Hyperliquid (HYPE) Might Hit $20 Amid Potential Golden Cross

The hyperliquid (hype) is under pressure, down 16% in the last seven days, because the technical indicators are increasingly indicating the lower control. The momentum has strongly weakened, the relative force index (RSI) falling below 40 and showing no sign of strong purchase interest since the end of March.

At the same time, the Directional Movement Index (DMI) shows that sellers acquire domination, with an increase in the rise suggesting a potential strengthening of the downward trend. While the media is tackling the main levels of support, the market is now waiting to see if the bulls can set up recovery – or if further is ahead.

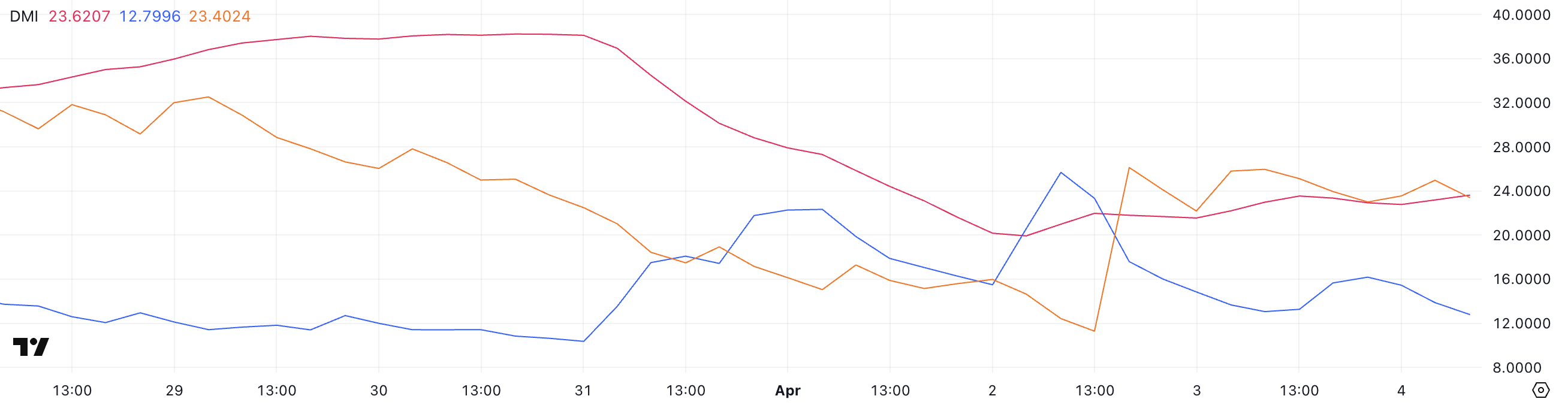

DMI hyperliquid shows that sellers control

According to its Directional Movement Index (DMI), the hyperliquid shows the first signs of a development trend, the average directional index (ADX) going from 21.5 to 23.6.

The ADX measures the strength of a trend whatever its direction. Readings less than 20 generally indicate a low market or linked to the beach, while values greater than 25 suggest the presence of a strong trend.

The current ADX approaching this threshold of 25, he suggests that the strength of trends is built – but has not yet been entirely confirmed – indicating that traders should be alert for potential continuation in prices.

Meanwhile, the lines + DI and -Di, which respectively represent the Haussier and lower directional movement, have changed significantly.

The + DI has dropped sharply from 25.68 to 12.79, while the -Di went from 11.29 to 23.4, indicating that the lower momentum has clearly exceeded the optimistic pressure. This change suggests that sellers take control of the market, and unless the line + can reverse and resume the ground, the media threshing could risk more decline.

If the current dynamic continues, it, combined with the rise up, could point out the start of a stronger downward trend.

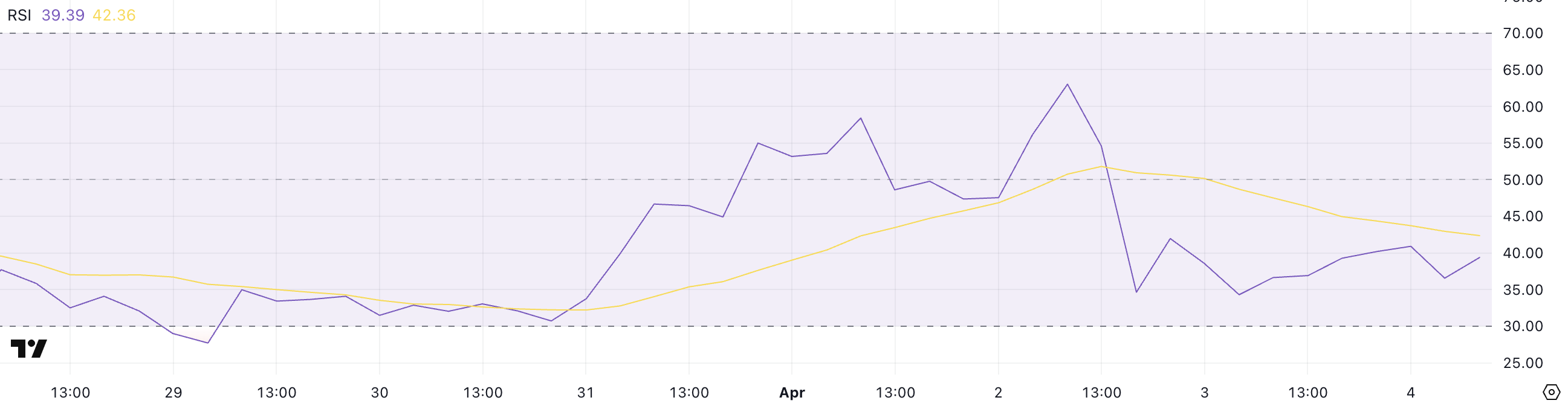

RSI hyperliquid shows the lack of momentum

The hyperliquid has seen its relative resistance index (RSI) drop considerably in the last two days, going from 63.03 to 39.39.

The RSI is a Momentum oscillator which measures the speed and extent of recent price changes, ranging from 0 to 100.

Readings above 70 generally indicate that an asset is overbuilded and may be due to a correction, while the readings less than 30 suggest that it is occurring and could be started for a rebound. The levels between 30 and 70 are considered neutral, but the directional changes in this beach often reflect the evolution of the momentum.

With the Hype RSI, now at 39.39, the indicator suggests weakening the bullish impulse and increasing down pressure. The fact that the RSI has not hit or exceeded the 70s mark since March 24 indicates a lack of strong purchase conviction in recent weeks.

This downward trend in RSI may indicate that the market is cool. Unless buyers intervene to reverse this trajectory, the media threw could continue to cope with a sale pressure.

If the RSI continues to derive around 30, it would increase the possibility of a new decline or the short -term consolidation.

Will hyperliquid soon fall below $ 11?

The hyperliquid price is currently at an important threshold, with a lower, but potential action for a rebound always on the table.

If the current downward trend continues, the media threshing could soon drop below the $ 11 bar.

This would be aligned with the recent drop in Momentum indicators like RSI and the growing downward pressure observed in directional movement data.

However, if buyers manage to intervene and change the momentum, the media threshing could try to recover higher levels. A break over the immediate resistance to $ 12.19 would be the first sign of recovery, potentially opening the door for a movement around $ 14.77.

If the Haussier momentum accelerates, the rally could extend up to $ 17.33, which will mark a complete reversal of the current lower structure.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.