Is SOL Price Overbought or Breaking Out? Experts’ Analysis and Insights

Solana (soil) Price joined 3% in the last 24 hours to discuss around $ 164 on Friday, July 11, during the American world session. The large capitalization Altcoin, with an entirely diluted assessment of around 99 billion dollars, recorded a 62% increase in its daily volume exchanged to oscillate about $ 7.9 billion at the time of writing this subject.

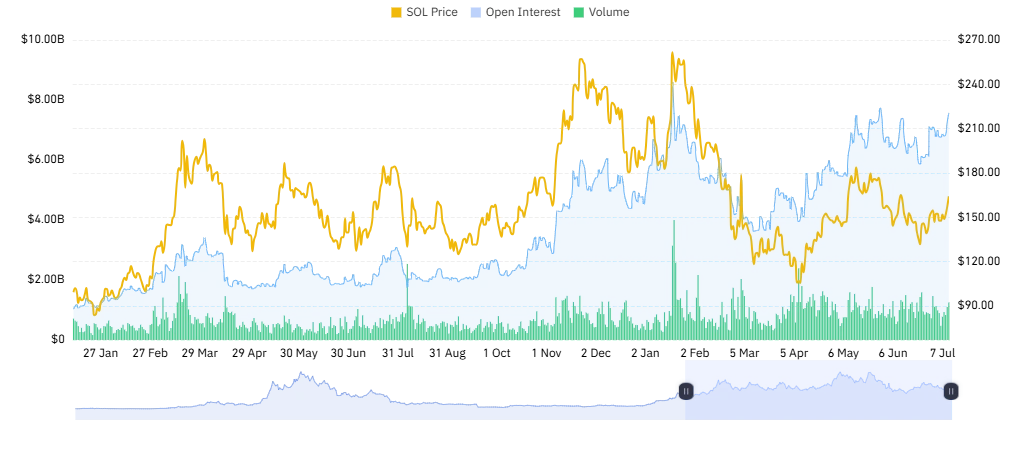

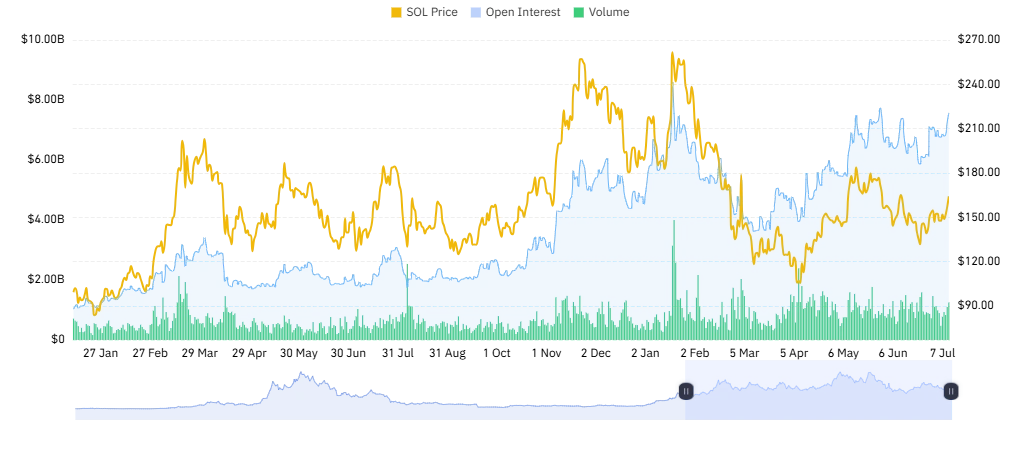

Due to increased volatility, more than $ 23 million have been liquidated from Solana’s leverage, with short traders involving $ 16.7 million. Meanwhile, Solana’s open interests (OO) have increased in tandem with its volume to around $ 7.5 billion and $ 16 billion respectively, according to the market data analysis provided by Coringlass.

Solana Network records a high offer vs shock of demand

The Solana network has recorded a significant increase in its activity on the chain, fueled by the rise in demand from retail merchants, whale investors and companies. It is sure to say that Solana’s bullish feeling is largely reinforced by the supply compared to the demand for demand fueled by the growing adoption of institutional investors.

Earlier Friday, Upexi Inc. (Nasdaq: Upxi) announced that it had raised $ 200 million thanks to a private placement of ordinary shares and convertible tickets to buy more Solana for its treasure. According to Allan Marshall, CEO of the company, Upexi plans to hold 1.65 million soil parts, worth 273 million dollars on July 16.

Upexi joins an increasing list of companies that have adopted Solana for cash management, including soil strategies.

Half-cross expectations for the ground price

Sol Price has gradually taken a bullish momentum in the daily and weekly time, especially after the Bitcoin price exceeded $ 119,000 for the first time in history. According to Crypto Ali Martinez analyst, the Sol price targets $ 180 in the coming days after having exploded a level of resistance around $ 158 in the last 48 hours.