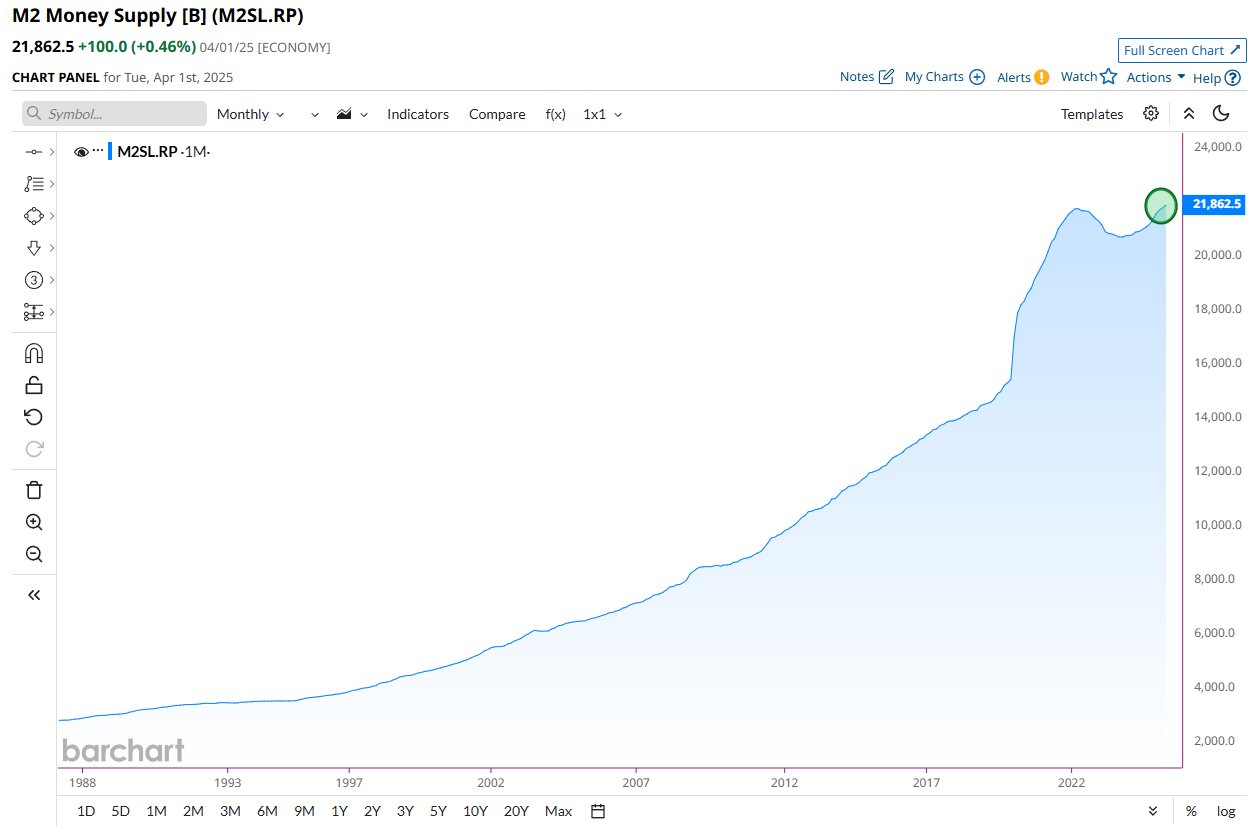

M2 Money Supply Hits Record High of $21.86 Trillion: Will Bitcoin Follow the Surge?

The money mass of M2 reached a record of 21.86 billions of dollars, which is optimism among the investors that Bitcoin (BTC) could soon reflect this upward trend.

This wave comes as the economy faces increasing pressures, with an increase in national debt, a public explosion and an increase in inflationary concerns threatening financial stability.

How the record of 21.86 M2 dollars billions could have an impact on bitcoin

For the context, the M2 money supply measures the total amount of money circulating in the economy. It includes M1 (Species and deposits checks), savings accounts, time deposits and investment funds.

According to the latest Barchart data, metrics culminated at a top of $ 21.86 billions of dollars.

The recent increase is aligned with broader economic challenges in the United States. A pseudonym analyst named Tech Teled recently shared his ideas on X (formerly Twitter). He stressed that the United States’s debt / GDP ratio has reached historically high levels.

Net payments of interest now do not represent 20% of federal income, which has exerted significant pressure on the budget. In addition, the analyst stressed that public spending continues to go beyond income.

“The money mass of M2 increasing at the heights of all time. The monetary printer is underway,” he added.

However, experts are increasingly optimistic about Bitcoin prospects in light of these data. Their point of view is supported by historical trends showing a strong correlation between the growth of M2 and the price of Bitcoin.

“On average, M2’s global money supply tends to carry out the price of the BTC of approximately 12 weeks. Recently, M2 has reached a new summit of $ 21.86 billions of dollars. This strongly suggests that BTC could follow suit in the coming months,” said Weiss Crypto.

The Tech Lead analyst corroborated the feeling.

“There are a lot of mixed signals, but the only one who really counts is liquidity. Follow the money,” he said.

But why does Bitcoin increase with M2? Well, as M2 develops, it can erode the value of fiduciary currencies, which led investors to bitcoin as a value reserve. More liquidity on the market also encourages speculation.

In addition, lower interest rates make traditional investments less attractive, increasing Bitcoin demand and pushing its higher price.

“When you follow the global money supply, you realize that everything else is only noise,” said investor James Wynn.

In addition to these factors, the mathematician and analyst Fred Krueger highlighted the potential of the BTC in the middle of these market conditions. He noted that since 2000, the world money supply and American debt have increased at a coherent rate of 8%.

However, the analyst stressed that Bitcoin stands out as an asset which not only retains its value but also increases at a much higher pace, making it an attractive alternative.

“Basically, we have a” fleeing bucket “which loses 8% of its value per year. Actions almost compensates it. Not after taxes. The accommodation does not compensate. At all. Bitcoin do not flee and increases 40% per year,” said Krueger.

These factors brush a bullish painting for the largest cryptocurrency, which faced a correction after peaking at a summit of $ 111,917 on May 22.

Beincrypto data showed that the BTC decreased 2.9% in last week. At the time of the press, he exchanged $ 104,529, marking a 0.8% drop in the last day.

Does the post M2 monetary mass reaches a record of 21.86 billions of dollars: will Bitcoin follow the overvoltage? appeared first on Beincrypto.