Market Buzz Grows Over Pi Day

The native token of Pi Network, pi, bounced after a few days of decline. He noted a 6% gain in the last 24 hours to exchange $ 1.47 at the time of the press.

The recovery comes from the advance on the IP day on March 14. There are also growing speculation on the market on a potential binance list.

Pi gains 21% as merchants gain confidence

Pi jumped 21.3% in the last 24 hours, driven by increasing speculation on a potential binance list and upcoming announcements on March 14.

This date also marks the deadline for the completion of KYC and the migration of Pi assets from the mobile application to the Mainnet. These upcoming developments have sparked a new wave of Pi demand, losing upward pressure on its price.

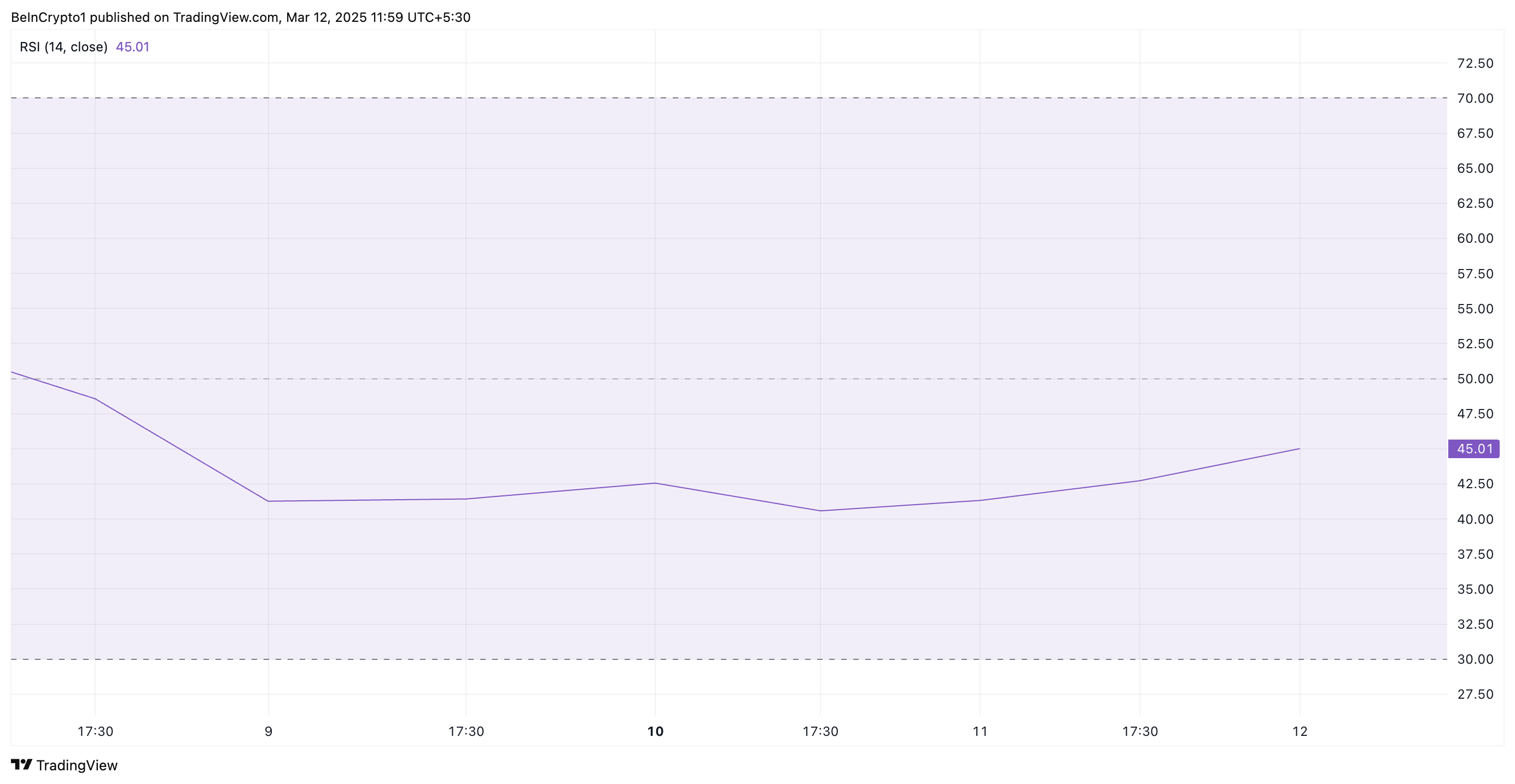

The regular increase in the PI (RSI) relative force index reflects the overvoltage of the purchase activity among the cashier in cash. The momentum indicator is in an upward trend and ready to break above the 50 cents line at the time of the press.

