LTC Price Drops 7% Amid Key Support Test

The Litecoin price (LTC) fell 7% in the last 24 hours, bringing market capitalization to $ 9.33 billion. Despite this drop, technical indicators show mixed signals. The RSI is in a neutral area, while the Ichimoku cloud suggests an uncertainty around the next movement of Altcoin.

The EMA structure in Litecoin remains generally optimistic, but the shortest EMA is sloping down. If the trend continues, it could lead to a death cross. With the LTC at a critical point, an escape could see it gain by 14% to $ 141, while the additional weakness could lower it by 14% to $ 106.

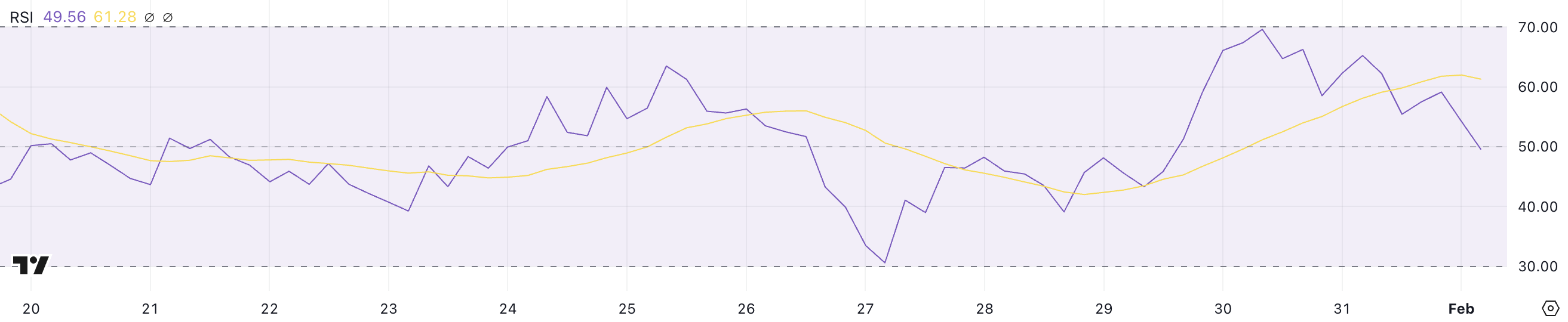

Litecoin RSI is currently neutral

Litecoin RSI is currently at 49.5, against 69.6 barely two days ago. This indicates a change of momentum, because the price has dropped by 7% in the last 24 hours, even after recent positive developments in its ETF applications.

The relative resistance index (RSI) is an indicator of Momentum which measures the resistance to the price on a scale of 0 to 100. The levels above 70 indicate over -racket conditions, and less than 30 suggest occasions of occurrence.

Reading between 40 and 60 generally indicates market consolidation, where neither buyers nor sellers have clear control.

With the LTC now at 49.5 RSI, it is in a neutral zone, not suggesting an optimistic or strong dowry.

However, the clear drop in almost opposite levels indicates a weakening of the purchase pressure. If RSI trends below 40, this could lead to new decreases.

If it stabilizes or goes up above 50, it can point out a renewal of purchasing interests and a potential recovery in prices.

