SOL Price Eyes Rebound as Whale Buying and Golden Cross Align

Solana (Sol) Price tries to recover the level of $ 200 after recently dropped below $ 190. This rebound occurs while its market capitalization is close to $ 97 billion, reflecting a renewal of investors’ interests.

The technical indicators suggest that soil could take additional momentum if a golden cross forms, which can push the price to $ 209 and beyond. However, if the purchase is weakening, Sol could face another decline, with key support levels at $ 187 and $ 175.8.

Solana whales are trying to recover

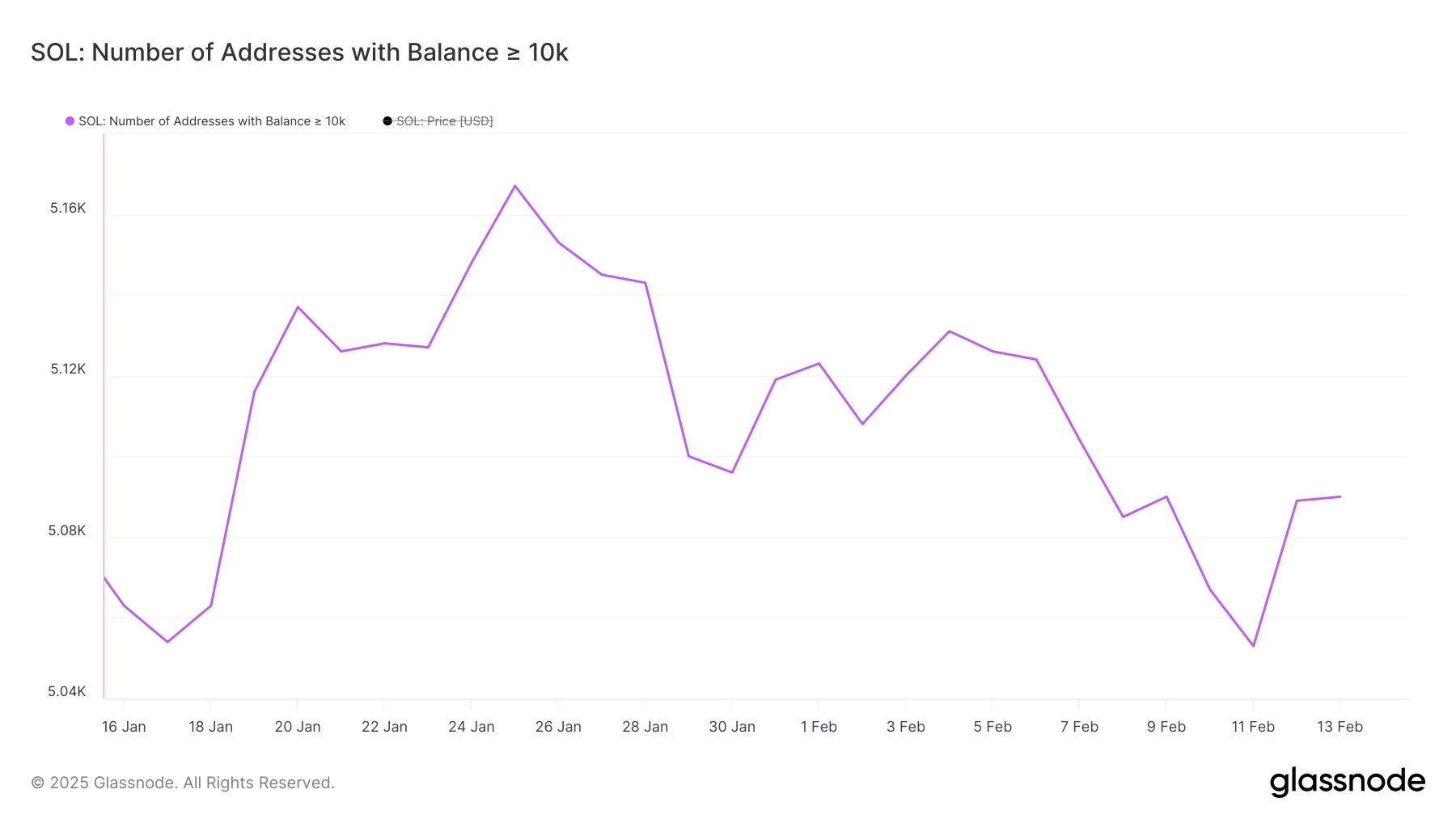

The number of Whales soil – portfolios holding at least 10,000 soil – has experienced a significant drop in recent days, going from 5 131 on February 4 to 5,053 on February 11.

