Investor Sell-Off Drives Pi Network Price Toward $0.57 Low

The recent Network PI price action has shown a clear drop, signaling potential continuous losses.

Market conditions have deteriorated for this Altcoin, the growing prudence of investors perhaps resulting in new drops. As the feeling weakens, the PI network can cope with a downstream pressure in progress.

Pi Network loses its grip among investors

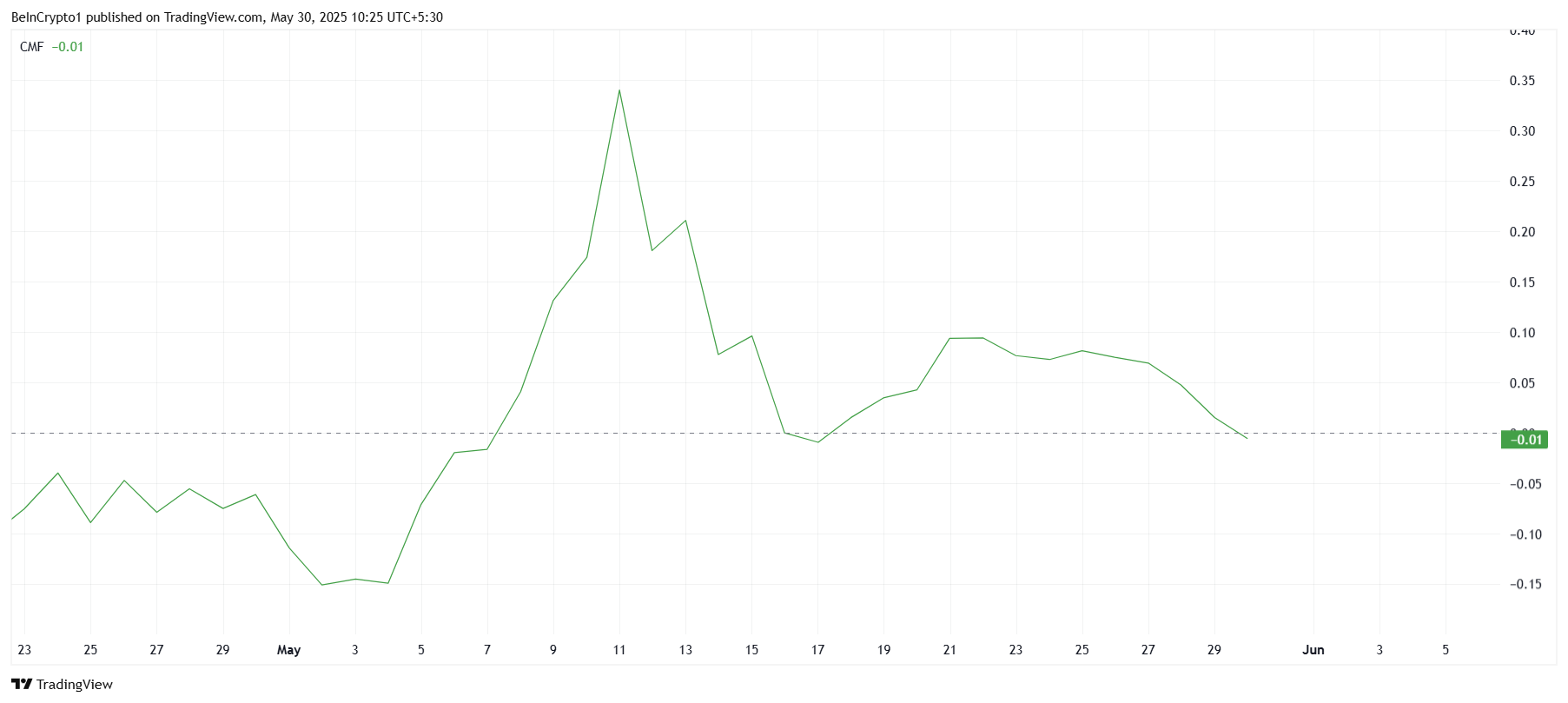

The Chaikin Money Flow (CMF) indicator reveals an increase in outings for the PI network, signaling an increasing sale of investors. CMF is currently slightly below the zero line, suggesting that the volume sale exceeds the purchase pressure. If the trend persists, this could indicate confidence and conviction among the holders.

