Huma Finance Unveils Tokenomics, Allocates 5% Airdrop

The Huma Protocol, a Payfi sector platform emerging, officially announced its Tokenomics and its air plan for season 1 for the Huma token.

The project has drawn the attention of numerous venture capital companies, because the Payfi sector is considered very promising. However, the current market context shows that retail investors pay less attention to traditional airlines for airlines.

Huma Finance Airdrops 5% to users

Payfi combines instant payments with decentralized finances (DEFI), using blockchain technology to allow fast, efficient and profitable financial transactions.

The Human Protocol aims to direct this trend by integrating DEFI with active world (RWA). The team designed the human token to serve both public services and governance and encourage the participation of the community to guarantee long -term advantages to stakeholders, including users, liquidity suppliers (LPS), partners and promoters.

The Human Protocol revealed its air plan for season 1, allocating 5% of the total supply of HUM (500 million tokens) to loyal users. However, many have indicated that this allowance seems quite low.

“5% for the airlines of season 1 are too lower,” said Investor Cryptostalker.

Despite criticism, the Human Foundation stressed that this is only the beginning. The Foundation has planned a second airline, allocating 2.1% of the total offer, about three months after the generation of tokens (TGE).

In addition, the total supply of Huma is capped at 10 billion tokens, and the food in initial circulation will be 17.33%.

