Is It The Perfect Buying Opportunity?

Solana’s price effectively rebounded almost 8% in early August after a sharp drop of 25% compared to the summits of July. This rebound occurs while key technical levels and optimistic flips feeling, despite macroeconomic concerns.

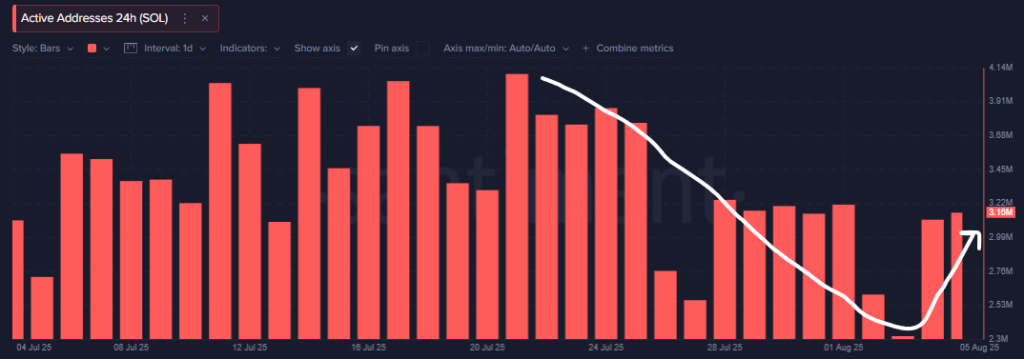

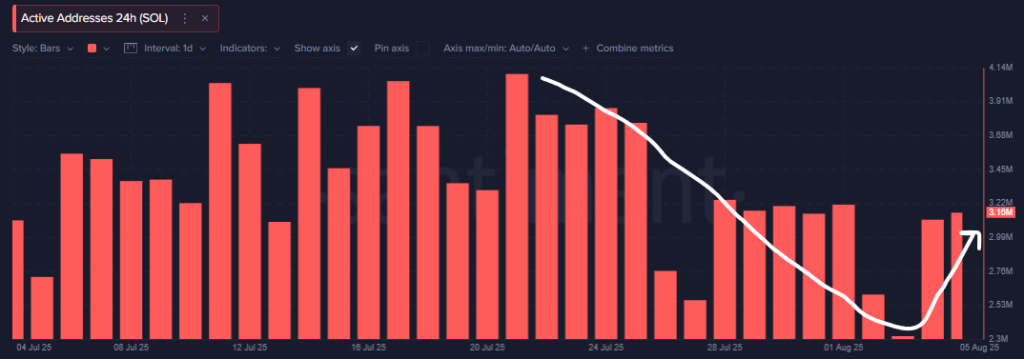

The renewal of interest is supported by the increase in active addresses, funding rate data and crucial trend support support on the daily graph.

Solana Price today: recovery gathers after a clear correction

After reaching a peak in July of $ 206, Solana’s price experienced a quick correction, mainly of the profits, allowing more than 25% to reach lows nearly $ 155.

However, a rapid reversal followed, where Altcoin jumped almost 8% in early August. During writing, the Solana price exchange today at around $ 167. This recovery is supported by a feeling of market improvement and positive fundamentals.

On Monday, one of the biggest feeling drivers came from the announcement of the mobile SOECKERS Initiative, which seems to have transformed the prospects for a renewed upward expectation. This optimism is also taken up in the data from Solana derivatives.

Derivatives and chain metrics confirm the bullish change

By looking at the quince platform more closely, he revealed that the weighted financing rate by OI was turned positive on Tuesday. This has clearly shown an important key signal representing the bullish positioning increasing among the traders in the long term.

This is aligned with the increase in active 24 -hour addresses indicated in health data, reflecting the growing interest of users.

In addition, the total locked value (TVL) on the DEFILMA platform started to rise up and are currently $ 9.84 billion.

The ground price graph shows a technical escape potential

Technically, the floor price today is trying to recover the criticism. The asset has already violated the exponential mobile average of 50 days and is now approaching the EMA group of 20 days.

This higher climb occurs in particular after the Solana price bounced from a trend support respected in early August.

The trend line, which acted as a springboard several times before, has once again proven to be reliable, the current overvoltage validating its strength.

Looking at the floor price table, a successful decision above the $ 195 resistance zone is necessary to review the vertices of July nearly $ 206. If this level was erased, the Solana price prediction range extends to $ 238 at $ 258.

Historical models refer to greater increase in increase

Interestingly, this is not the first time that Solana has been testing such a trend for support. Similar bullish configurations in the past, especially in 2023, have led to strong rallies. A third new test of this type was now observed in 2025.

This historical repetition gives weight to the theories of a parabolic break, although the immediate targets remain moderate.

If short -term resistance nearly $ 195 is convincingly raped, the scene can be fixed for the USD Sol price again $ 206 and can potentially make new annual heights.