Is Sui Overtaking Solana As The Next Institutional Favorite?

Suis and Solana recently made the headlines with a notable change in institutional interest. In recent weeks, SU has won significant land, exceeding Solana to become one of the best assets of institutional entries.

The question arises now: is it a temporary trend, or do institutions really change to concentrate on suis as the next big competitor in the blockchain space?

Sui exceed Solana

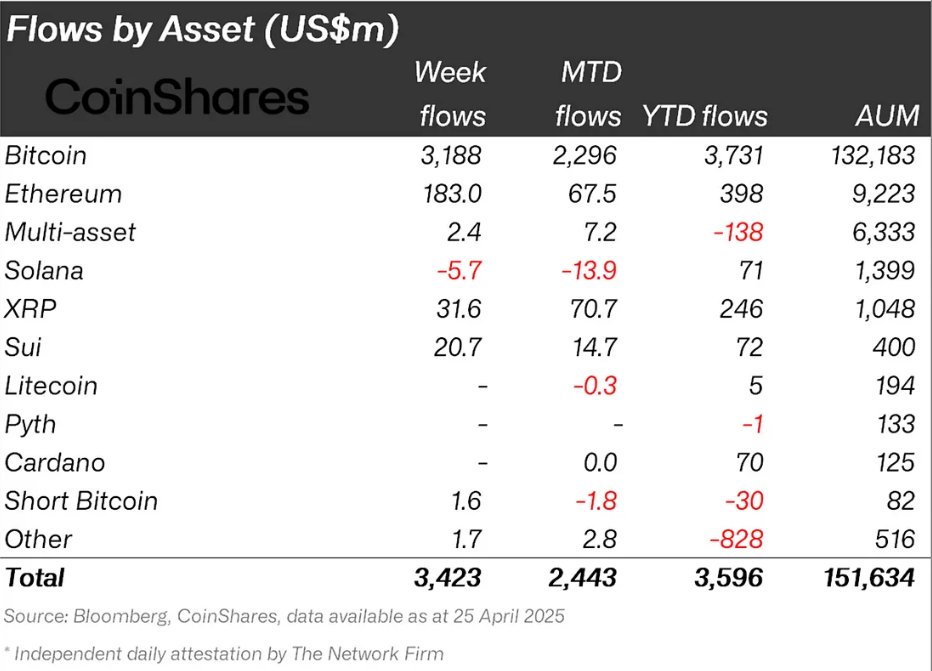

Avril turned out to be a crucial turning point in Such while he exceeded Solana in terms of institutional entries. Sui attracted $ 14.7 million in entries. Meanwhile, Solana saw $ 13.9 million in outings during the same period.

Even the year up to date, SUD gives difficult competition in Solana, with entries of $ 72 million. This change in the feeling of investors could indicate a broader change in the market, indicating that institutions promote Sui compared to its well -established counterpart.

The trend is particularly interesting, given the performance of the two active ingredients. While Solana has long been considered a strong actor in the blockchain space, the recent increase in sui suggests that investors can diversify on the main platforms.

Juan Pellicer, senior research analyst at Intotheblock, shared similar opinions with Beincrypto concerning Su.

“Institutions are diversifying rather than replacing Solana by Sui. Some capital has changed, by indices that 60% of Solana’s outings moving to Suit, drawn by its growth potential and more recent technology. However, the market capitalization of $ 73 billion in Solana, its ecosystem and its solid ETF, the maintenance of the ETF, declared Pellice, the role of sui in the role of diversified Portfolios institution, “said Pellice.

