Is a Bigger Surge Coming?

The native token of Hedera Hashgraph Hbar posted a price increase of 10% in last week, pushing the Altcoin to a new more than 30 days of $ 0.179.

While the broader feeling of the market is improving, Altcoin seems to be well positioned to prolong its rally in the coming days. But how high can he climb?

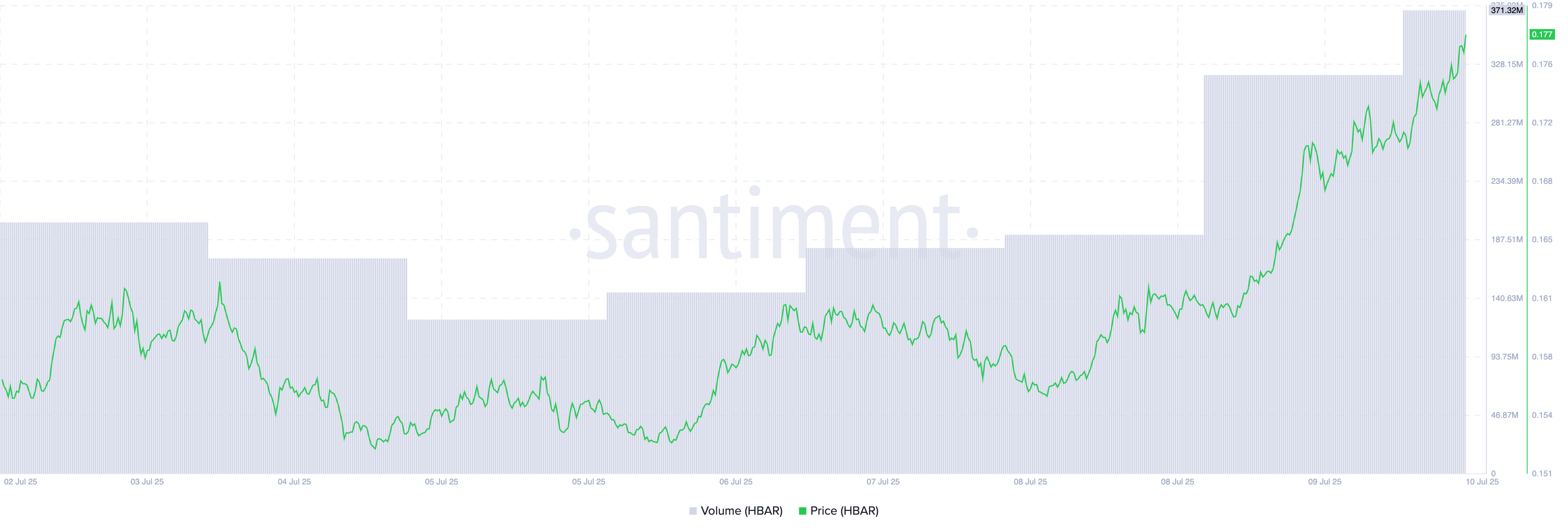

Hbar volume reaches $ 373 million, long positions take the lead

The volume of Hbar daily trading has climbed almost 100%, reaching a summit of 60 days of $ 373 million at the time of the press. This highlights the growing interest of investors and strengthens the strength of the current trend.

When the price of an asset and the volume of negotiation climb simultaneously, it signals a strong bullish dynamic and an increasing confidence of investors. The increase in volume confirms that the price movement is supported by a significant commercial activity.

This therefore reduces the probability of a false escape and suggests that buyers actively stimulate the market.

For Hbar, its two -digit thrust – on the level at a higher level of 60 days in a volume of negotiation of $ 373 million – indicates that the recent gathering is gaining ground. This convergence of the force of prices and volume supports the opinion that the upward trend of Hbar could continue in the short term.

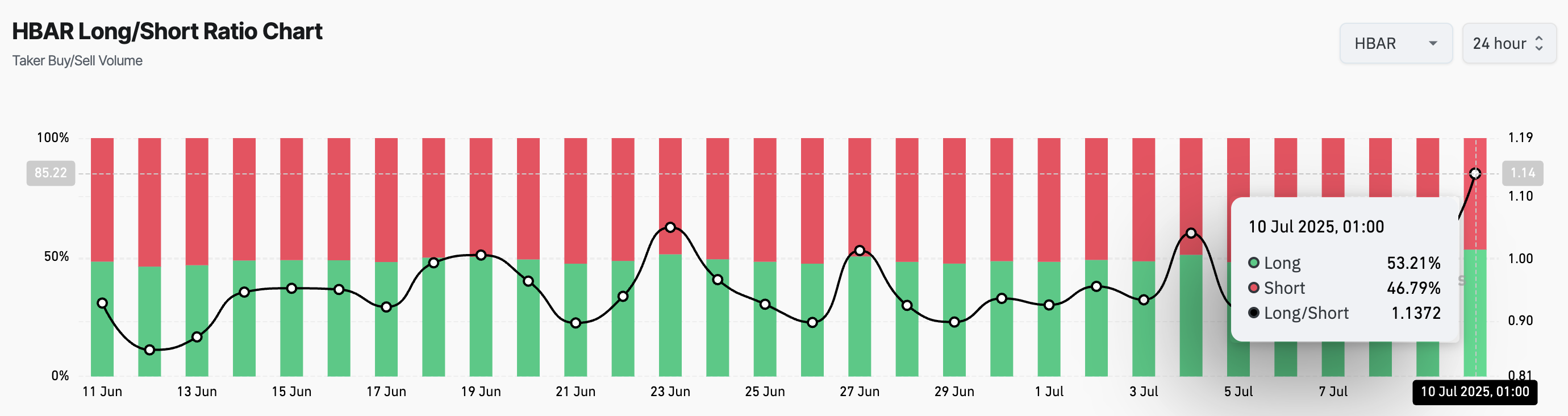

In addition, the high increase in the price of Hbar to a 30 -day summit triggered a demand for long positions in its long -term market. This is reflected by its long / short ratio, which is at a summit of 30 days of 1.13 at the time of the press.

