Pi Network (PI) Struggles to Reclaim $2

After reaching a peak of $ 2.99 on February 27, Pi Network is down almost 40% in the past two weeks. The technical indicators suggest that the pi momentum stabilizes.

The DMI shows that the purchase pressure has increased in the last two days, but the ADX has decreased, indicating that the strength of the trend can weaken. Meanwhile, RSI has increased levels of occurrence, approaching a territory on ignition, which could lead to consolidation or continuation to key resistance levels.

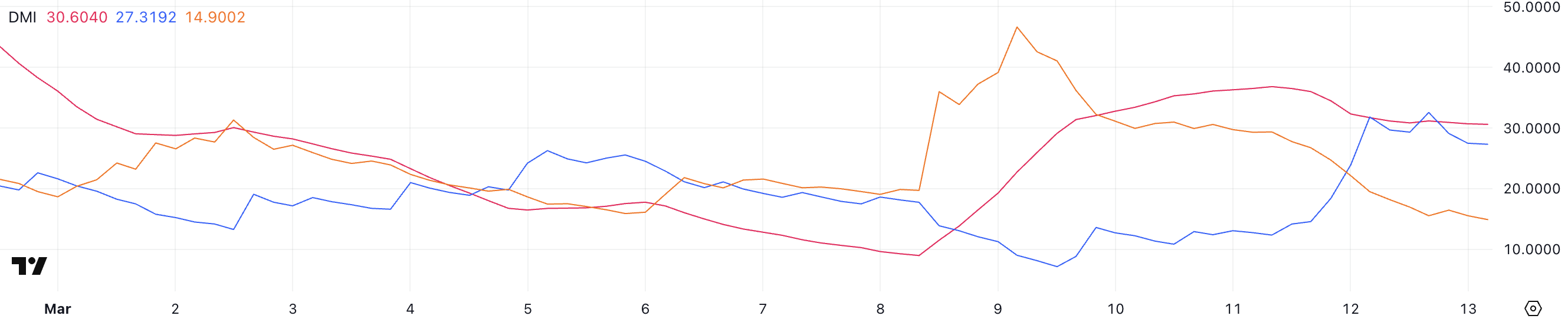

Pi Network DMI is up to the rise is still there

The DMI graph of PI indicates that the average directional index (ADX) fell to 30.6 against 36.5 in the last two days. ADX measures resistance to trend, values above 25 generally indicating a strong trend, while values below 20 suggest a low or consolidating market.

An ADX increasing the signals strengthening the momentum, while an ADX declining suggests a weakened trend, even if the price action continues in the same direction.

ADX’s current decline suggests that if Pi remains in an upward trend, the momentum behind this movement softens.

Looking at the directional indicators ( + DI and -DI), + DI increased to 27.3 from 12.3 two days ago, but remained stable since yesterday, while -Di fell sharply at 14.9 from 29.3. This change indicates that the purchase pressure has increased considerably in the last two days, an overwhelming previous sale pressure.

However, with + Di now stable and ADX in decline, the strong dynamic of purchase seen earlier can be faded. This does not necessarily mean an immediate reversal, but it suggests that the upward trend could slow down or enter a consolidation phase unless the renewal of the purchasing force repels the ADX.

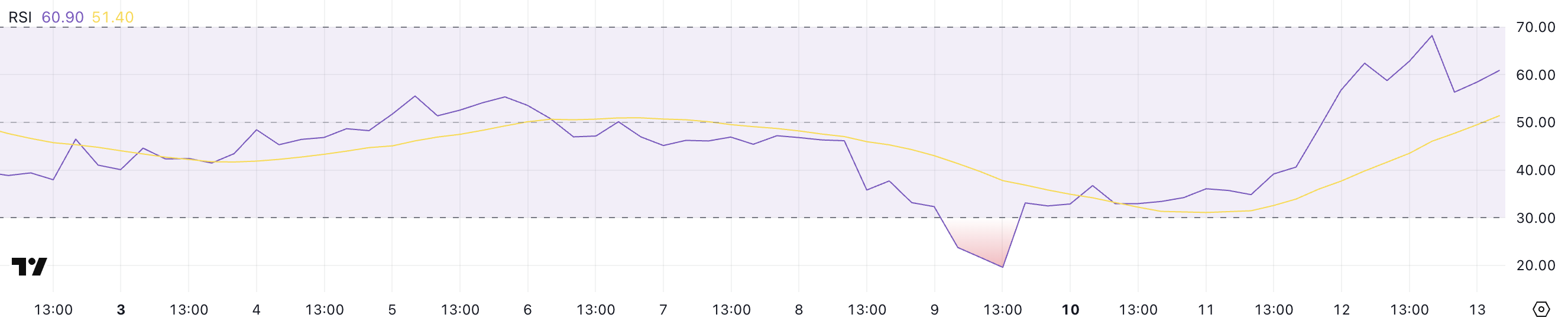

Pi Network RSI has jumped in the last two days

The PI (RSI) relative force index climbed 60.90, against 34.8 yesterday and 19.5 four days ago. RSI is a momentum oscillator that measures the speed and extent of price movements on a scale of 0 to 100.

Generally, the RSI values greater than 70 indicate excessive conditions, suggesting a potential for a decline, while values below 30 conditions of signal exceeding, often preceding prices recovery.

