely to sell either to secure profits or to avoid losses if the price is reversed. This dynamic could create volatile conditions, especially if Bitcoin strikes the resistance or undergoes a offset down.

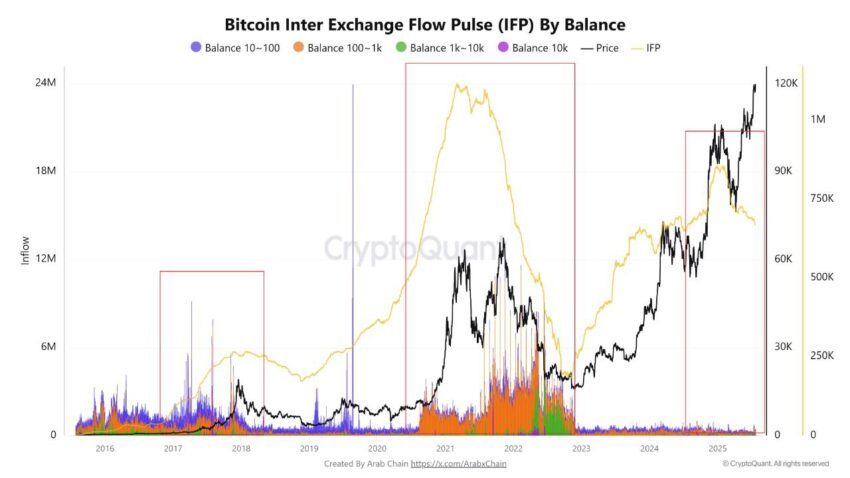

The Bitcoin macro dynamic shows mixed signals, with the Bitcoin flow impulse currently decreasing. Analyst Kyledoops noted that, unlike previous market cycles in 2017 and 2021, where Bitcoin saw an increase in flows before major sales, Bitcoin Flow Pow actually drops after Bitcoin reaches the level of $ 120,000.

This suggests that the big players do not transfer their assets to the exchanges, indicating that there may be fewer incentives to sell to long -term holders (or “diamond hands”). While Bitcoin Flow Pow continues to decrease, this could suggest that institutional and major investors adopt a more cautious approach.

The price of the BTC has not yet found any direction

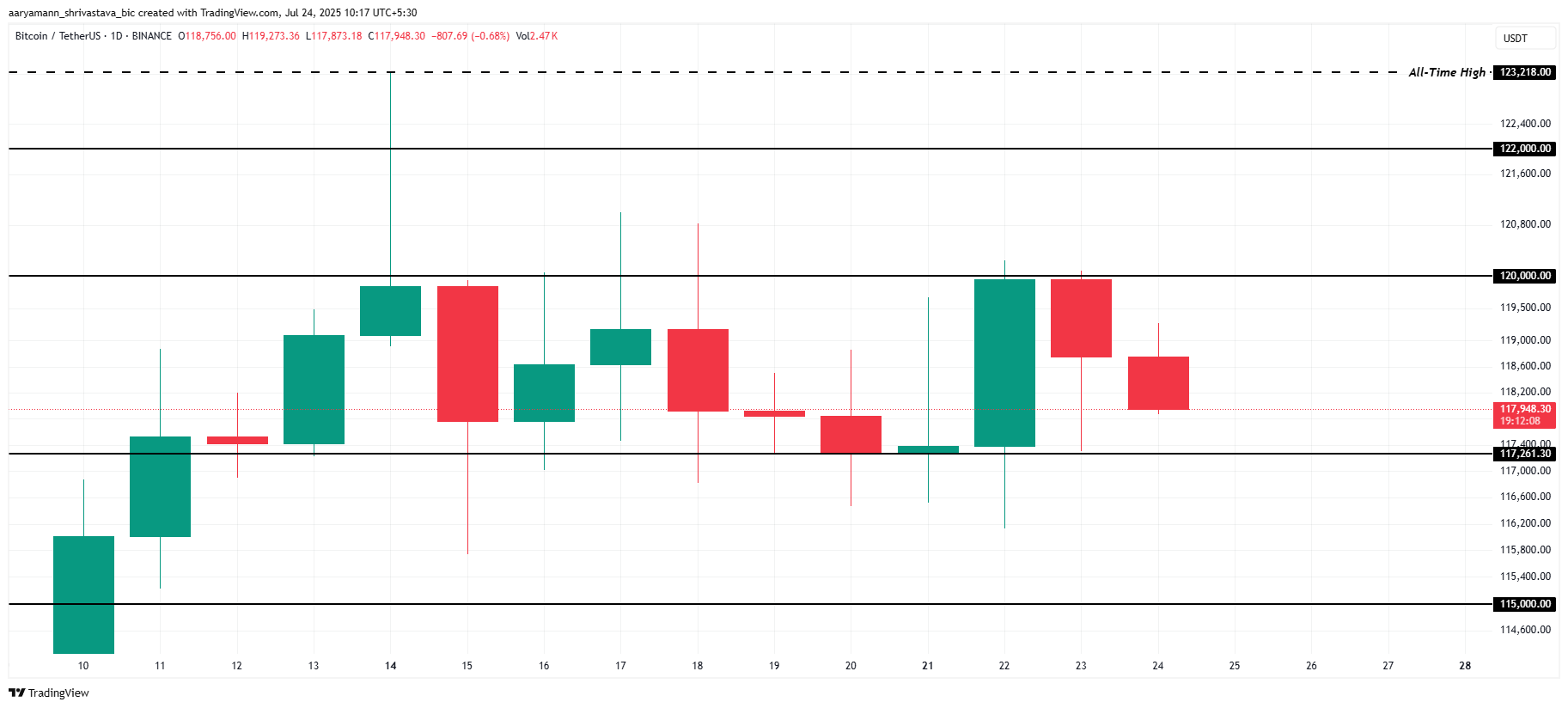

The Bitcoin price has consolidated in the range of $ 117,261 and $ 120,000. The level of $ 120,000, in particular, is a crucial psychological barrier. The violation could trigger the profits of investors who remain skeptical about the current rally.

Given the mixed feeling of the market and the influx of short -term holders, Bitcoin should continue its lateral movement. The price can gravitate towards a potential drop below $ 117,261, but Bitcoin should maintain support over $ 115,000, providing a cushion against new decreases. This consolidation phase could last several days while the market digests the recent capital of capital.

However, if buyers focused on FOMO remain confident and continue to hold their positions, Bitcoin could exceed the barrier of $ 120,000 and possibly target $ 122,000. If this happens, the current lowering feeling would be invalidated and Bitcoin would have the potential to increase more.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.