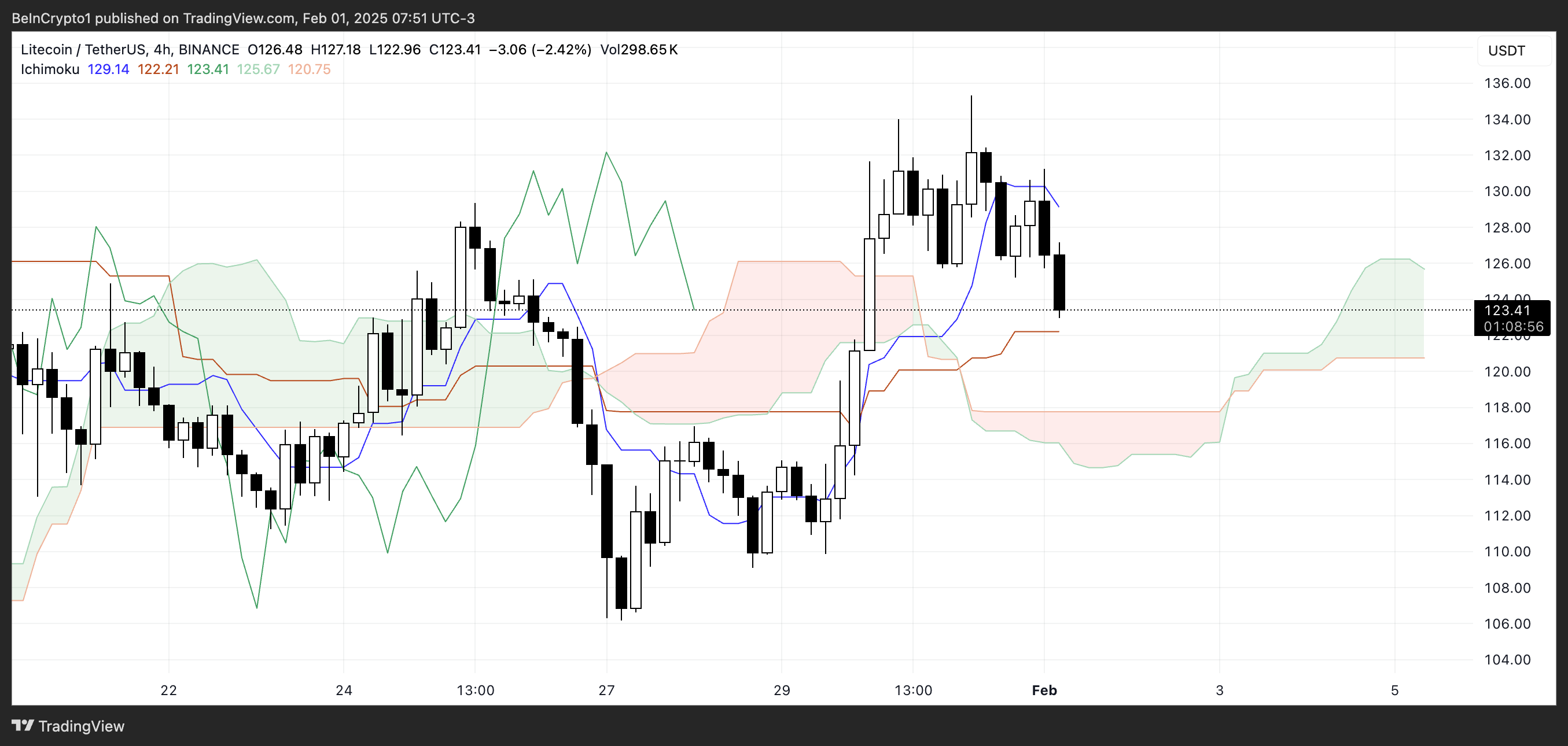

The Cloud Ichimoku LTC shows mixed signals

The price of the SLC is currently traveling after failing over Tenkan-Sen (conversion line), which is now sloping down, indicating a short-term weakened trend. The Kijun-Sen (basic line) is relatively flat, which suggests that the price balance is tested, and a stronger directional movement can develop soon.

The price is approaching the Kumo (cloud), which serves as an important domain for trend confirmation. Staying above, this would indicate a continuous upper dynamic, while breaking underneath could point out increased weakness.

The upcoming cloud (Kumo) is green, suggesting that the wider trend remains positive, but the current price movement near the uncertainty of the edges of the cloud. If The Litecoin price finds a support near the cloud, which is between $ 120 inND $ 126, he could stabilize and try to regain strength.

However, if it moves in or below the cloud, this would indicate a loss of momentum and a reversal of potential trend. This happens because the action of prices inside the Kumo generally represents consolidation or indecision.