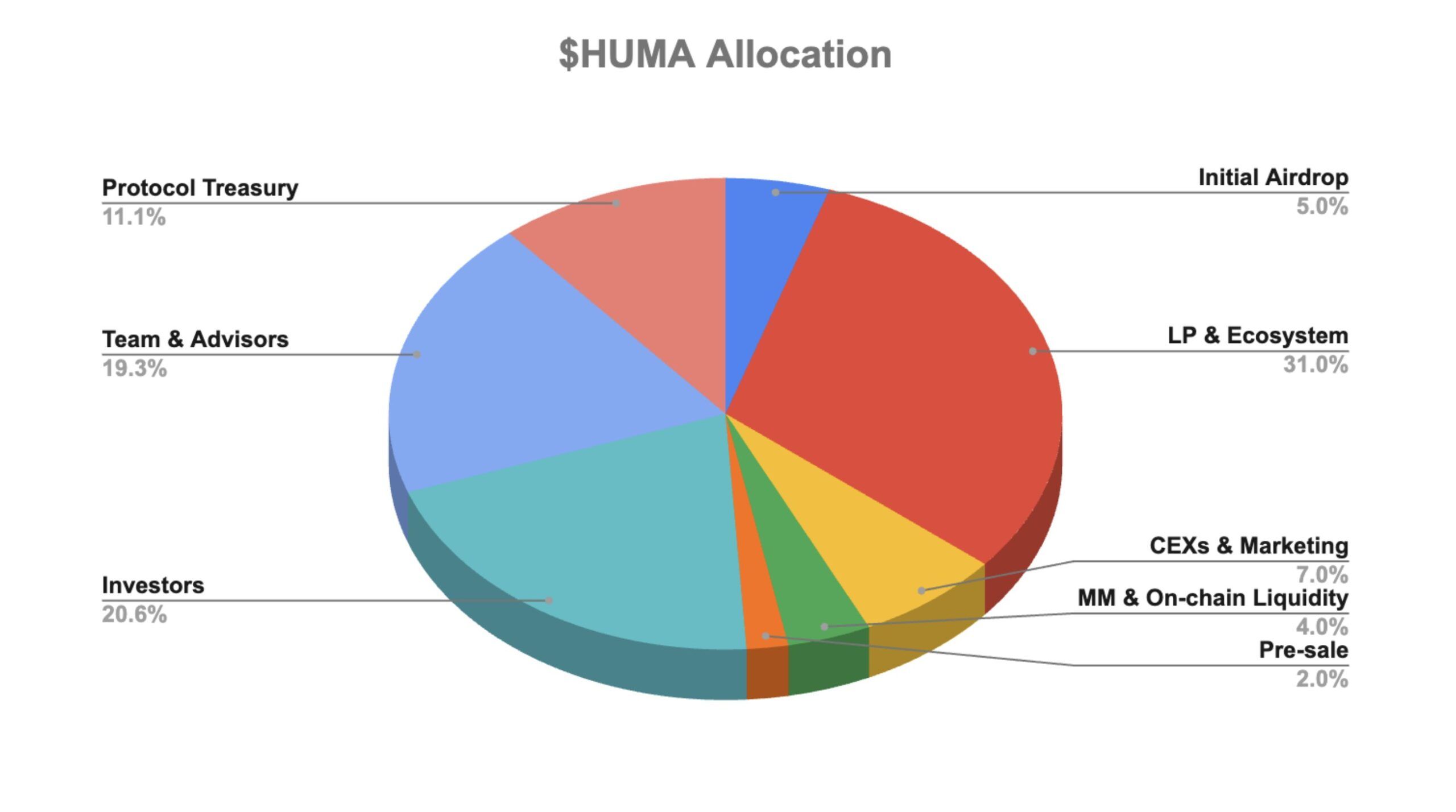

The distribution of tokens includes:

- 31% for liquidity suppliers and the ecosystem,

- 20.6% for investors,

- 19.3% for the team and the advisers,

- 11.1% for the protocol treasury.

