Brown University Discloses $5M in BlackRock’s IBIT: Bitcoin Price Recovers

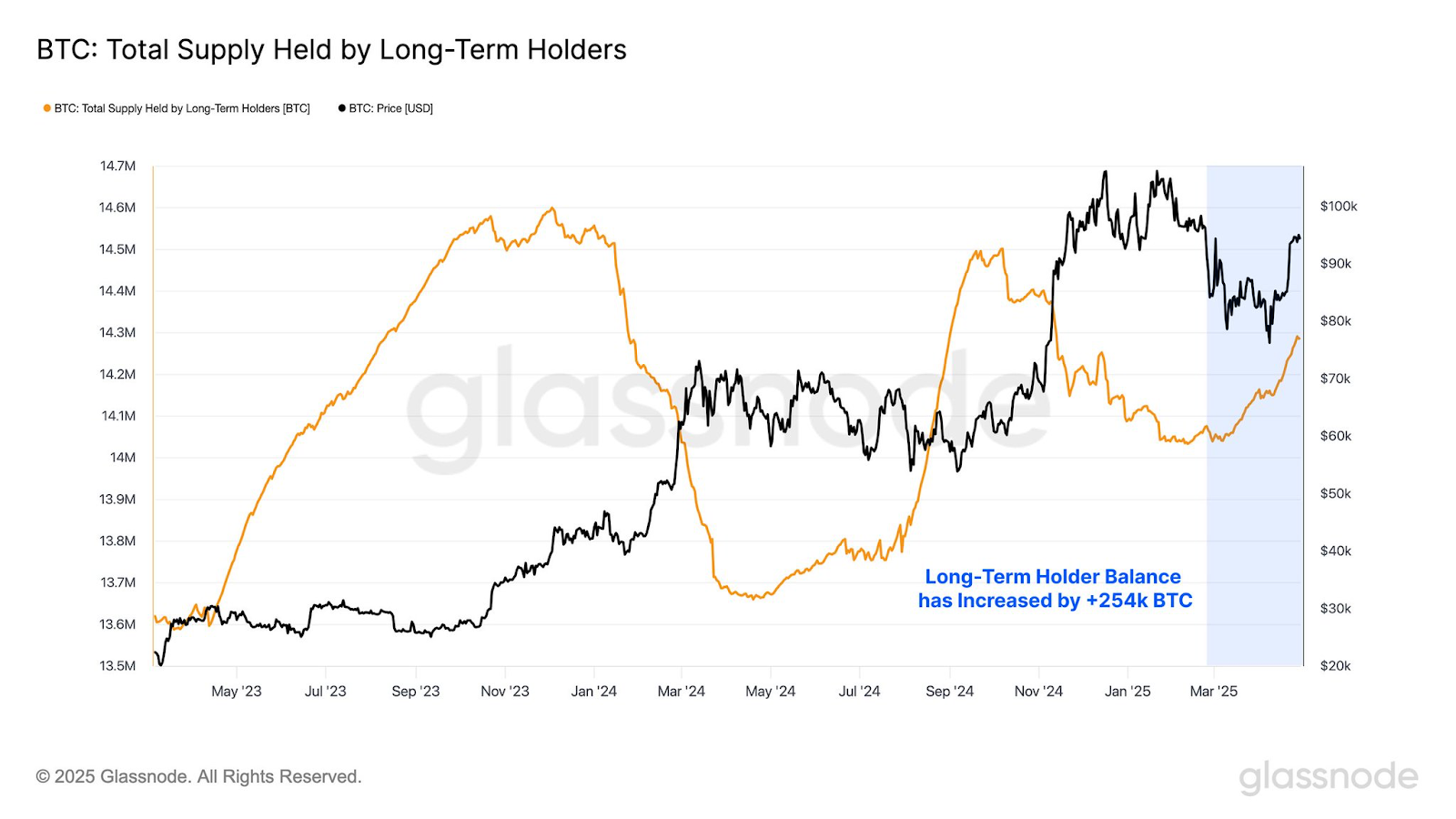

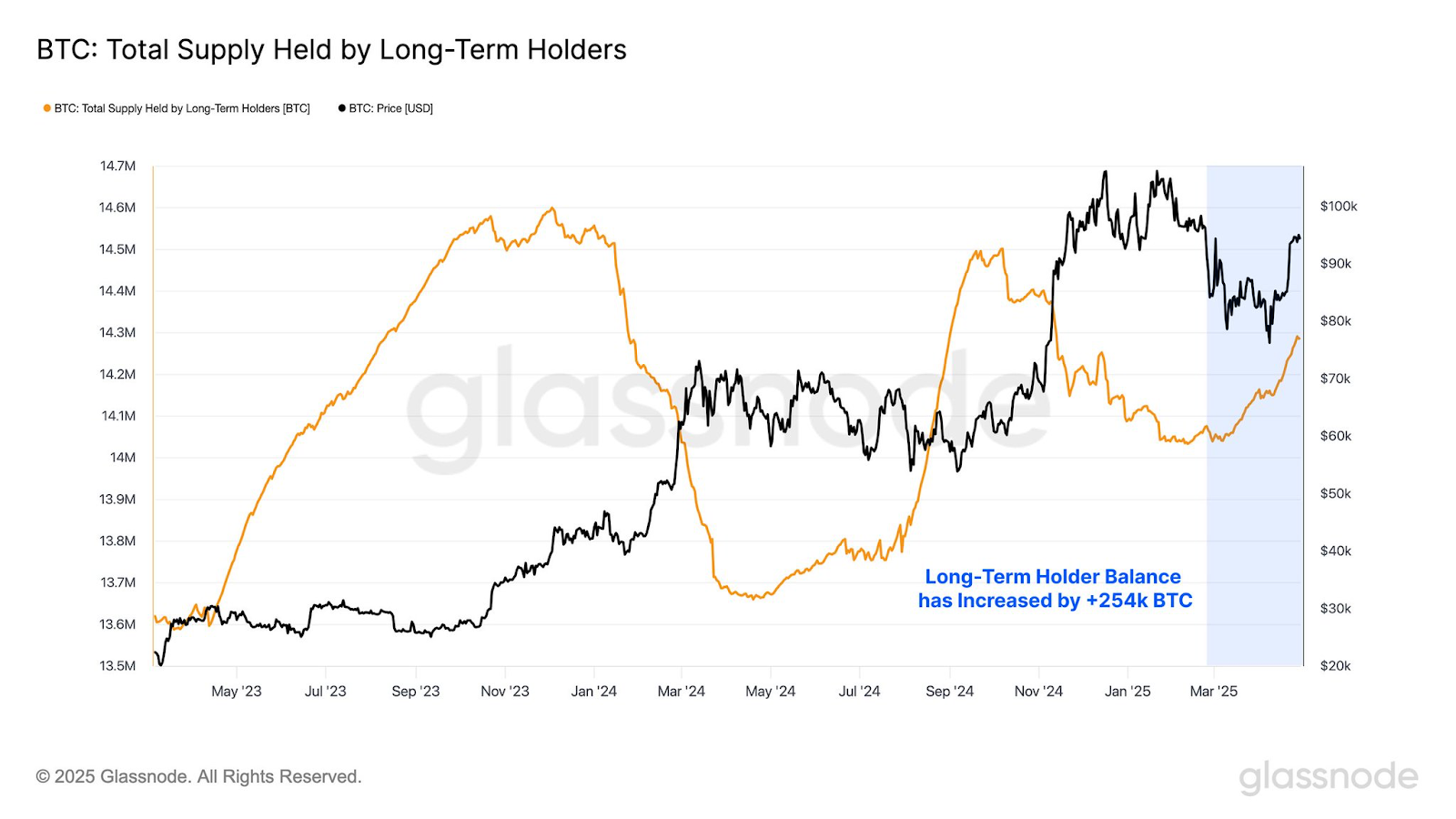

- The chain data show that long -term holders have continued to accumulate more bitcoins in a recent past.

- A parabolic rally for the BTC price is imminent in the coming months supplied by the increase in world liquidity and institutional adoption.

While the price of gold (XAU) signals a potential market reversal after an impressive rally since the first quarter of 2024, the rotation of capital in Bitcoin (BTC) has accelerated. According to Glassnode market data, long -term holders have added more than 254,000 BTC in the last three months to currently contain around 14.3 million parts.

Brown University is Bitcoin

Brown University, a veteran university founded in 1764, revealed an outfit of $ 4,915,050 of BlackRock Ishares Bitcoin Trust ETF in Form 13F at the US dry. The IBIT Fund has increased considerably in the past year to currently have around 607,685.5 bitcoins, which is worth more than $ 58 billion.

After the announcement, Brown University has become the third American university to publicly announce a Bitcoin holding company. In addition, Emory and the University of Austin (UATX) previously announced an important purchase of Bitcoin.

Brown University has a rich assessment of more than $ 7 billion in allocations, which could be converted into Bitcoin in the near future. In addition, Bitcoin has proven to be a reliable reserve of value and the United States is about to implement its Bitcoin strategic reserve.

Impact on BTC price action

The growing adoption of Bitcoin by institutional investors in the midst of increasing global liquidity has contributed to increasing its bullish feeling. The flagship piece is about to record its fourth, a consecutive optimistic weekly fence, after a first bearish quarter powered by fears of the trade war.

From the point of view of technical analysis, BTC Price now aims to retest its top of all time and to start the highly anticipated parabolic rally 2025. However, a drop below $ 92,000 will cause additional capitulation and potentially a long pressure in the following weeks.