Is XRP Price Rally Sustainable as Data Suggests Overvaluation?

XRP saw a notable rally last week, climbing 35%. The altcoin is currently trading at $3.10, slightly below its all-time high of $3.41.

However, on-chain data suggests that the token might be overvalued at its current price. This raises concerns about its ability to surpass its all-time high (ATH) as profit-taking picks up among traders.

XRP’s Overvalued Status Could Trigger More Selling

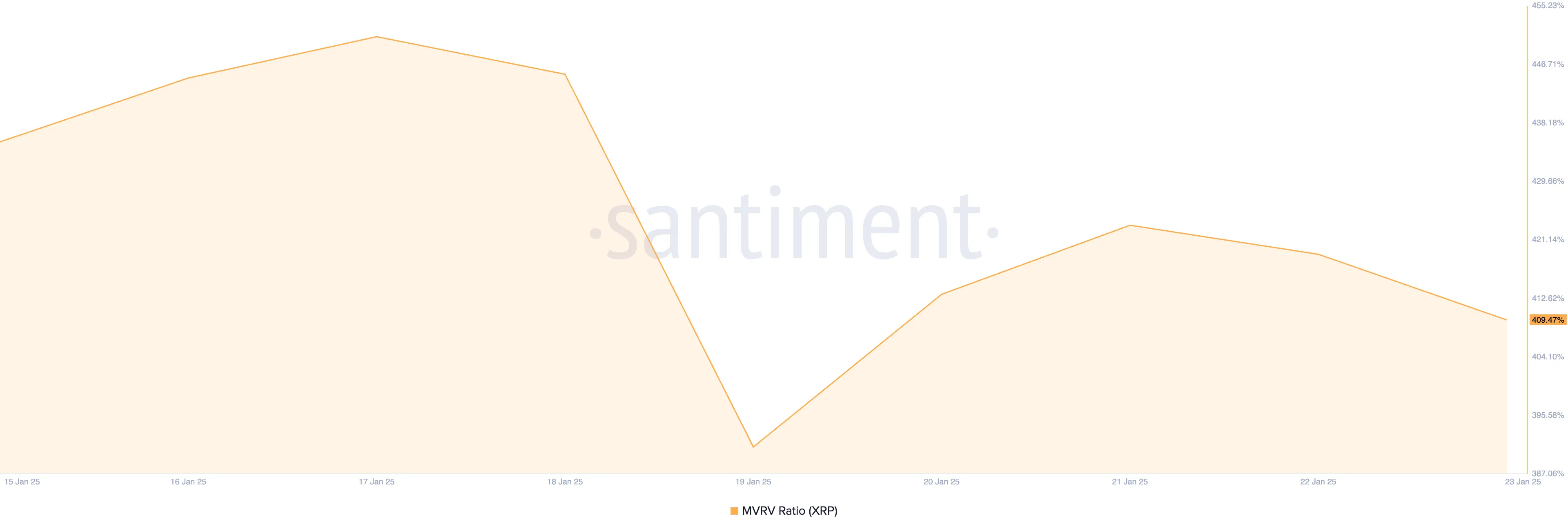

XRP’s market value to realized value ratio (MVRV) highlights its overvalued status, standing at 409.47% at press time, according to Santiment data.

The MVRV ratio assesses whether an asset is overvalued or undervalued by comparing its market value to its realized value. A positive ratio indicates that the market value exceeds the realized value, suggesting overvaluation. Conversely, a negative ratio means that the market value is lower than the realized value, indicating that the asset is undervalued compared to its original purchase price.

At 409.47%, XRP’s MVRV ratio shows that its market value is 409% higher than its realized value – the price at which the tokens were last moved or acquired. In simpler terms, this means that on average, investors who purchased XRP are making a profit of 409% from their initial purchase price. This could lead to increased selling pressure.