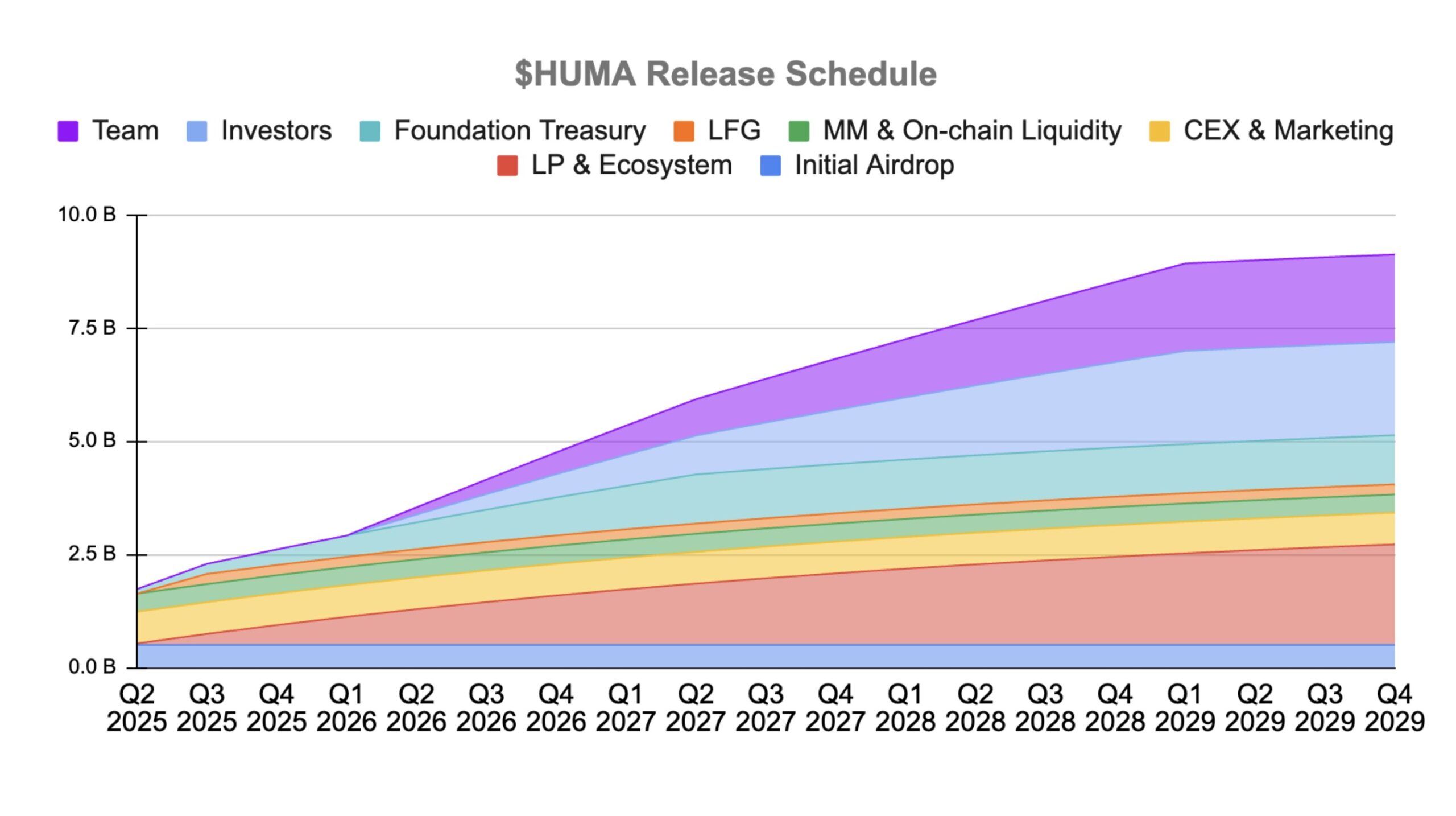

In addition, the publication calendar will continue until the end of 2029. The tokens assigned to the team and investors will be locked for 12 months, followed by a three -year acquisition period.

The allowances for the LPS and the ecosystem will decrease by 7% each quarter. These rates can be adjusted by the governance of the protocol.

Huma Finance is faced with both potential and challenges

The human protocol develops as Payfi is gaining ground. While governments develop policies adapted to crypto and stables, payments based on cryptography could emerge as a dominant alternative to traditional systems.

“Web2 has a lot of problems, and a centralized payment network is one of them. Slow transactions, high fees and no user control. But there is now a solution. Huma Finance is the first Payfi network, which aims to accelerate global payments with instant access to liquidity anywhere and at any time. ” Pointed out the investor Niels.

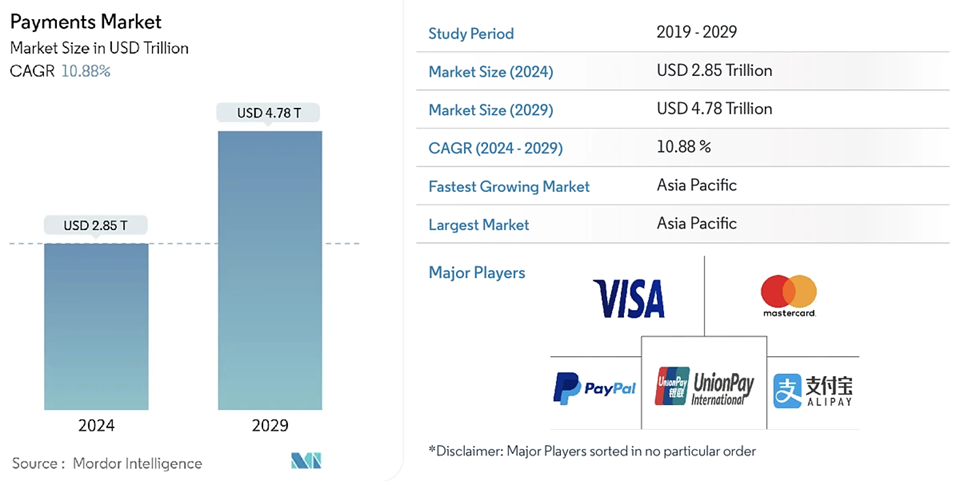

According to a Coingecko report referring to the research of Mordor Intelligence, the world market for financing payments should reach 2.85 billions of dollars in 2024 and reach 4.78 billions of dollars by 2029.

“This massive growth highlights the urgent need for progressive, effective and accessible financial infrastructure – it is extremely what Payfi aims to deliver,” noted the report.

For this reason, the first movers as the human protocol enjoy a competitive advantage. The project raised more than $ 46 million in investors such as Haskey Capital and Circle.

However, current market conditions have failed to give Huma a strong initial dynamic. Low -content allowances and the change in user interest, driven by new models like Binance Alpha, have made traditional Airdrops less attractive.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.