MANTRA (OM) Charts Look Worse than LUNA – No Buying Activity

Yesterday, Mantra (OM) underwent an astonishing accident of 90%, and he is still falling today. More specifically, OM graphics and indicators seem as bad as the collapse of the Terra Luna 2022, if not worse.

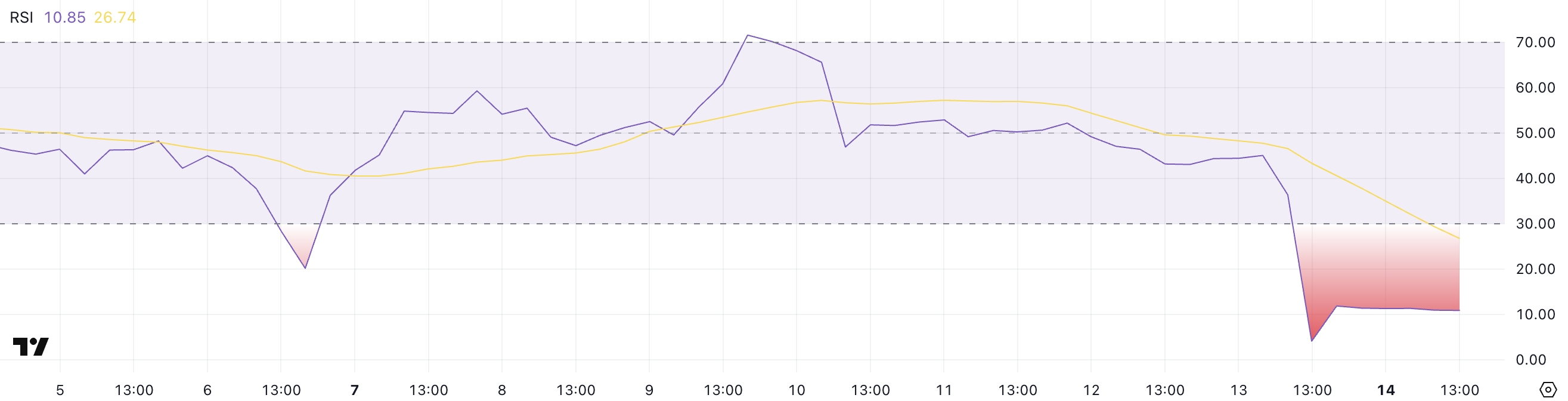

The OM RSI omits near the extreme surveillance levels, and the indicators reflect that there is practically no purchase activity. When Luna collapsed, a large number of traders bought the accident for a short -term pump. But, even it seems unlikely for the mantra, on the basis of current graphics.

OM RSI has reached levels of less than 10

After having crushed more than 90% in a few hours, some traders can look at the Mantra OM token as a potential opportunity “buy the accident”.

However, the relative resistance index (RSI) tells a different story – WHO dropped from 45 to 4 during collapse and only slightly recovered to 10.85.

The RSI is a momentum indicator which measures the speed and extent of price changes on a scale of 0 to 100. As a rule, the values less than 30 indicate occurrence conditions, while levels above 70 suggest that the asset is exaggerated.

Despite the rebound from low extremes, the OM RSI has oscillated around 10.85 for several hours, reporting that very few buyers intervene to support the price.

This lack of monitoring of follow -up shows that the feeling remains strongly lower, and the traders are not yet confident enough to accumulate the token, even at these high reduction levels.

Recently, speaking to Beincrypto, analysts warned against the potential lack of true value on the mantra chain.

OM is potentially installed for more drop or a period of prolonged stagnation because the market awaits a catalyst or clearer recovery signals.

Mantra DMI shows that the purchase activity is almost nonexistent

The MANTRA DMI (MANTRA MOVEMENT) graph clearly shows an intense lower momentum. The ADX, which measures the strength of a trend whatever the direction, is currently at 47.23 – well above the threshold 25 and showing no signs of weakening.

The -Di, which follows the sale pressure, decreased by its peak from 85.29 to 69.69, indicating that if the sale of panic can slow down, it remains dominant.

Meanwhile, the + DI, which measures the purchase pressure, went from 3.12 to only 2.42, highlighting a total lack of bull response to collapse.

This imbalance reveals that although the worst of immediate sale can be completed, practically no significant purchase activity is entering to support the price of OM.

The fact that + DI remains extremely low suggests that traders always avoid the token, hesitating to buy even after a massive discount.

As long as this dynamic continues – a strong trend force, high sales pressure and a nearby purchase pressure – OM is likely to remain under high bearish pressure, with any extremely improbable recovery attempt unless the feeling moves considerably.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.