This growing domination of outputs on entries reflects hesitation and a loss of confidence in the short -term potential of the PI network. Investors seem more and more suspicious, leading to new sales that could weigh on the price.

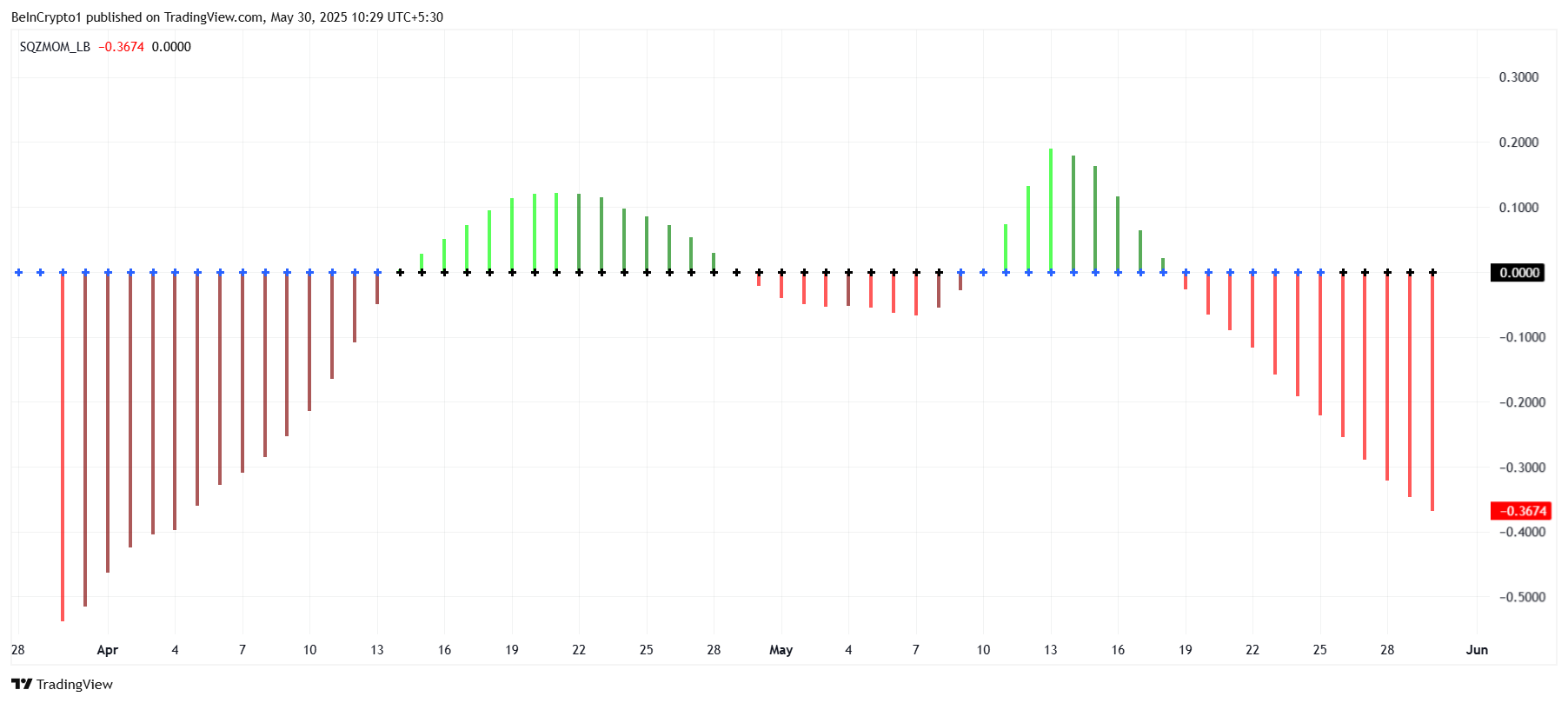

The PI network is currently experiencing active compression, as indicated by the switching indicator. Black pots over the graphic diagram signal periods with low volatility, generally followed by a release marked by blue dots where prices evolve strongly. Current compression constitutes a lower momentum.

Given the negative momentum in force, the imminent release of volatility is likely to cause a rapid drop in prices. This technical model often precedes significant movements downwards, strengthening the lowering perspectives for the PI network.

