Indicators Show Bitcoin’s Shocking Difference in the US and Korea

The Bitcoin price has reached consecutive heights of all time in July, but two key indicators suggest that the rally is strongly focused on the United States.

An increasing divergence between American and Korean commercial activities raises questions about global participation – and market risk.

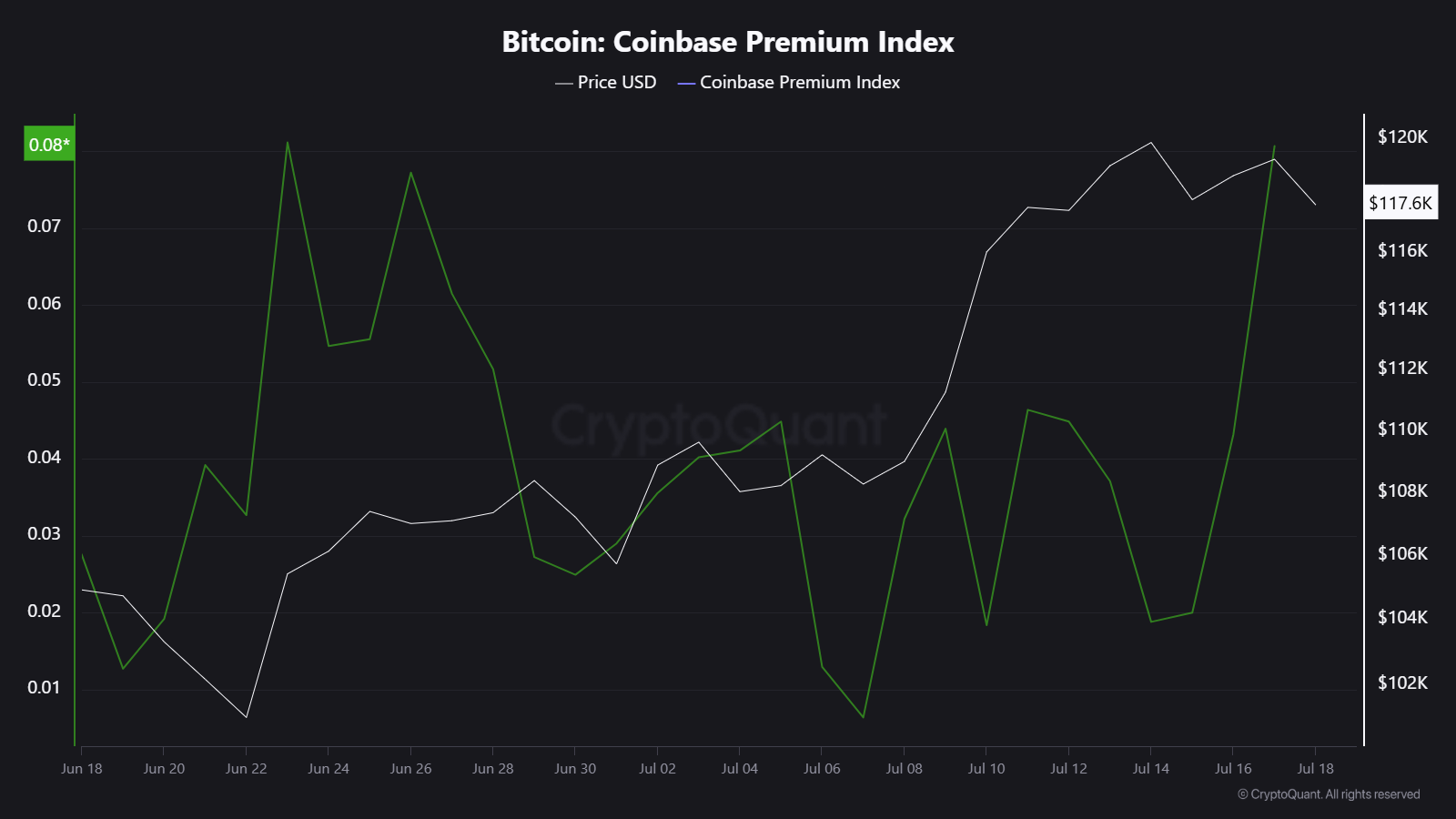

Coinbase Premium increases alongside Bitcoin Etf entries

The premium Coinbase index, which follows the price difference between Bitcoin on Coinbase (USD) and Binance (USDT), increased throughout July.

This premium climbed up to 0.08%, signaling high purchase pressure in the United States.

Coinbase serves American institutional investors and detail. An increase in the premium often reflects an aggressive accumulation of American whales, FNB suppliers or companies.

This is aligned with recent entries of more than $ 14.8 billion in Bitcoin ETF, pushing the BTC at a record level nearly $ 123,000.

These movements confirm that American institutions lead the current cycle, supported by favorable regulations and access to capital.

