Lawmaker Slams Commerce Secretary Over Nvidia Sales to China, Even as Nvidia Faces Hurdles in Resuming Supply

A republican legislator increases pressure on the US trade department regarding its decision to allow Nvidia to resume exports from its H20 artificial intelligence chips to China, warning that this decision could seriously undermine the technological edge of America and empower military and monitoring ambitions.

In a strongly formulated letter sent to the Secretary of Commerce on Friday, Howard Lungick, representative John Moolenaar, who chairs the restricted committee of the Chamber to the Chinese Communist Party, criticized the reversal of a restriction of previous export and asked for an urgent clarification on the way in which the ministry intends to manage renewed sales. The prohibition, initially imposed in April by the Trump administration, aimed to cut China access to AI cutting edges designed by the United States of national security problems.

“The Commerce Department made the right call in the ban on the H20,” wrote Moolenaar, referring to the chinese of Nvidia China. “We cannot let the Chinese Communist Party use American tokens to train AI models that will fuel its soldiers, censor its people and undermine American innovation.”

Register For TEKEDIA Mini-MBA Edition 18 (September 15 – December 6, 2025)) Today for early reductions. An annual for access to Blurara.com.

Tekedia Ai in Masterclass Business open registration.

Join Tekedia Capital Syndicate and co-INivest in large world startups.

Register become a better CEO or director with CEO program and director of Tekedia.

Moolenaar also warned that allowing H20 fleas in China could tilt the world AI race in favor of Beijing.

“The H20 considerably surpasses everything that Chinese flea manufacturers like Huawei can currently produce on a large scale,” he noted, calling this a “substantial increase in AI development in China”.

Her latest remarks are the strongest to date since Nvidia announced earlier this week that she had obtained approval to resume H20 shipments in China as part of a revised license regime. Under the current policy, the Commerce Department still requires export licenses for H20 sales, but Nvidia has said that it has received insurance that licenses will be granted and prepare to send fleas.

Nvidia designed the H20 in response to restrictions on the Biden era which blocked the exports of its most advanced GPUs to China. Although the H20 has been specifically designed to comply with these rules, it remains powerful in keys to ia tasks such as inference – the process by which the models of formed AI generate real -time responses. Computing inference is now one of the most precious segments on the AI flea market market, with applications ranging from cloud services to AI assistants.

Moolenaar’s letter stresses that these chips already help Chinese technology giants to speed up AI capabilities. He underlined Chinese companies like Tencent and Deepseek, which would have used the H20 to develop massive AI systems and even superordinators. A recent Congress report published in April 2025 by the Restricted Committee of China cited the critical role of the H20 in the activation of the Deepseek IA model which amazed the world technological community earlier this year.

The criticism of the legislator represents a rare public reprimand of a Trump administration policy by a republican colleague, stressing how deep the alarm is among the Hawks of Washington on the rapid progress of the Beijing AI. A bipartite consensus has emerged around the restriction of china access to fleas designed by Americans, a key ingredient for the construction of powerful automatic learning models and national security tools.

The decision to facilitate restrictions also sparked larger market reactions. On Friday, Nvidia’s actions plunged into a negative territory shortly after Molenaar published his letter. A spokesperson for Nvidia defended this decision, saying: “The government made the best decision for America, promoting American technological leadership, economic growth and national security.”

The Commerce Department did not comment publicly, but secretary Lutnick said on Tuesday that the decision to resume H20 exports was linked to larger negotiations with China involving rare land materials and strategic products such as magnets – essential components in the defense and technology industries.

But legislators like Molenaar do not remain convinced. In his letter, he asked for a detailed briefing no later than August 8 on the way in which the Commerce Department plans to assess license requests for H20 and similar fleas. He also demanded transparency on the number of chips that should be exported and the recipients.

The controversy has rekindled a debate on the delicate balance between the preservation of the technological domination of America and engaging in strategic trade, in particular with a geopolitical rival which actively works to fill the AI gap.

Nvidia is facing obstacles in the resumption of supply to China AI Chip after American approval

Meanwhile, NVIDIA informed customers in China that he has limited supplies of his H20 artificial intelligence chips, the most advanced model he is authorized to export to the country under current American restrictions.

The disclosure, reported by information, adds to an increasing uncertainty surrounding Nvidia’s activities in China, even if the company tries to navigate the intensification of geopolitical and regulatory opposite winds.

The H20 was part of a trio of personalized AI chips – next to the L20 and L2 – developed by NVIDIA to comply with Washington export controls, which aimed to reduce China access to advanced American semiconductors for military and surveillance. While the L20 and the L2 set up on the market, the H20 was faced with delays and finally a stop of shipments following a directive of April in the US trade department requiring licenses for the sale of the three fleas to China.

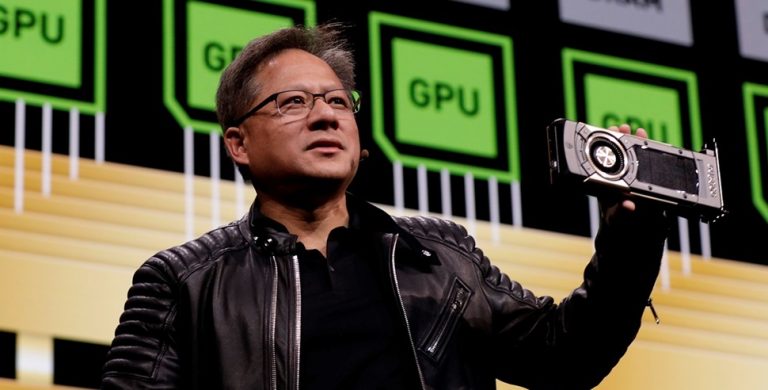

According to information, NVIDIA was forced to cancel client orders and Taiwan semiconductor manufacturing company (TSMC) TAIWAN following the April policy change. TSMC, which had previously allocated the capacity of the production of H20, reused its lines for other customers, and the restart of H20’s production would take up to nine months, said Jensen Huang, CEO of Nvidia, during a press briefing in Beijing last week.

Despite this disruption, Huang said Nvidia expects licenses for the H20 to be granted quickly. He also assured that expeditions would resume in China, although the recent internal communication cited by information suggests that the supply is considerably limited in the short term.

Meanwhile, Nvidia has announced its intention to introduce a new graphic chip specifically for the Chinese market called RTX Pro GPU. This product, according to the company, is designed to fall below the performance thresholds which would trigger American export prohibitions, which makes it compliant with current restrictions.

The H20 shortage of flea market adds to the complex position of Nvidia in China, a market which represented around 17% of its income from the data center before the export ban in October 2023. Since then, Nvidia has been trying to consolidate its presence with modified equipment, while adapting to changing Washington policies.

The time for recovery expeditions followed a private meeting between Jensen Huang and President Donald Trump earlier this year, when technological export restrictions and Nvidia China interests were discussed. After this meeting, Huang embarked on a closely watched trip to China, where he met senior executives and publicly expressed his optimism that H20 export licenses would be treated quickly.

In Beijing, Huang confirmed that the company was working to increase the offer of the H20 chip in China and at the same time announced the RTX Pro GPU. RTX PRO is a graphic chip designed for less advanced AI tasks, which makes it free from the last cycle of restrictions.

Analysts claim that the company’s balancing law – the American compliance of the company while preserving the market share in China – will continue to test the strategic flexibility of Nvidia. With an increase in high -end flea demand due to AI boom, competitors, including Huawei, also increased their efforts, taking up the opportunity created by Nvidia’s regulatory constraints.

NVIDIA is expected to provide updates on its strategy in China at its next report on the results, scheduled for August 21.