Iran’s Bitcoin Mining Faces a Digital Cold War

Welcome to the morning briefing of the US Crypto News – your essential overview of the most important developments in the crypto for the coming day.

Take a coffee to read on Bitcoin extraction wars. A sharp drop in the world hashrate, linked to power outages and American strikes in Iran, sparked fears of a new era: a new era: one where hashness becomes a geopolitical battlefield.

Crypto News of the Day: Bitcoin Hashrate Plunge Sparks Geopolical Alarm

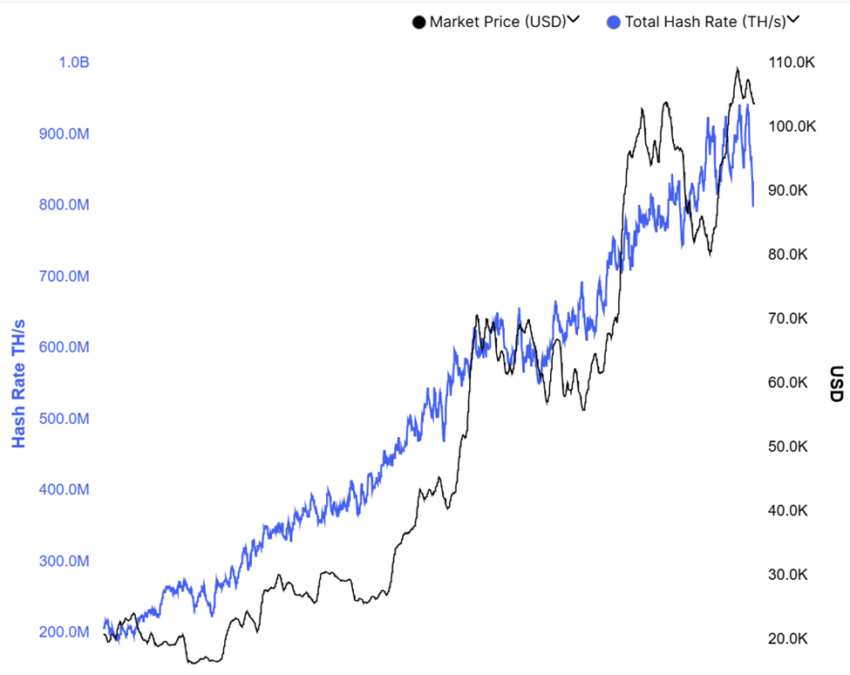

Network data show that the global Hashrate of Bitcoin has undergone its strongest decrease in three years, lowering more than 15% between June 15 and 22.

Beincrypto reported the recent dive, which made Bitcoin hashrate at an eight -month hollow. This sparked a debate on the question of whether weakness signals a wider risk for minors or an opportunistic point of entry for investors.

A week earlier, the mining costs had jumped more than 34% in the middle of world hairs records. The trend reversal suggests that minors have pushed the material limits despite the narrowing of profitability margins.

The sudden drop coincides with reports on American military strikes on Iranian infrastructure and generalized internet breakdowns in the country. This triggered alarms on the growing geopolitical risks linked to Bitcoin exploitation.

In this context, Beincrypto contacted Max Keizer for insights. The Bitcoin pioneer suggested inaugurating a new consolidation phase and a regional reshuffle.

“We could have entered an era when countries bombard the Bitcoin extraction installations of the other as part of the world hash was predicted in 2017,” Max Keizer told Beincrypto.

In particular, the volatility of the hashrate is not unusual during seasonal power changes. This is particularly true in North America, where hydroelectric availability changes during the summer.

Notwithstanding, the moment of this particular disturbance is notable. Iranian mining activity represents approximately 4% of the global Hashrate of Bitcoin, analysts specifying that the Iranian energy regions provide a paradise for mining on an industrial scale despite international sanctions.

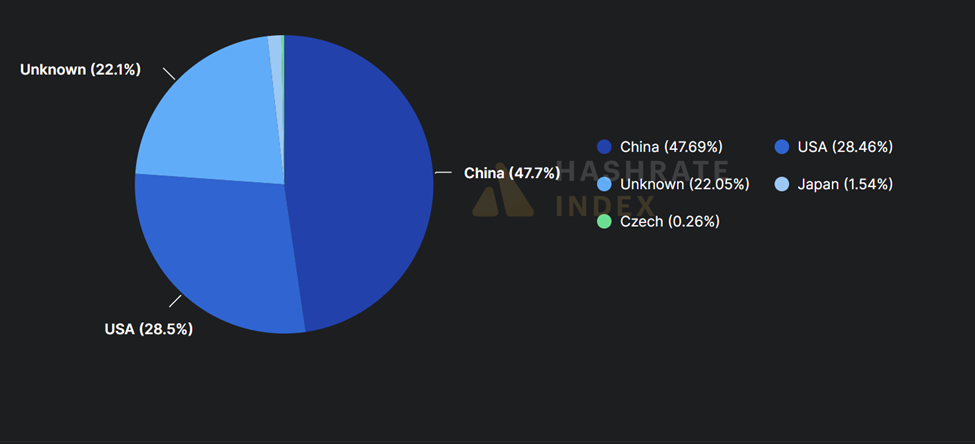

Meanwhile, the United States represents 30% and 47% for China. Keizer has also warned that the American mining center in Texas could present “strategic vulnerability” if hostilities increase in cyberspace or on the ground.

The comments echo long -standing concerns among the Bitcoin maximalists that the hash would eventually become a question of national security.

With military tensions that increase and decentralized the increasingly entangled infrastructure with national interests, Bitcoin exploitation may no longer be the apolitical industry which it once aspired.

Meanwhile, it should be mentioned that President Trump’s trade policies have also caused a reshuffle of minors. Beincryptto reported that Chinese Bitcoin extraction equipment is moving to the United States to avoid prices. This means that distribution could change, potentially in favor of the United States.

This report aligns with recent reports, indicated in a recent American publication of Crypto, which the mining hash power has also become a geopolitical battlefield, such as the stock market.

Graphic of the day

Alpha the size of an byte

Here is a summary of more news from crypto in the United States to follow today:

Presentation of the actions of the crypto-actions

| Business | At the end of June 25 | Preview before the market |

| Strategy (MSTR) | $ 388.67 | $ 386.70 (-0.51%) |

| Coinbase Global (Coin) | $ 355.37 | $ 357.26 (-0.53%) |

| Galaxy Digital Holdings (GLXY) | $ 19.40 | $ 19.41 (+ 0.052%) |

| Mara Holdings (Mara) | $ 14.98 | $ 15.01 (+ 0.20%) |

| Riot platforms (riot) | $ 10.00 | $ 9.99 (-0.10%) |

| Core Scientific (Corz) | $ 12.30 | $ 12.40 (+ 0.81%) |

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.