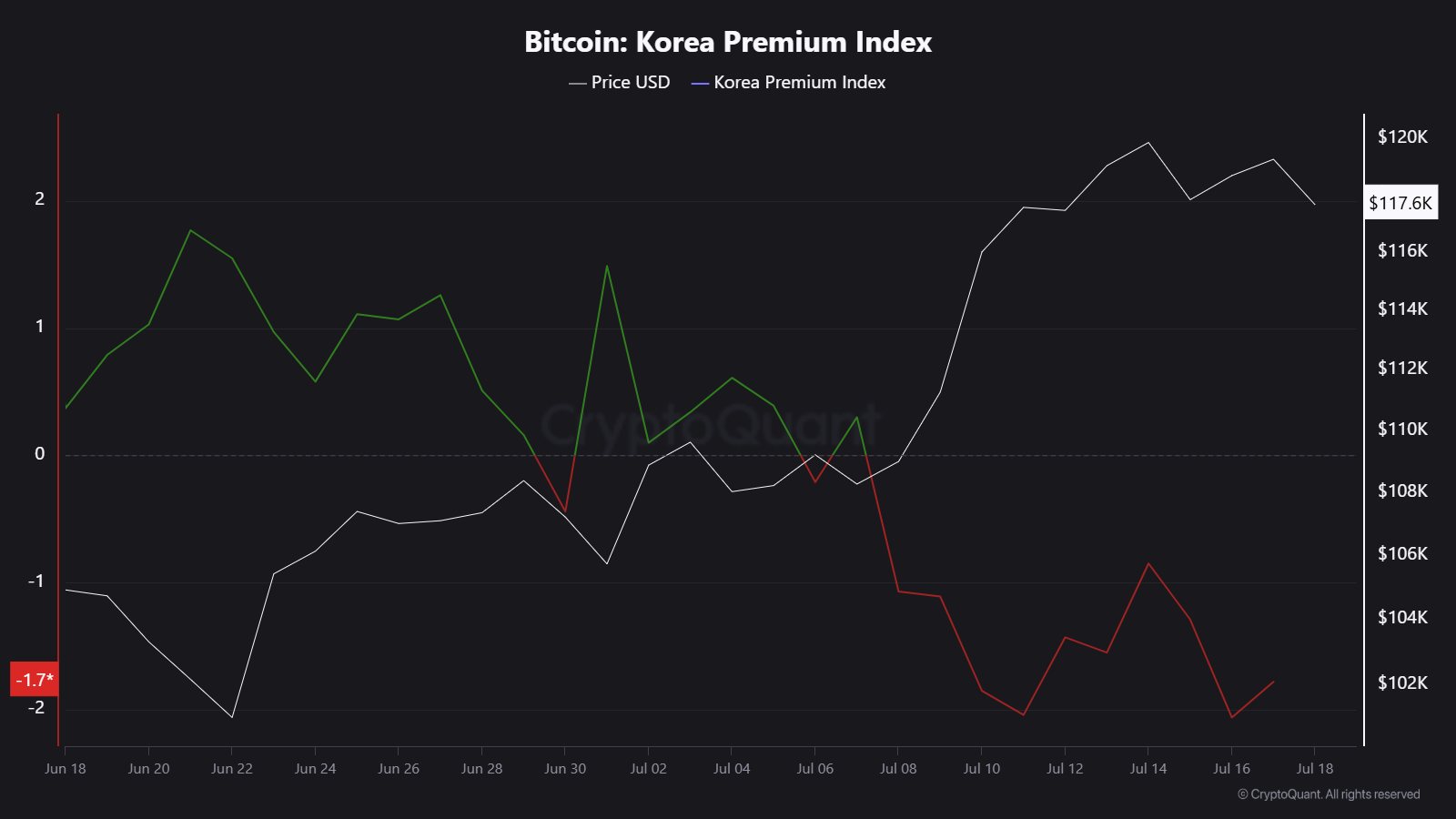

The Korean Bitcoin market tells another story

On the other hand, the Premium Korea index – often called “Kimchi Premium” – fell below zero.

This index follows the price difference between bitcoin on Korean exchanges (for example, Upbit, Bithumb) and global platforms.

In mid -July, the premium remains approximately -1.7%, showing that bitcoin is cheaper in South Korea. A negative Korea premium suggests that the demand for Korean detail is low, with few new investors entering the market.

In previous Bull Runs (2017, 2021), Korea has often seen bonuses of + 10% or morePulled by the speculative frenzy of retail. This dynamic is absent today.

Why this divergence is important

The split in premium indices reveals that the Bull Run de Bitcoin is not balanced worldwide. He is centered in the United States, with a limited retail enthusiasm of one of the most active markets in Asia.

Historically, the broad detail participation has supported and extended the bull markets. Without this, there is a risk that the rally will become too heavy, which depends on institutional flows alone.

This can also affect the dynamics of Altcoin, which is often based on Korean exchange liquidity and stories focused on retail.

Overall, the Coinbase bonus must remain positive if the American demand remains strong. But if he dives while Korea remains negative, this can point out a decreasing momentum.

A flip in the Korean premium in Positive would suggest a retail return and could feed the next step in the Bitcoin climb.

Until then, the action of Bitcoin prices will probably remain focused on the United States, led by ETFs, companies and wealth managers-and not global retail investors.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.