Made in USA Coins and Trump’s 100 Days – In Numbers

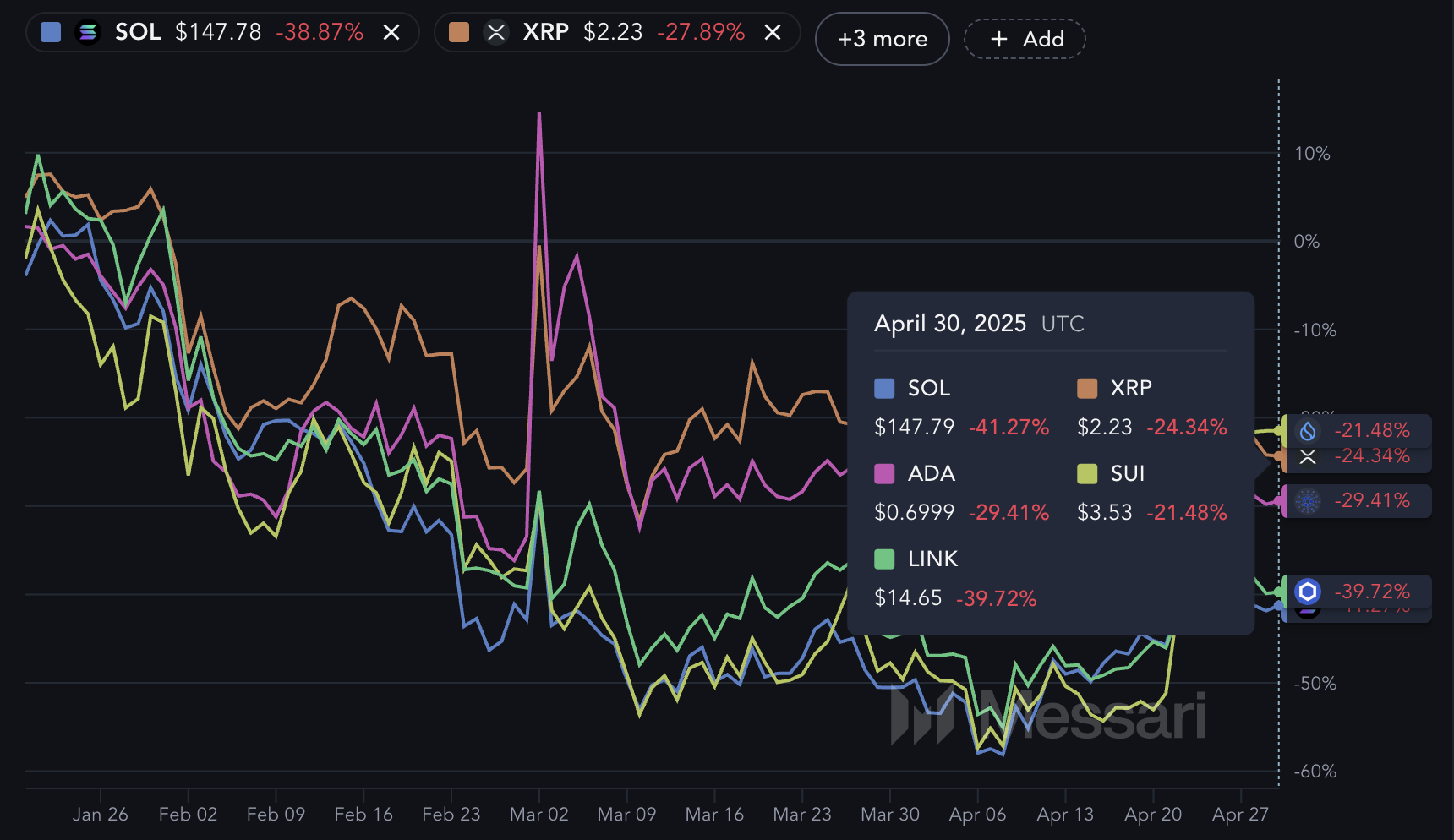

Made in USA Coins subperformed in the first 100 days of Trump’s new mandate, with the five assets linked to the United States down at least 20% since January 20.

On the other hand, the non-used coins like Bitcoin and Tron have resisted better, showing more resilience when Ethereum and Dogecoin displayed steep losses. The divergence highlights the impact of broader political pressures, such as prices – potentially compensating for interior cryptography reforms.

Made to coins in the United States are fighting under the Trump era

The five main “made in USA” pieces have decreased by at least 20% since January 20, on the day of the inauguration of Trump. Although recent short-term gains have helped improve feeling, the wider trend of 100 days remains negative for these assets linked to the United States.

This performance comes despite the expectations of a more favorable environment for the crypto as part of the current administration.

Solana (soil) is the lowest artist in this group, down more than 41% since Trump took office, even after winning more than 18% in the last 30 days.

On the other hand, SUD joined 58% during the same period, supported by a strong growth in the trading of memes parts and the decentralized exchange volume (DEX). Recently, he became the fifth larger channel by Dex activity.

ADA, Link and XRP all displayed modest gains between 7% and 10% in the last month, but dropped by more than 24% in the first 100 days of the administration.

The overall performance of Made in USA Coins diverged initial expectations after the return of Trump, which included promises of a more friendly cryptographic position.

While the dry, now under Paul Atkins, has abandoned several cases against cryptographic companies, removing the regulatory overhanging, other political developments can limit the advantage.

In particular, current trade pressures linked to Trump’s pricing strategy can create additional winds for cryptographic assets linked to the United States.

Despite the losses of ETH and DOGE, the non-used coins are better

Among the five largest non-used coins, only two have posted significant losses in the last 100 days. Ethereum (ETH) fell by more than 43% and Dogecoin (DOGE) fell by almost 51%.

These drops are strongly distinguished, in particular given the more stable performance of the other best assets. Bitcoin (BTC) is down 6% during the same period, while BNB slipped by almost 12%.

Short -term trends offer a more balanced view. Bitcoin has won almost 16% in the last 30 days, reflecting a stronger momentum than its peers.

DOGE is up more than 7% in the same window, while BNB and ETH remained largely flat. TRON (TRX) is the only higher room outside the group linked to the United States to publish gains on both deadlines, up 7.5% in the last 100 days.

The wider group of world active ingredients resulted relatively better than done in American rooms. Despite strong losses in ETH and DOGE, the group has outraged American currencies like soil and Ada, many of which dropped more than 20 to 40% in the same period of time.

This divergence suggests that if the regulatory feeling in the United States can improve, the macro-contrary winds and specific to politics could weigh more on domestic cryptographic assets.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.