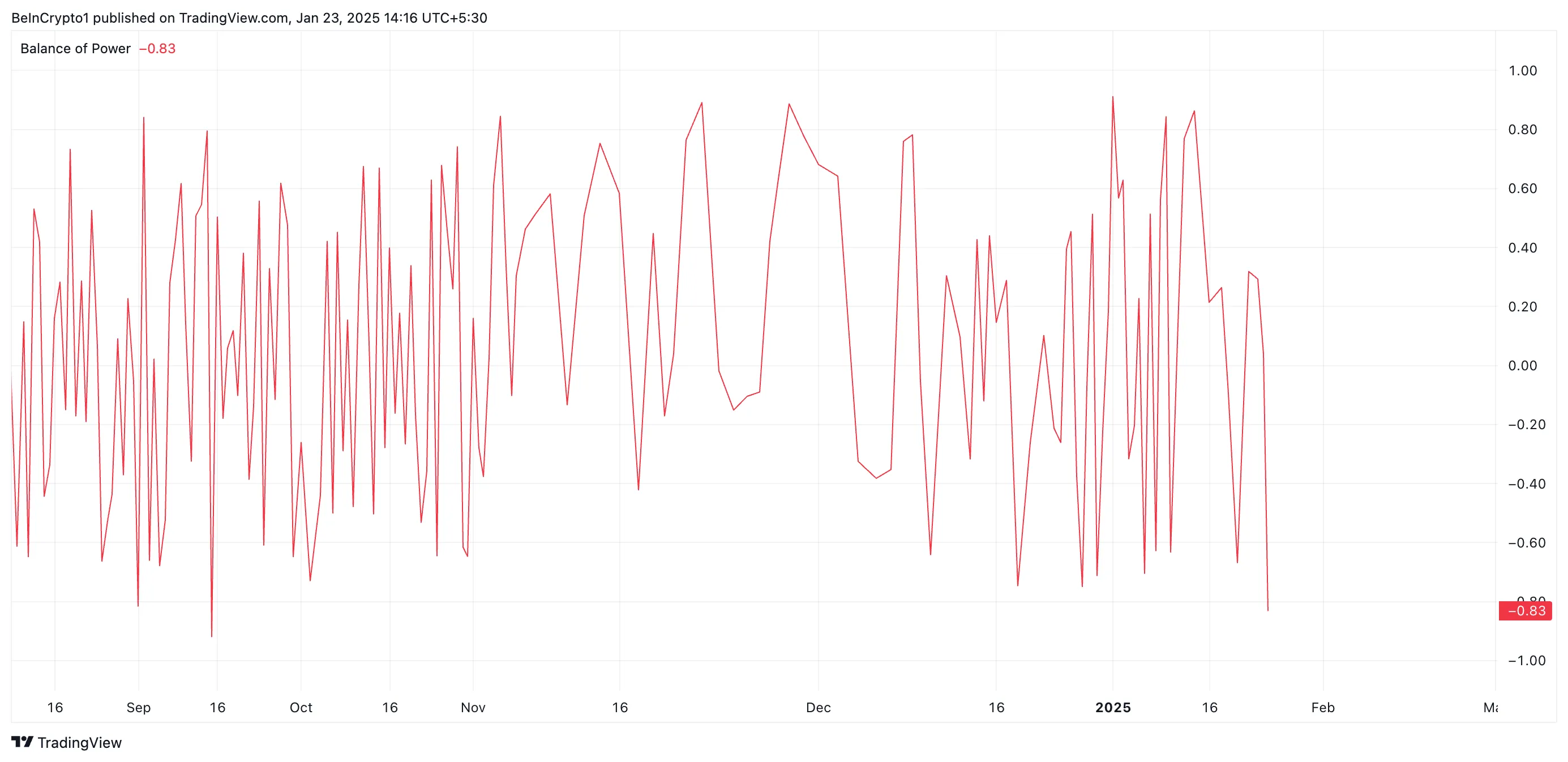

Notably, XRP’s negative balance of power (BoP) confirms that this profit-taking is already underway. At press time, it stands at -0.83.

BoP measures the relative strength of buying pressure versus selling pressure in the market. When the BoP is negative, it indicates that selling pressure outweighs buying. This suggests that more investors are looking to liquidate their positions rather than accumulate them, which could lead to lower prices.

XRP Price Prediction: Selling Momentum Threatens to Drive Prices Down

As selling activity accelerates, the price of XRP will fall further from its all-time high. According to readings from its Fibonacci retracement tool, the altcoin price could fall to the support at $2.45.

Conversely, a change in market trend towards accumulation would invalidate this bearish projection. In this case, the price of XRP would reach its all-time high and attempt to surpass it.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to providing accurate and unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult a professional before making any financial decision. Please note that our Terms and Conditions, Privacy Policy and Disclaimer have been updated.