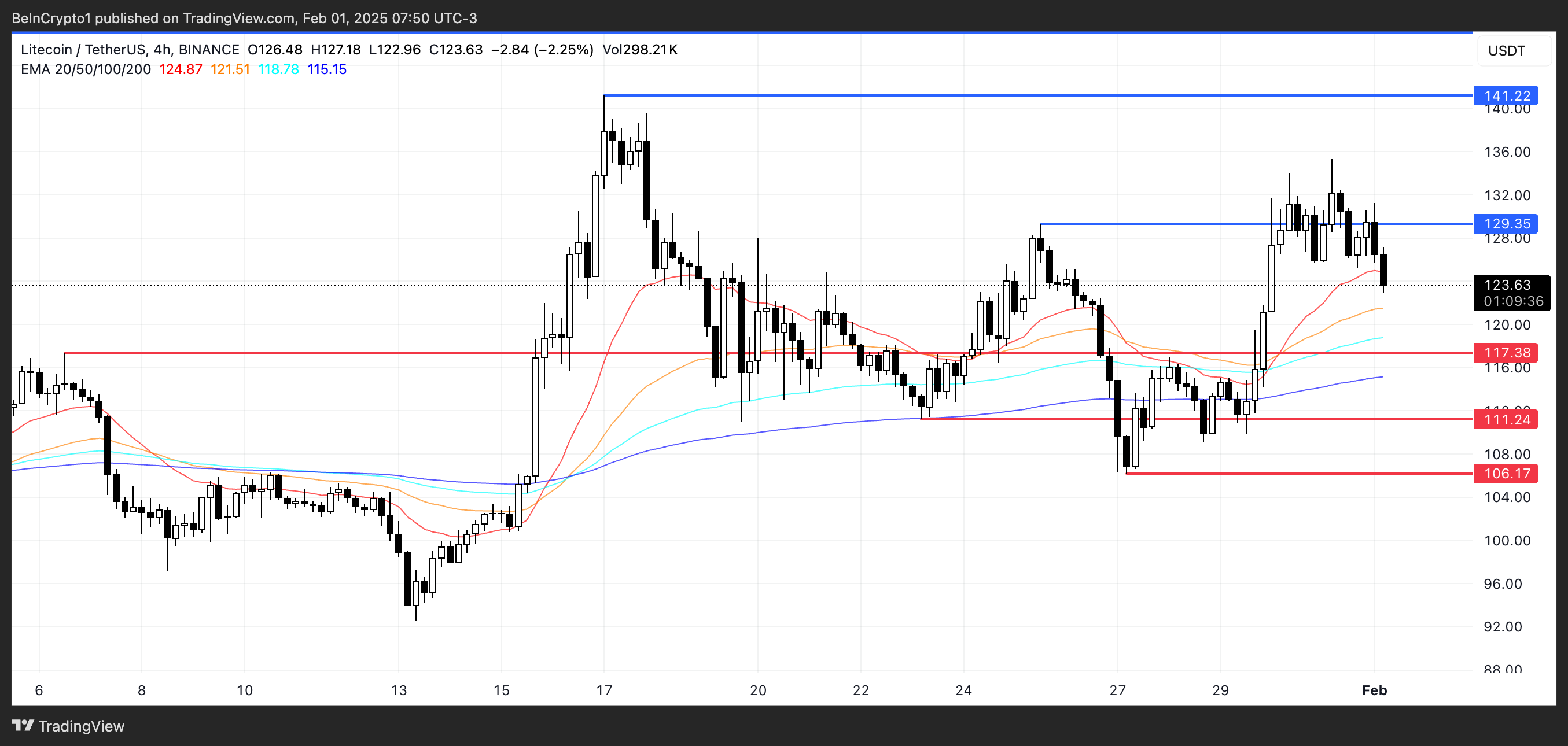

Price prediction of the LTC: an increase or a drop of 14%?

Litecoin EMA lines remain optimistic, with short-term EMAs still positioned above the long-term EMA. However, the shortest EMA begins to descend downwards, which weakens the dynamics.

If he crosses the EMAs in the longer term, he will form a death cross, a lower signal that could lead to a new drop. In this case, The price of SLC can test the support at $ 117.

If This level does not hold, the price could extend its decline to $ 111, or even $ 106, marking a potential drop of 14% compared to current levels.

On the other hand, RSI and Ichimoku’s cloud indicate that the overall upward structure is still intact, which means that Litecoin could always recover its momentum.

If the purchase increases and the EMA maintains their bullish positioning, the LTC could climb to the level of resistance of $ 129. A successful breakthrough above this level could push the price to $ 141, which represents a potential gain of 14% if the momentum is strengthened.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.