Israel Stock Market Surges While Bitcoin Holds

Welcome to the morning briefing of the US Crypto News – your essential overview of the most important developments in the crypto for the coming day.

Take a coffee for an update on what is happening on the market today, especially with regard to Bitcoin (BTC). In the middle of the ongoing geopolitical tension, the crypto pioneer continues to bear uncertainty, recent developments should stimulate volatility.

Crypto News of the Day: Iran strikes the stock market by $ 475 billion in Israel, but TA-125 rallies

The previous publication of US Crypto News has highlighted the resilience of the S&P 500 despite the escalation of geopolitical tension.

In the latest development, Iran has struck Israeli economic infrastructure, attacking the Stock Exchange Building in Tel Aviv, in a relocation to the capital market of $ 475 billion in Israel.

“The Israeli Bourse building in Ramat Gan, east of Tel Aviv, was hit in the last Iranian missile attack,” said reports.

Yesterday, the cyber attacks linked to Israel affected the Iranian banking system and destroyed tens of millions of digital assets.

Beincrypto reported how the financial market is the new battlefield in the War of Israel-Iran, with blockchain as one of the fronts.

“And the market reaction?” It was not organic. It was created calm. Operation of liquidity. The AI algos have strangled. Deleted panic. For what? Because it’s not just war. It is a controlled demolition. A change in financial power wrapped in theaters of missiles and speeches. Look at the money, not the titles.

However, in a surprising turn, the markets have rallied, the TA-125 reaching a 52-week high the same day. The next day, TA-125 jumped more than 0.53%, which is not an average feat in terms of political uncertainty.

TA-125 is a stock market index in Israel which followed the performance of the 35 largest and most actively negotiated companies listed on the stock market.

Meanwhile, Ray Yossef, CEO of noons and ex-CEOs of Paxful, told Beincryptto that Bitcoin is still stuck in a narrow range almost $ 105,000 despite geopolitical tension. The executive of cryptography claims that daily volatility remains less than 2.1% and that there is no sale of panic.

“Bitcoin no longer seems to work like an active hedge; instead, it behaves more like a high beta technological stock, caught in macro winds but not really directing its own ship. The link between BTC and the Nasdaq 100 is always solid at 0.68”, added Yossef in a shared press release with Beincrypto.

Bitcoin’s current force is not only technical but structural, say analysts

Bitcoin maintained above the critical level of $ 100,000 for more than 40 days. The pioneering crypto shows impressive resilience in the middle of increasing geopolitical tensions and prudent signals from the Central Bank.

In this context, analysts say that macroeconomic and institutional forces are now converging to support the position of Bitcoin as a long -term treasure ratio.

This is aligned with the claims of Robert Kiyosaki, who pleaded for Bitcoin among other assets, as indicated in a recent publication of Crypto News.

“Despite the current conflict between Israel and Iran, Bitcoin remained incredibly resilient during last week.

Johnson also underlined the impact of institutional demand, noting that with companies and governments pouring billions on Bitcoin vouchers, led by Michael Saylor himself with his latest purchase of $ 1.05 billion, it is not surprising that BTC remains firmly more than $ 100,000.

Nic Puckrin, founder of the coins, has echoed this feeling, saying that the level of $ 100,000 is cemented in the minds of investors as a basic price and not just support.

“Any sale of detailed investors panic now becomes exit liquidity for institutional buyers,” noted Puckrin.

On the macro side, the markets were reassured by the latest Fed dowry layout projecting two rate drops in 2025. According to Puckrin, liquidity arrives, and when it floods, Bitcoin will be the largest beneficiary.

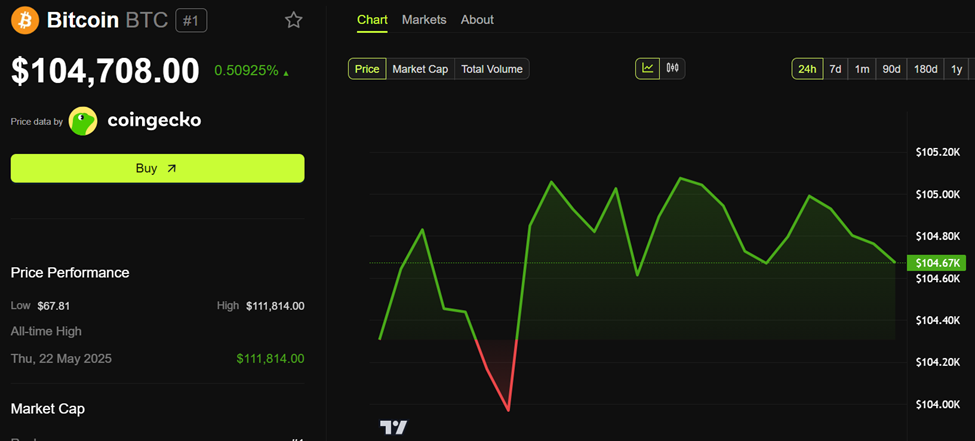

Bitcoin was negotiated at $ 104,708 when writing this article, up 0.5% in the last 24 hours.

Graphic of the day

Alpha the size of an byte

Here is a summary of more news from crypto in the United States to follow today:

Presentation of the actions of the crypto-actions

| Business | At the end of June 18 | Preview before the market |

| Strategy (MSTR) | $ 369.03 | $ 370.50 (0.40%) |

| Coinbase Global (Coin) | $ 295.29 | $ 293.45 (-0.62%) |

| Galaxy Digital Holdings (GLXY) | $ 26.12 | $ 27.05 (+ 3.57%) |

| Mara Holdings (Mara) | $ 14.49 | $ 14.61 (+ 0.83%) |

| Riot platforms (riot) | $ 9.94 | $ 9.96 (+ 0.20%) |

| Core Scientific (Corz) | $ 11.90 | $ 11.97 (+ 0.59%) |

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.