IP Price Surges 11%, Market Cap Now Crossing $500 Million

The price of history (IP) has increased by more than 10% in the last 24 hours as the excitement accumulates around its newly launched Mainnet. Story was one of the most anticipated crypto launches of the year, supported by $ 134 million in investor financing like Andreessen Horowitz and Polychain Capital.

With a strong dynamic stimulating its price action, the technical indicators suggest that the IP is at an important moment. Its market capitalization has crossed $ 500 million before seeing a brief correction. Whether it continues its rally to new peaks or faces resistance and backwards will depend on how traders react to key support and resistance levels.

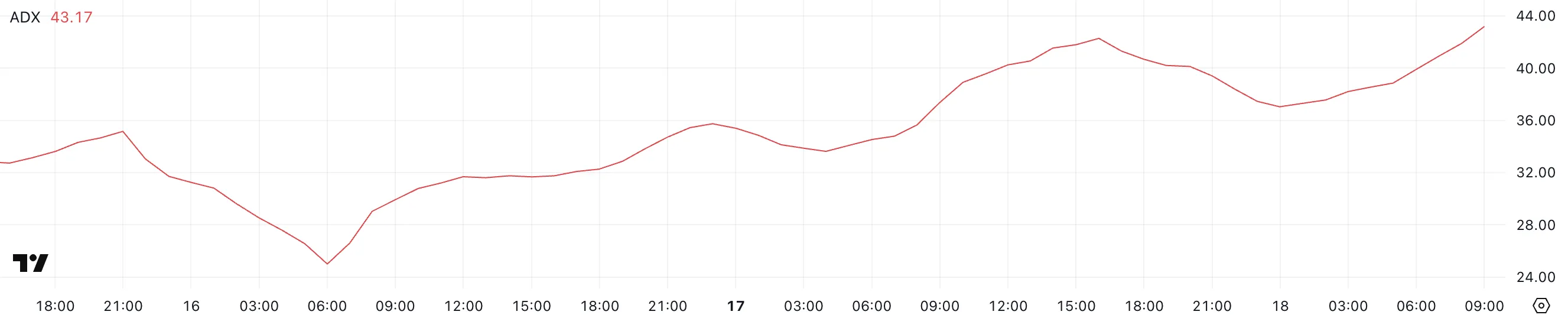

Adx history shows the upward trend is very strong

The story is trendy after the official launch of its layer of layer 1, its recent thrust triggering a sharp increase in ADX. The average directional index (ADX), which measures the trend force, whatever the management, went from 25 yesterday to 43 today.

Its price has increased by more than 11% in the last 24 hours, making it the most efficient Altcoin of the day.

As a rule, an ADX reading greater than 25 confirms a strong trend, while the values below 20 indicate a low price or jerk action. The current increase suggests that the momentum is reproducing, with increased commercial activity and a sustained directional movement.

With ADX now at 43, the trend remains strong, strengthening the bullish feeling. This means that buyers control and that the price could continue its upward trajectory if the momentum takes place. If ADX continues to climb, it could support other gains and report a prolonged trend.

However, if ADX begins to decrease, it may suggest that the momentum (IP) fades, which could lead to consolidation or even a potential reversal.

A drop in ADX alongside the weakness of prices would be an early warning for the exhaustion of trends, while stabilization in ADX at high levels would indicate that the market is still in solid phase.

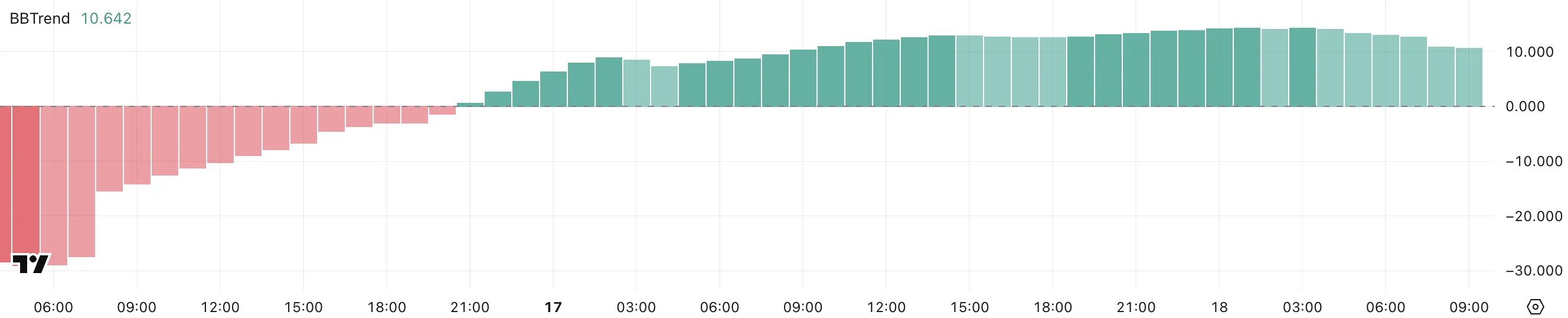

Bbtrend IP Is always very positive, but stable

IP bbtrend remained positive for more than a day, reaching a peak of 14.3 before going up to 10.6. This occurs after a strong recovery compared to his lowest of February 16, when he reached a negative peak of -29.

Bbtrend (Bollinger Band Trend) is an indicator that measures the price management compared to its Bollinger bands, helping to identify the strength of trends and potential inversions.

The positive values indicate a bullish momentum, while the negative values suggest a downward trend. Extreme readings often indicate over -racout or occurrence conditions.

With Bbtrend now at 10.6, the indicator remains in bullish territory, but its drop of 14.3 suggests that the momentum cools. This could mean that the purchase of pressure fades, leading to a period of consolidation or to a potential change in trend.

If Bbtrend stabilizes around this level, the increase trend can continue, but a new drop could indicate an increasing weakness. Traders will watch closely to see if the withdrawal is temporary or the start of a larger movement down.

IP price prediction: Can history reach $ 2.30 soon?

History (IP), which places it between the intersection of intellectual property and artificial intelligence, is currently negotiated between resistance to $ 2.12 and a support at $ 1.90, remaining in a fork of key price. If the upward trend is weakening and $ 1.90 is lost, the next major support is at $ 1.79.

A continuous downward trend could push further to $ 1.58, or even $ 1.40, reporting a deeper correction. These levels will be essential to determine whether buyers work to defend the trend or if the sales pressure is intensifying.

On the other hand, if the rise in trend is strong, the Altcoin could test the resistance of $ 2.12. An escape above this level could confirm the bullish momentum and open the door for a movement around $ 2.20, or even $ 2.30.

In this case, buyers would remain in control and pricing action could extend.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.