This follows a summit of 5,167 all time on January 25, after which whale assets began to decrease. Such a decline suggests that some major holders discharged their positions, potentially creating sales pressure on the ground price.

Monitoring the activity of whales is crucial because these major holders play a key role in market movements. After reaching 5,053, the number of whales started to increase, currently at 5,090.

This slow recovery could indicate renewed confidence among major investors, but the global trend remains uncertain. If the accumulation of whales continues, it could support the price of Solana, while stagnation or another decrease can point out a weakness.

Solana DMI shows that buyers are trying to take control

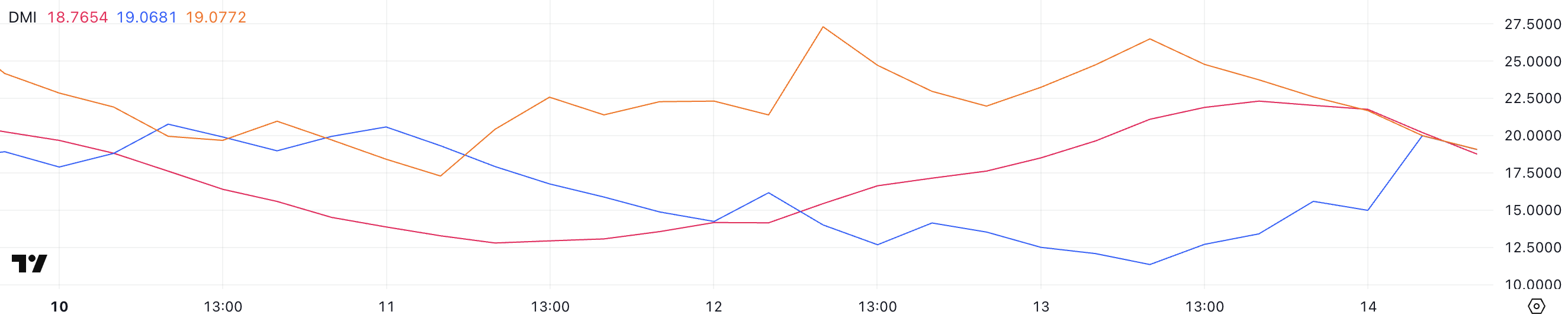

The graph of the Solana Directional movement index (DMI) shows its average directional index (ADX) to 18.7, against 22.2 yesterday. An ADX declining suggests weakening the strength of trends, indicating that the previous decline trend can lose momentum.

Meanwhile, the + DI went from 11.3 to 19, while the -Di went from 26.4 to 19, signaling a change in the purchase and sale of pressure.

ADX measures resistance to trend on a scale from 0 to 100, with values above 25 indicating a strong trend and values less than 20 suggesting a low or undecided movement.

With ADX in decline and + di increases while -Di falls, Solana seems to try a trend reversal. If the purchase pressure continues to increase, soil could establish a new upward trend, but if ADX remains low, the market can remain in consolidation before a clearer direction emerges.

Can Solana Price: So Solana maintains levels above $ 200?

Solana Price tries to recover the threshold of $ 200 after recently dropped below $ 190. One of its short -term mobile averages is close to crossing another, which could lead to a golden cross.

If this Haussier signal materializes, soil could increase to test $ 209, and a break above this level can push it to $ 219.9. If the momentum of returns from the previous month, Sol Price could even go back to $ 244, marking its highest level since the end of January.

However, if soil fails to establish an upward trend, it could face a renewed sales pressure.

A drop in support of $ 187 is possible, and if this does not hold, Sol could decrease more to $ 175.8.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.