BlackRock Dominates RWA With BUIDL’s AUM Nearing $1.5 Billion

BUIDL, BUIDL, noted a strong increase in adoption, assets under management of the fund (AUM) exceed the sharp increase in the asset note under management (AUM).

This growth highlights a strong evolution towards the tokenization of real assets (RWA), even if the wider crypto markets face opposite winds.

Blackrock’s Buidl directs the Rwa sector

According to RWA data. XYZ, AUM of Buidl, has increased by almost 129% in the last 30 days, which has increased it to $ 1.4 billion.

This step means that it only took a year for the fund, which was launched on the security platform in March 2024, to cross the billions of dollars.

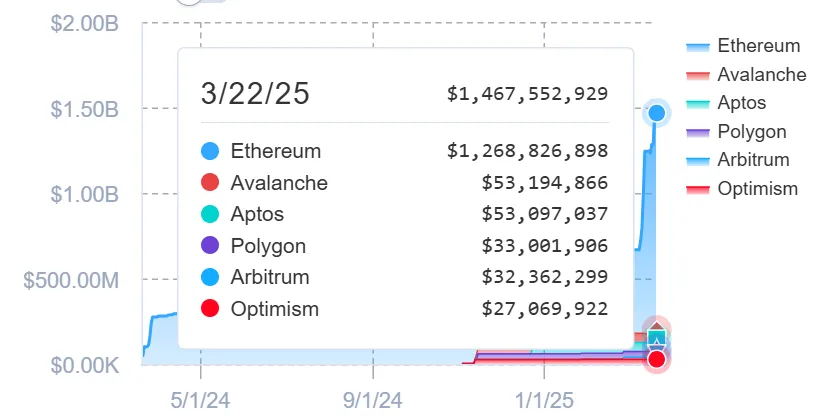

While Buidl has extended to several blockchains, the majority of its offer – more than $ 1 billion, or 86.46% – is on Ethereum. This indicates a strong strike activity on the network.

Other channels, such as Avalanche and Aptos, each hold about $ 56 million in the fund’s offer, or around 3.6%. Ethereum Layer-2 networks like Polygon, Arbitrum and Optimism host the rest.

Meanwhile, investor participation has also increased. During the last month, the number of holders increased by 19%, bringing the total to 62.

Market observers have stressed that these figures highlight growing confidence in blockchain -based financial products and growing institutional interest in tokenizing obligations and credit.

Fidelity joins the race for tokenization

Buidl’s milestone arrives while the Fidelity asset management company is also entering the tokenization space.

During last week, the company filed with the Securities and Exchange Commission (SEC) of the United States to launch a version based on the blockchain of its money market fund of the Treasury. The new Share class, called “Onchain”, will work using the blockchain as a transfer and settlement agent.

“The ONCHAIN class of the fund is currently using the Ethereum network as a public blockchain. In the future, the fund can use other public blockchain networks, subject to eligibility and other requirements that the fund could impose,” added the file.

Fidelity’s movement reflects a broader trend. Financial institutions turn to blockchain for obligations, funds and credit instruments. This change offers improved efficiency, 24 -hour regulations and better transparency.

Meanwhile, the deposit comes as an institutional interest for RWAS continues to increase, despite a slow cryptography market. While Bitcoin is down 11% for the start of the year, RWA tokens experienced sustainable growth in 2025.

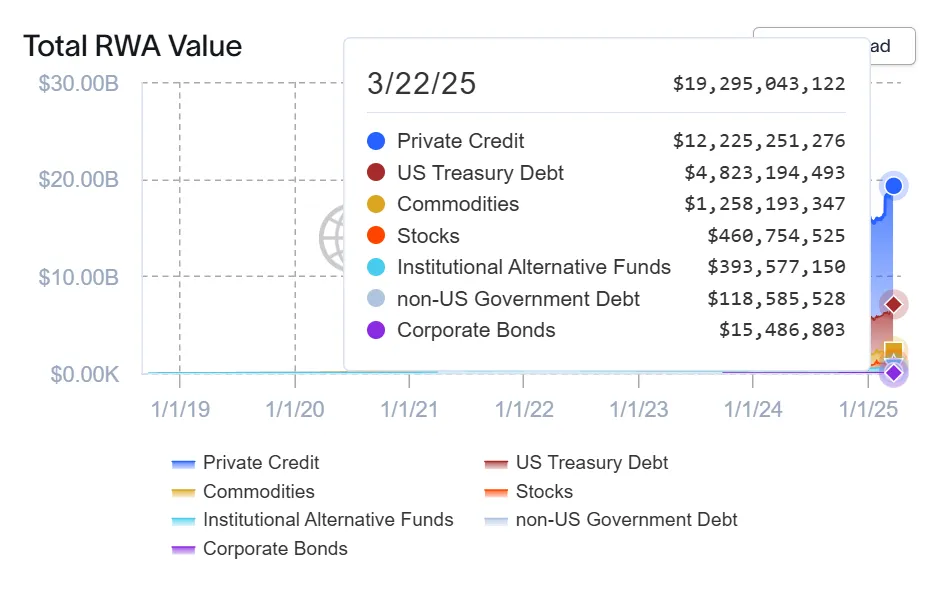

Chain data show that the total RWA market has increased by 18.29% in the last 30 days, reaching $ 19.23 billion. The number of RWA holders has also increased by 5%, now exceeding 91,000.

Blackrock’s Buidl leads RWA space by market capitalization. It is followed by USDY de Hashnote at $ 784 million and Tether Gold (XAUT) at $ 752 million.

Meanwhile, US treasury bills represent Total $ 4.76 billion, while private credit dominates with $ 12.2 billion.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.