Pi Price faces a drop

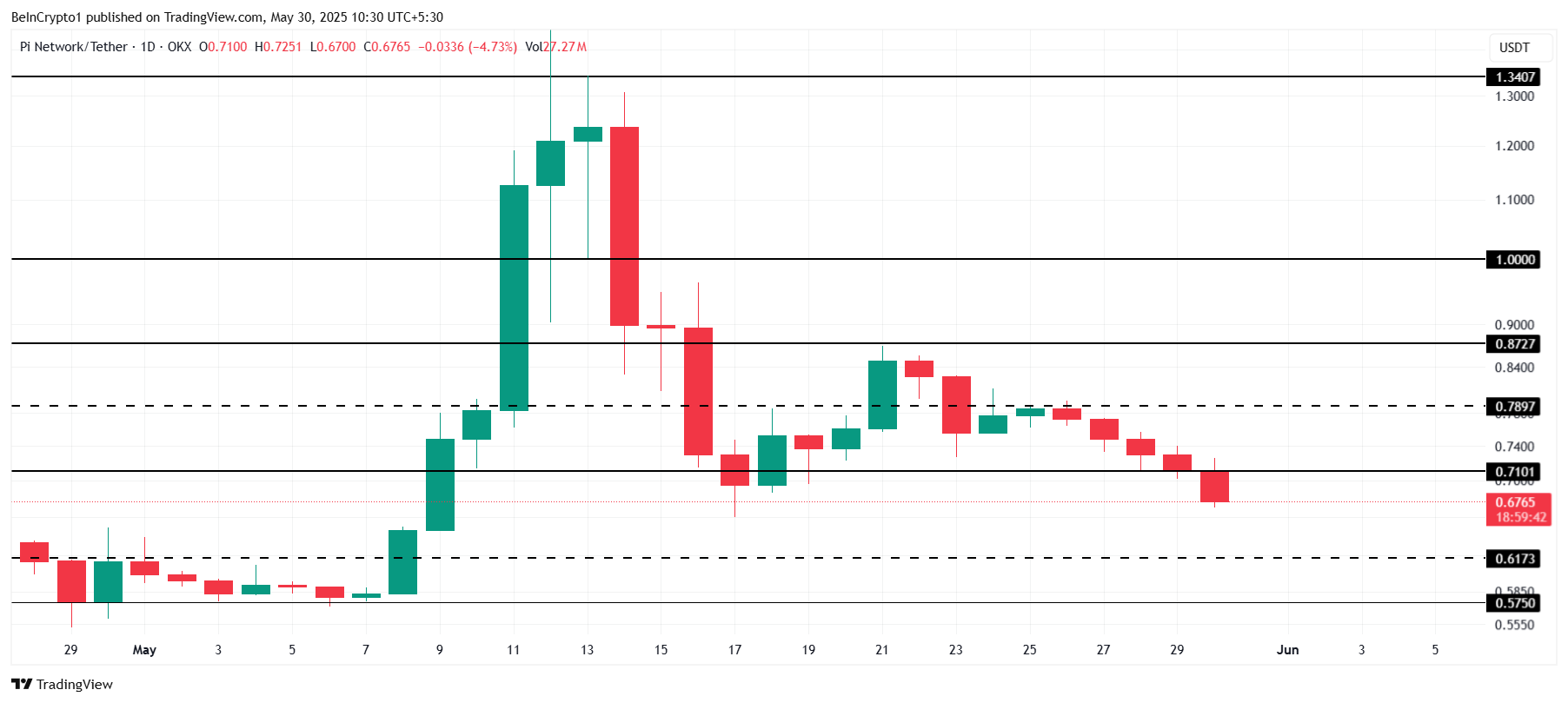

PI Network is negotiated at $ 0.67 after losing the level of critical support of $ 0.71 in the last 24 hours. This violation suggests that Altcoin could continue to slide lower in the coming days as the lowering feeling is gaining ground.

Immediate local support is $ 0.61. If the PI network does not hold this level, the price could still drop to $ 0.57. Such a decision would deepen the losses for investors and extend the downward trend.

Conversely, if Pi Network manages to recover $ 0.71 as a support level, it could trigger a recovery. An increase of $ 0.78 would point out a renewal of purchasing interest and invalidate the short -term downward thesis, potentially reversing the negative trend.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.