The rapid increase in levels deeply occurred to almost 61 suggests a strong change of momentum, buyers taking control.

With RSI of Pi touching 68 earlier and now seated at 60.90, he approaches an exaggerated territory but has not yet crossed the critical threshold 70.

The fact that PI has not exceeded 70 since February 27, suggests that this level has historically acted as a barrier, which has made it possible to trigger profits or a temporary slowdown.

If RSI stabilizes near its current level, PI could consolidate before making another higher push. However, if it passes in front of 70, it would signal an overly upward momentum, although it also increases the probability of a short -term correction.

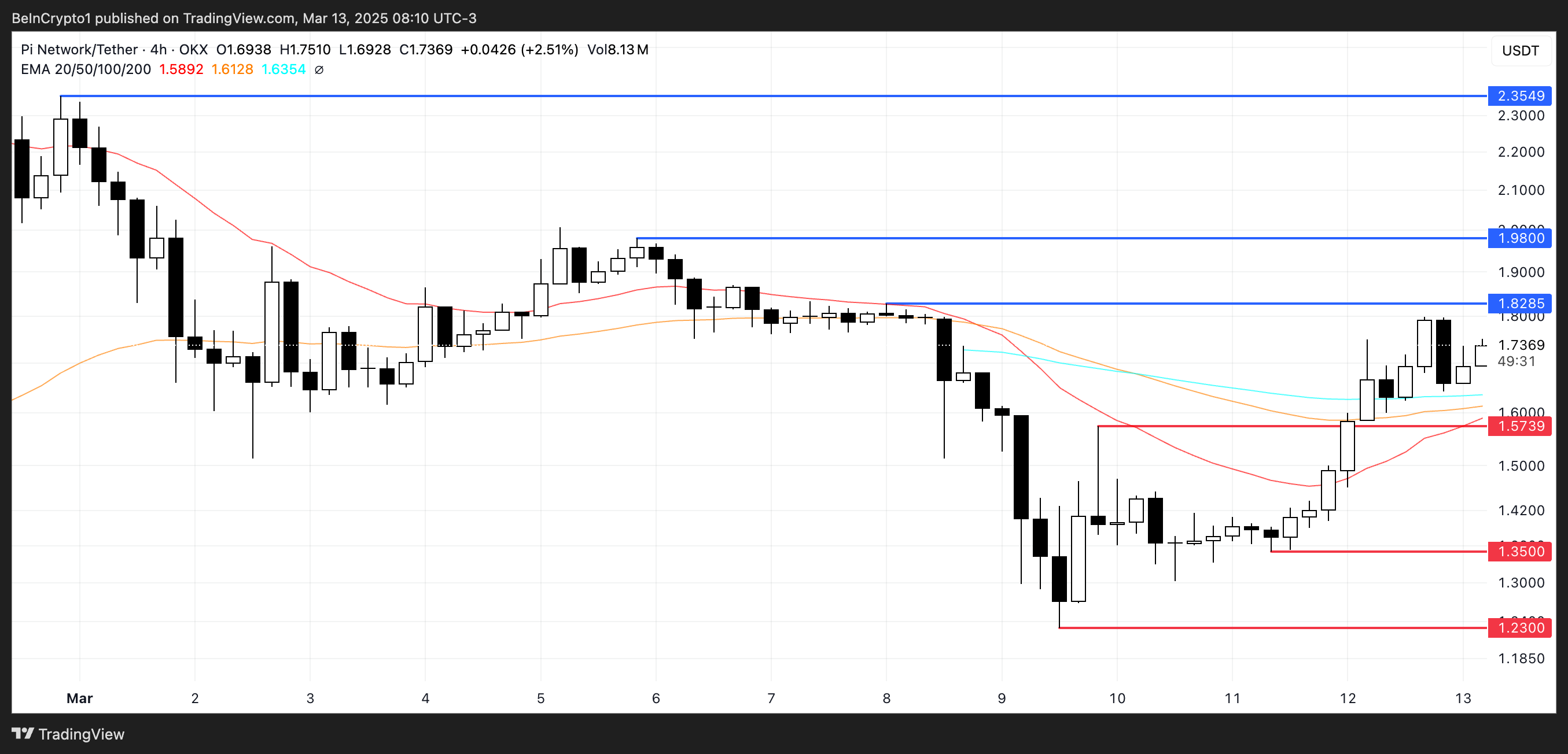

Pi can recover levels of $ 2.35 soon

Pi Price is currently negotiating in a key range, facing resistance at $ 1.82 while having support at $ 1.57. If the current trend persists and buyers manage to exceed $ 1.82, the following target would be $ 1.98.

A break above this level could open the door to a stronger rally, especially if Pi takes up the positive momentum given last month. In this scenario, the price could extend its climb to $ 2.35, strengthening a more optimistic perspective.

However, cleaning these levels would require prolonged purchase pressure and breakup confirmation greater than $ 1.82.

Lower down, if the PI trend is reversed, it could retain its immediate support at $ 1.57.

The loss of this level would weaken the bullish structure and expose the price to additional drops, potentially testing $ 1.35. If the sales pressure is intensifying, Pi could fall even more at $ 1.23, marking a deeper correction.

The strength of the support at $ 1.57 will be crucial to determine if the current rise in trend is maintained or if Pi between a larger withdrawal phase.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.