Hyperliquid Surpasses dYdX with $1.5 Trillion Trading Volume

The hyperliquid recently exceeded the commercial volume of Perpetuals Exchange Dydx, reaching 1.5 billion of dollars. Despite being a much more recent platform, the buyouts of hyperliquid tokens and the lack of cash incentives have ensured long-term stability.

To be fair, the hyperliquid was also involved in much larger controversies, delimiting Jellyjelly in response to short pressure earlier this year. However, the platform has rebuilt its reputation and generated a high volume.

The hyperliquid trading volume exceeds dydx

Hyperliquid, a high performance trading L1 blockchain, recently had many successes. Earlier this month, he captured more than 60% of the Perpetuals exchange market, and his threshing token reached a 3-month summit shortly after.

Analysts yesterday noticed that the trading volume of all hyperliquidal times had exceeded Dydx and that it reached 1.5 billion of dollars today.

Dydx is an exchange of decentralized perpetual which has been active for five years, while the hyperliquid platform only launched in 2023.

Nevertheless, the younger protocol exceeded it. After launching its native token in 2021, Dydx began to use it to reimburse user negotiation costs, increasing its volumes. He then built a community media threw around an informal “trading competition” with competitors.

The hyperliquid, on the other hand, was not based on the incitement strategy of Dydx. After his own TGE last year, he managed to accumulate huge volumes thanks to the functionality, word of mouth and product quality.

2024 was a peak year for the trading of perpetual crypto, and the media beaten took advantage of the moment. It apparently turned out to be a more sustainable approach.

In addition, Hyperliquid directs the vast majority of its negotiation costs to the redemptions of token, that Dydx only instituted months later, and to a lesser extent.

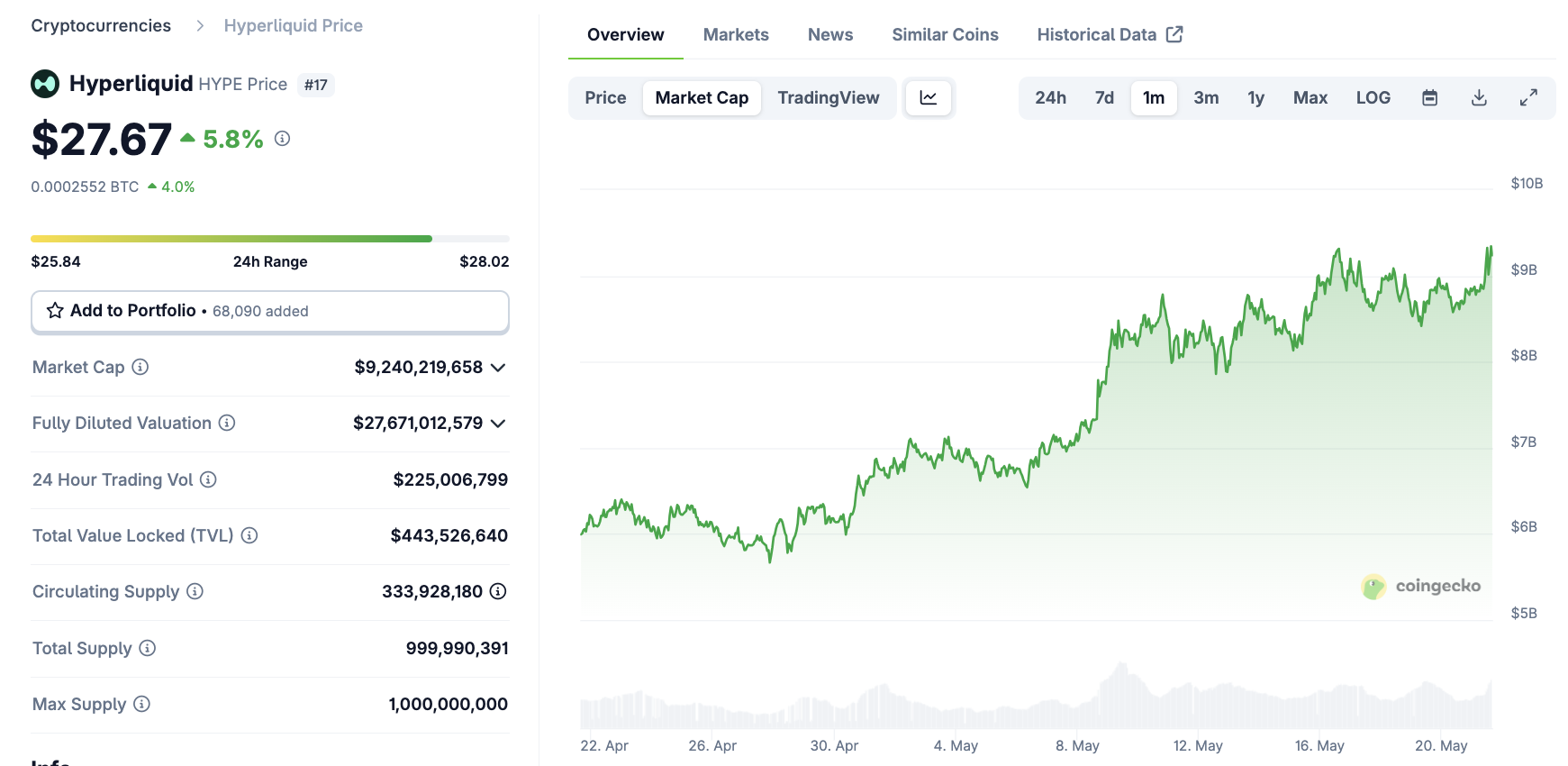

This helped the company buy 17% of the threshing media tokens in total circulation, offering several key advantages. During the last month, hype market capitalization regularly increased to $ 10 billion:

Despite its sharp increase, hyperliquid also experienced several major controversies. For example, he denied the allegations of a security violation of the Lazare group despite clear evidence on the channel last year.

In March 2025, he sparked a major scandal when he struck Jellyjelly in response to short pressure. This led to charges of market manipulation and substantial losses.

Dydx has not undergone public debacle like this for many months, but hyperliquid has acted quickly to rebuild its reputation. So far, it seems to have worked.

Earlier in the day, Hyperliquid also reached a new summit of all time in an open interest, exceeding 8 billion dollars. If it can maintain this momentum, the exchange can build a dominant advance on the market of deffi perpetuates.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.