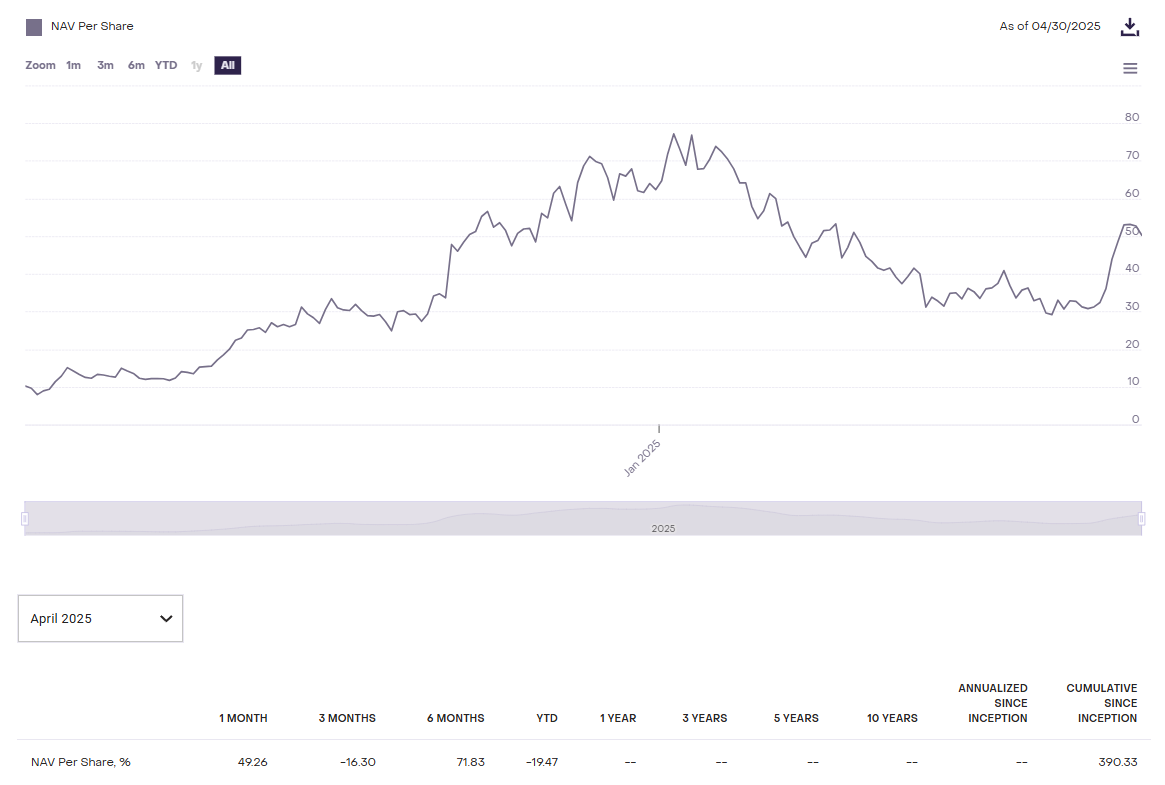

The macro impulse of the two active ingredients also deserves to be considered, in particular when comparing the gray levels for sui (suifund) and Solana (GSOL). Over the past six months, the value of net assets (NAV) from the Graycale sui trust has experienced a positive variation of 71.8%, while Solana navigation has remained flat.

This striking contrast in performance highlights the different demand from these tokens and the subsequent impact on their associated investment vehicles.

In addition, CBOE recently requested the approval of the dry for the SUD ETF of Canary Capital. However, Pellicer thinks that it may not happen anytime soon.

“An ETF Suis is less likely to be approved in front of an ETF Solana. The June 2024 deposits in Solana, $ 73 billion, and the support of large companies such as Fidelity priority for the decisions of mid-2025. The March 2025 SUP deposit can allow delays in status more recently than expected.

Prix performance on against Solana

SUP and Solana have experienced a price drop since the start of the year, Suis experienced a drop by 14% and Solana a drop of 19%. However, April marked a significant change for the two tokens, following 56.6% to negotiate $ 3.54, while Solana posted a more modest rally of 21%, of $ 151.

Despite growth in April, it is important to note the difference in market capitalization between the two. The growth in market capitalization of $ 11 billion in Solana in April is equivalent to all the market capitalization of Sui. This difference in growth in market capitalization indicates that if the SUP rally is impressive, the higher market capitalization of Solana gives it a more established presence on the market.

However, the strong performance of Suit in April highlights a change of native interest, driven by its more scalable channel and its growing partnerships. This trend could continue, fueling more in -depth growth of Sui at T2 and T2, while it is based on its momentum. However, SUI is still far from overflowering Solana as an institutional favorite.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.