This metric measures the proportion of upward (long) positions to lower (short) positions in the long -term market of an asset. When the ratio is lower than one, traders bet on a drop in prices rather than an increase.

It shows skepticism around the short -term price prospects of the token, because traders predict more downward movement.

Conversely, as with Hbar, when the report is higher than one, there are more long positions than the shorts. This suggests a bullish feeling, most traders expecting the value of the asset to increase.

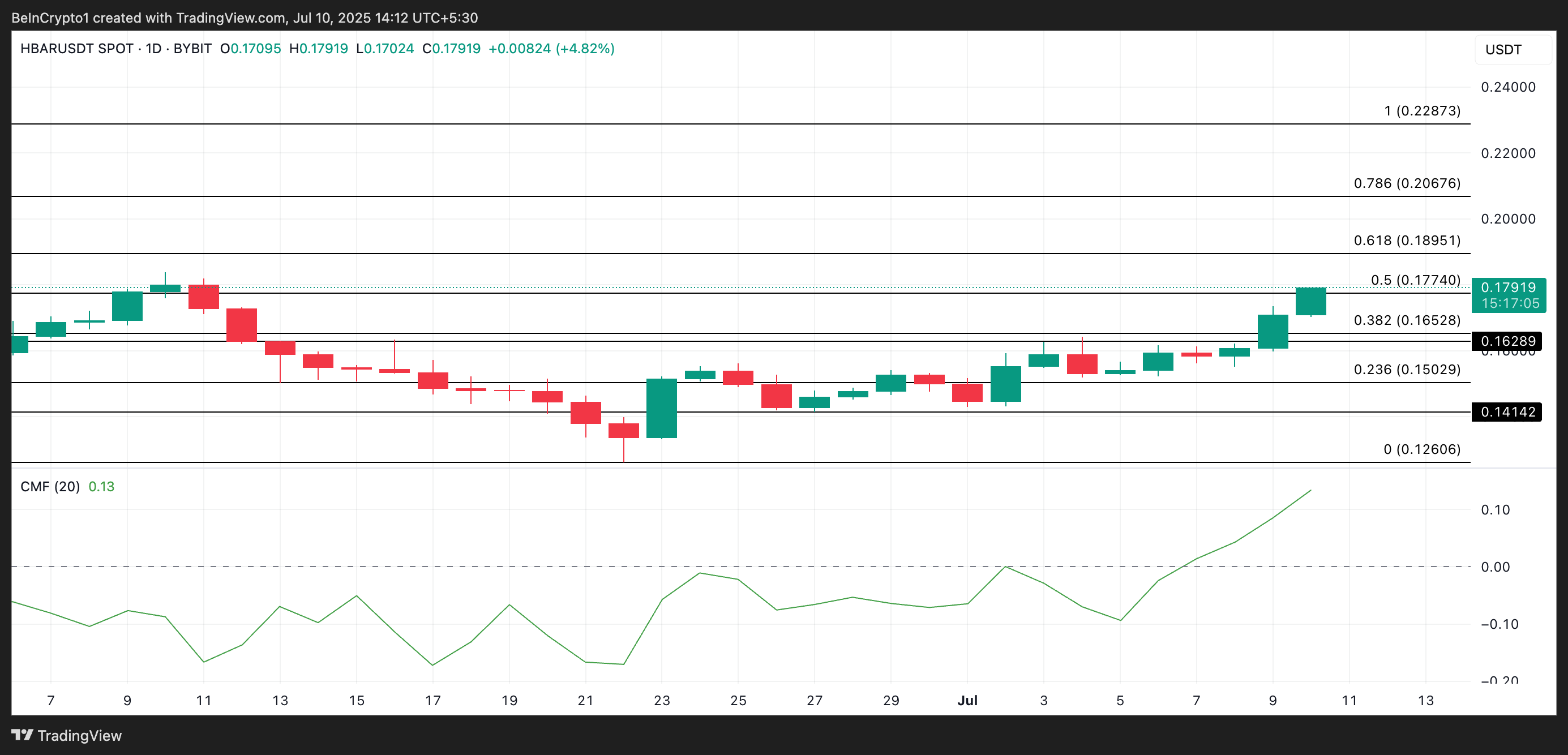

The monetary flow in Hbar – Price’s overvoltages faces a pivot test of $ 0.189

The Chaikin Rising Monetary Flow (CMF) of Hbar on the daily graphus supports the upward perspectives above. This momentum indicator, which follows the way in which money flows in and out of the asset, is above the zero line at 0.13 and in an upward trend at the time of the press.

The positive readings of CMF during rally periods as this indicate that the purchase of the pressure prevails over the sale pressure, the capital flush regularly in the Hbar. This means that investors are confident in its upward trend and accumulate in the hope of recording more gains.

If this continues, the price of the token could test the resistance at $ 0.189. A successful violation of this price barrier could send Hbar to $ 0.206.

On the other hand, if the sales activity resumes, this bullish projection would be invalidated. In this case, the price of the token could fall to $ 0.165.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.