US Economic Indicators Impacting Crypto This Week

According to the report of the Bureau of Labor Statistics (BLS) on the American IPC (consumer price index) last week, traders and cryptographic investors still monitor the country’s economic calendar.

This week, three American economic indicators will influence the feeling of Bitcoin (BTC) and crypto. In particular, Trump’s trade policies and geopolitical tension in the Middle East continue to influence the American economy.

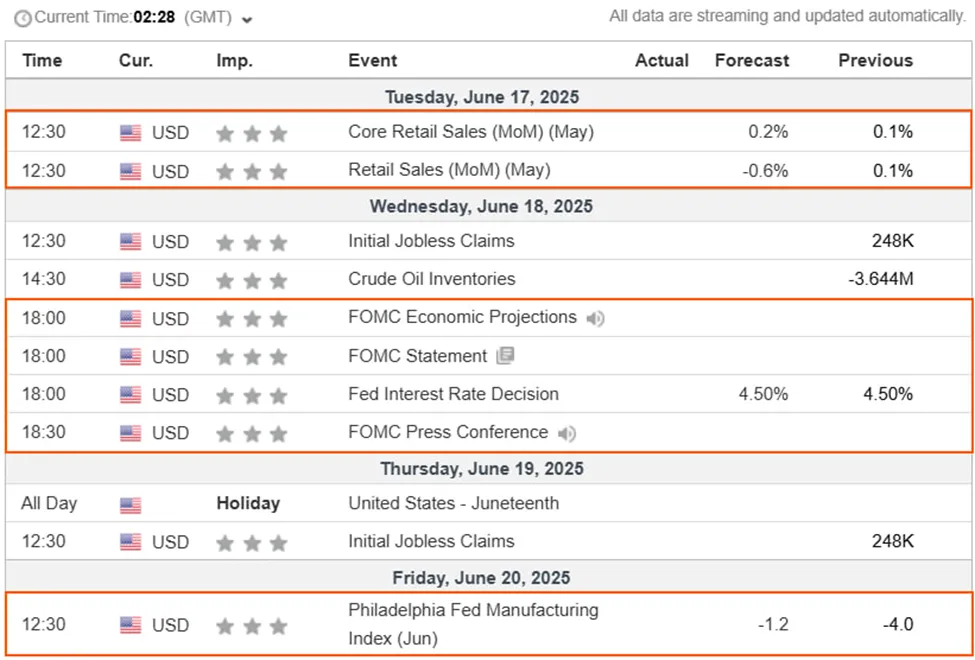

American economic indicators to be monitored this week

The following American economic indicators could move the portfolios of merchants and cryptographic investors this week.

Retail sales in the United States

This week, retail data published by the country’s census office will start the list of American economic indicators. This data point reflects consumption expenditure, which drives around 70% of the American economy and thus influences the feeling of the market.

Marketwatch data shows retail sales of 0.1% per month (MOM) for April 2025, as indicated in May. This reflects a modest growth in consumption expenditure. The economist surveys declared by Marketwatch predict a 0.6% drop in retail retail sales from April to May 2025.

This suggests that economists expect consumption expenses to take place, probably due to the uncertainties according to Trump’s tariff chaos. A confirmed drop by -0.6% or worse could increase expectations for the rate reduction in the Federal Reserve (Fed) because it suggests economic weakness.

Such a result would support bitcoin as a cover against softening or monetary inflation, which could increase prices.

Conversely, if the data is positively surprised, for example, coming from 0.1% flat or greater than 0.1%, this could strengthen the US dollar and reduce cutting bets. In the same way, such a possibility would put pressure on the prices of cryptography.

Initial unemployment complaints

Since Thursday, the Juneteenth festivals, the initial complaints on unemployment last week will be published on Wednesday, June 18. This American economic indicator measures for the first time the number of American citizens who have applied for unemployment insurance.

Beincrypto said the American labor market is gradually becoming the macroeconomic Bitcoin data point. For this reason, this data point will be a critical watch this week.

After a previous reading of 248,000 for the week ending on June 7, which was higher than the 242,000 economists had projected, economists project even higher unemployment insurance at 250,000 for last week.

The expectation of an increase in initial unemployment complaints suggests knowledge by economists to soften the labor market in the United States. This is optimistic for Bitcoin because it inclines the chances in favor of a fed pivot.

“The labor market is cracking → initial unemployment complaints have reached 248k (the highest since October) → Average of 4 weeks: 240K (the highest since August 2023) → People on services: 1.96 m (the highest since November 2021) weakness = Fed Pivot = Crypto Moon,” wrote analyst Eye Hour in a post.

FOMC interest rate decision

Meanwhile, this week’s highest point of American economic indicators will be the interest rate decision of the Federal Open Market Committee (FOMC), also on Wednesday. This macroeconomic data point will be a complete circle after last week’s American CPI.

Beincryptto said inflation has increased in May and for the first time since February. The American IPC is a late indicator, making it a main objective for targeting inflation and, therefore, linked to the 2% objective of the federal reserve.

Data on IPC inflation last week will affect the decision of the FOMC interest rate. According to CME Fedwatchtool, the markets provide a probability of 96.7% that the Fed leaves interest rates unchanged at 4.25 to 4.5%.

Meanwhile, some see a rate of rate reduction of 3.3%, potentially at the beach of 4.0 to 4.25%, which would mean a reduction in the quarter base (BP).

This week, the FOMC interest rate decision would depend on economic data reporting a need for monetary stimulus to support its double price for price stability (inflation objective of 2%) and maximum employment.

Beyond the aforementioned American economic indicators, the main drivers of rate reductions may include the political pressure of President Donald Trump. Despite the Fed’s commitment to caution, Trump continues to put Powell to reduce rates.

“Fed should lower a full point. Paigne much less interest on future debt. So important,” Trump wrote on Truth Social after the data from the IPC.

With market prices in the cuts from September, a surprise cup on Wednesday would shock the market, Bitcoin likely to rally. The sharp increase would be lower than the lower rates would reduce the opportunity cost of the holding of uninformed assets.

Conversely, a catch may not have an impact as much on the market, since it is already expected and, therefore, at the price.

Beincryptto data shows that Bitcoin was negotiating $ 106,576 to date, up almost 1% in the last 2 hours.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.