Is the Genius Act a Fiat Slavery Tool for Banks?

Welcome to the morning briefing of the US Crypto News – your essential overview of the most important developments in the crypto for the coming day.

Take a coffee and seated. While legislators in the United States are pushing the new stablecoin regulations, the veteran of Bitcoin Max Keizer does not hold back. It warns that far from promoting financial freedom, Stablecoins strengthen the Fiat Bitcoin system (BTC) to disrupt.

Crypto News of the Day: Max Keizer warns against the anti-bitcoin agenda behind us Bill de Stablecoin Bill

In a declaration shared with Beincrypto, Bitcoin Advocate Max Keizer launched a puffy attack against Stablecoins.

He warns that the stablecoins undermine the central goal of Bitcoin by strengthening the domination of the Fiat and supporting the traditional banking system.

His remarks come when the debate intensifies on the proposed engineering law, an American bill which aims to regulate the StableCoin market. The proposed US law will create a regulatory framework for the stablescoins supported in dollars.

“For those who hate money supported by the state, inflationary and trustee, you will really hate stablecoins,” Keizer told Beincrypto.

Bitcoin Pioneer maintains that stablecoins, often presented as a crypto springboard, actually serve a very different master.

“As I said, Stablecoins are not a ramp with the Bitcoin ramp. They are designed to be a ramp on the US dollar; empower politicians and transmitters, who work with the banks inherited to fight against self-chatted bitcoin and FIAT freedom of slavery,” he added.

Keizer’s comments align with the growing concern that Stablecoins, in particular those set to the US dollar, are co -opted to support the existing financial order.

In a recent American publication of Crypto News, Max Keizer highlighted a growing trend among stablecoin issuers using US Treasury bills to buy Bitcoin for free. As Beincrypto reported, Keizer said that these actions could undermine government reserves and lead to financial instability.

The emergence of the genius law has put this tension to a clearer home. Critics argue that the bill is strongly biased in favor of banking interests.

One of the most controversial aspects is the ban on stablecoin transmitters transmitting interest income to users.

“The law on engineering traces a brutal line: no authorized or foreign stabbing transmitter can offer a return, interest or a reward for the holding of the token. More magical Apy, ”said the researcher of Defi Pumpus in a post.

Some analysts claim that the engineering law could merchant stable offers, forcing competition to distribute yields.

The move would intend So that traditional banks are competitive by preventing high -efficiency stable stables from becoming a viable savings alternative. Some consider this to be a direct attempt to neutralize the disturbing potential of decentralized finance (DEFI).

They claim that the bill aims to anchor the power of regulated financial entities rather than encouraging innovation and economic sovereignty.

These stories suggest that the debate on the role of stablecoins in the cryptography ecosystem is heated. For Keizer, the stablecoins are “fiat in disguise”. Those who really seek monetary freedom should go to Bitcoin, not digital dollars.

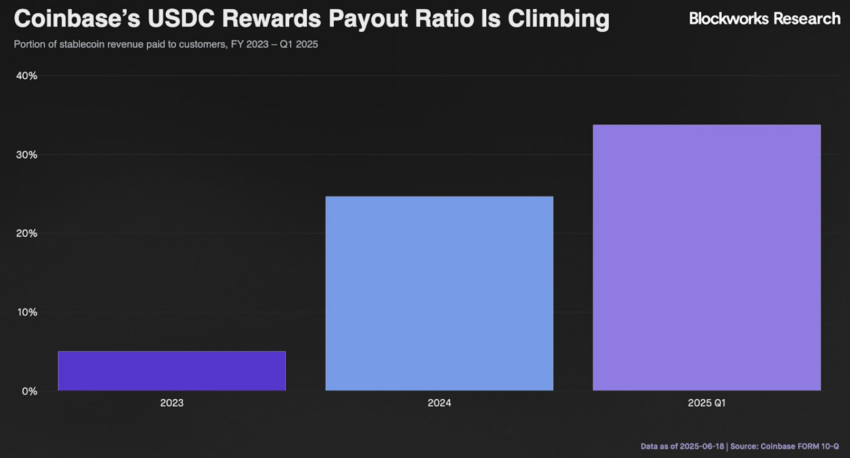

Graphic of the day

Although the law prohibits issuers from paying the return directly, this graph shows that distributors like Coinbase can offer a return as “marketing discounts”.

Alpha the size of an byte

Here is a summary of more news from crypto in the United States to follow today:

- Crypto entries extended a 10 -week sequence to $ 1.2 billion despite geopolitical tensions.

- OKX explores an IPO in the United States, after its recent return to the market with a new head office and new leadership.

- The testimony of Jerome Powell on June 24 could have an impact on the volatility of Bitcoin as a function of the Fed position on inflation and interest rates.

- Cardone Capital added around 1,000 BTC to its business record. Meanwhile, Metaplanet now holds more than 11,000 BTCs, accelerating its policy of the treasure supported by Crypto.

- The FNB Bitcoin Spot experienced $ 1.02 billion in entries last week, down 29% compared to last week, in the middle of the appetite for cooling investors.

- Analysts like Raoul Pal and Arthur Hayes indicate that macro-tendencies and monetary policy as a key random key for the BTC.

- Iran’s potential reprisals against the United States, including closing the Hormuz Strait recently, could lead to a significant drop in the price of bitcoin. Analysts predict a fall of 20%.

- Cryptographic whales see major victories and losses while Israel-Iran tensions shake the market.

- PI2day, June 28, could reveal major developments, including a potential link between the PI and Genai network, the increase in the excitement of the community.

- Analysts expect Bitcoin’s domination to peak almost 71%, which can precede another net correction in altcoins, as shown in February 2025.

Presentation of the actions of the crypto-actions

| Business | At the end of June 20 | Preview before the market |

| Strategy (MSTR) | $ 369.70 | $ 363.70 (-1.62%) |

| Coinbase Global (Coin) | $ 308.38 | $ 300.71 (-2.49%) |

| Galaxy Digital Holdings (GLXY) | $ 18.86 | $ 18.95 (+ 0.48%) |

| Mara Holdings (Mara) | $ 14.32 | $ 14.04 (-1.96%) |

| Riot platforms (riot) | $ 9.56 | $ 9.41 (-1.56%) |

| Core Scientific (Corz) | $ 11.86 | $ 11.84 (-0.17%) |

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.