Litecoin Slumps 12% in 24 Hours

Litecoin (LTC) is down more than 12% in the last 24 hours, its price merchanting around $ 100 and its market capitalization falling to $ 7.5 billion. The sharp decline occurs while the sale pressure intensifies, pushing the RSI of LTC in the territory of occurrence and the flow of silver of Chaikin (CMF) more deeply in the negative levels.

If the downward trend continues, the LTC could test the support of $ 92.5 and potentially fall to $ 80, its lowest price since November 2024. However, if the momentum moves, the LTC could try a recovery, exceed $ 100 and target resistance levels at $ 106, $ 111 and maybe $ 119.

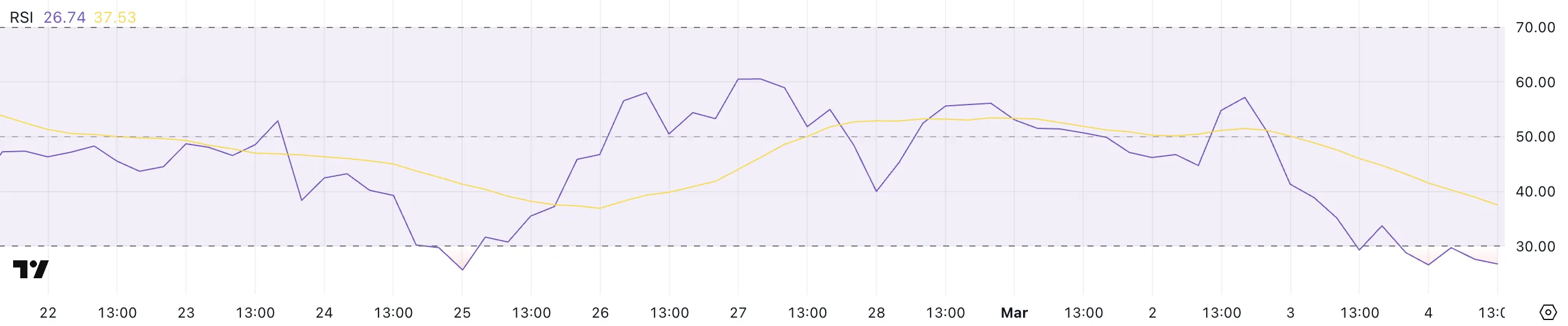

LTC RSI is currently at levels of occurrence

The Relative Force of Litecoin (RSI) fell to 26.7, a sharp decline of 57.1 only two days ago. This abrupt fall indicates that the LTC entered the surveillance territory, suggesting intense sales pressure.

Such a rapid drop often reflects the sale of panic or a strong downward trend, leaving the LTC vulnerable to a drawback unless buyers intervene.

However, an RSI This weak also indicates that the assets can approach a short -term potential reversal, as the conditions of occurrence often cause relief rebounds.

RSI is a momentum indicator which varies from 0 to 100, measuring the strength of recent price movements. Readings greater than 70 indicate over -racket conditions, where assets are likely to cope with sales pressure, while readings less than 30 suggest occasions of occurrence, where purchasing opportunities can emerge.

With the RSI of the LTC now at 26.7, it is deeply in the territory of occurrence, increasing the chances of a short -term rebound.

However, if the downward dynamics persist and RSI continues to fall, Litecoin could find it difficult to find support and extend his losses before any recovery attempt.

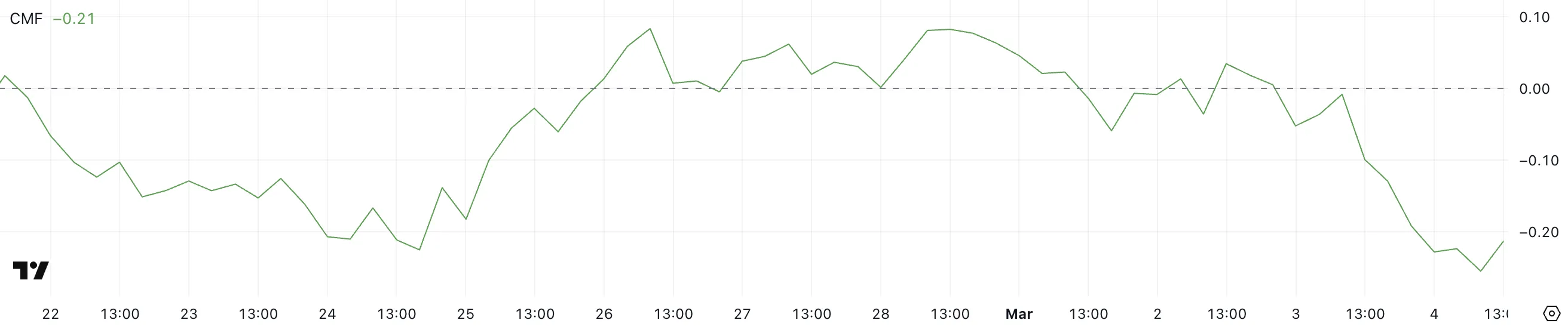

Litecoin CMF fell below -0.20

Litecoin’s Chaikin Silver Flow (CMF) is currently at -0.21, against 0.03 barely two days ago, indicating a significant change in capital flow. Earlier, CMF briefly fell to -0.26, its lowest level since mid -February, strengthening the lowering feeling.

A declining CMF suggests that the sales pressure increases, with more capital that flows from SLD than.

This trend notes that investors draw liquidity from Litecoin, which makes it difficult to maintain short -term rebounds.

CMF measures the pressure of purchase and sale by analyzing the volume and price movements ranging from -1 to 1. The positive values indicate an accumulation, which means that more money flows in an asset, while the negative values suggest the distribution and the increase in the sale pressure.

With the CMF of the LTC now at -0.21, the sellers remain in control and unless the returns in volume of purchase, LTC can have trouble finding support.

The recent decrease to -0.26 shows that capital outputs reach extreme levels, increasing the risk of more downwards unless the feeling changes.

Will Litecoin soon fall below $ 90?

If the Litecoin drop tendency continues, the price could test the support level of $ 92.5, a key area that had previously had buyers. If this level is lost, the LTC could drop as low as $ 80, marking its lowest price since November 2024.

With momentum indicators such as RSI and CMF showing a downward pressure, other decreases remain a possibility unless buyers intervene to defend support.

However, if the LTC reverses its trend, it could resume the momentum and exceed $ 100, with $ 106 as the first level of major resistance.

An escape above this could lead to a test of $ 111, and if the bullish momentum is strengthened, the LTC could rally at $ 119.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.