When the RSI of an asset tries to cross its level of 50 neutrals, it signals a change of momentum of the bullish. This suggests that the purchase of pressure increases, which potentially causes additional price gains if the trend continues.

A movement confirmed above 50 would reinforce the positive feeling around PI and attract more traders in search of an ascending momentum.

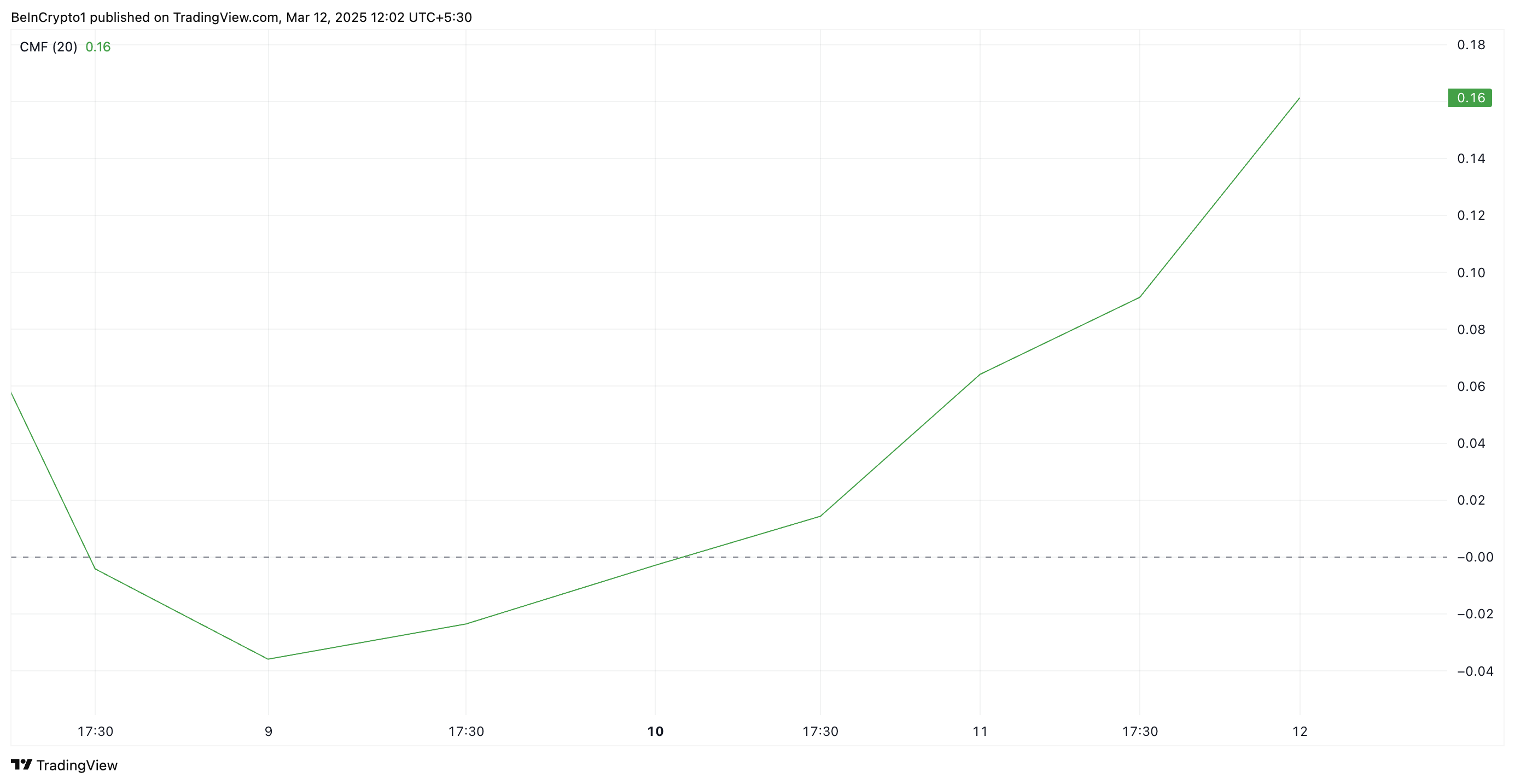

In addition, its positive chaikin monetary flow (CMF) confirms this optimistic perspective. This indicator, which follows the way the money flows in and out of Pi, is greater than zero at 0.16.

This trend indicates that the purchase of pressure is stronger than the sales pressure from PI traders. He indicates that investors are confident in the assets, increasing the probability of an additional price assessment.

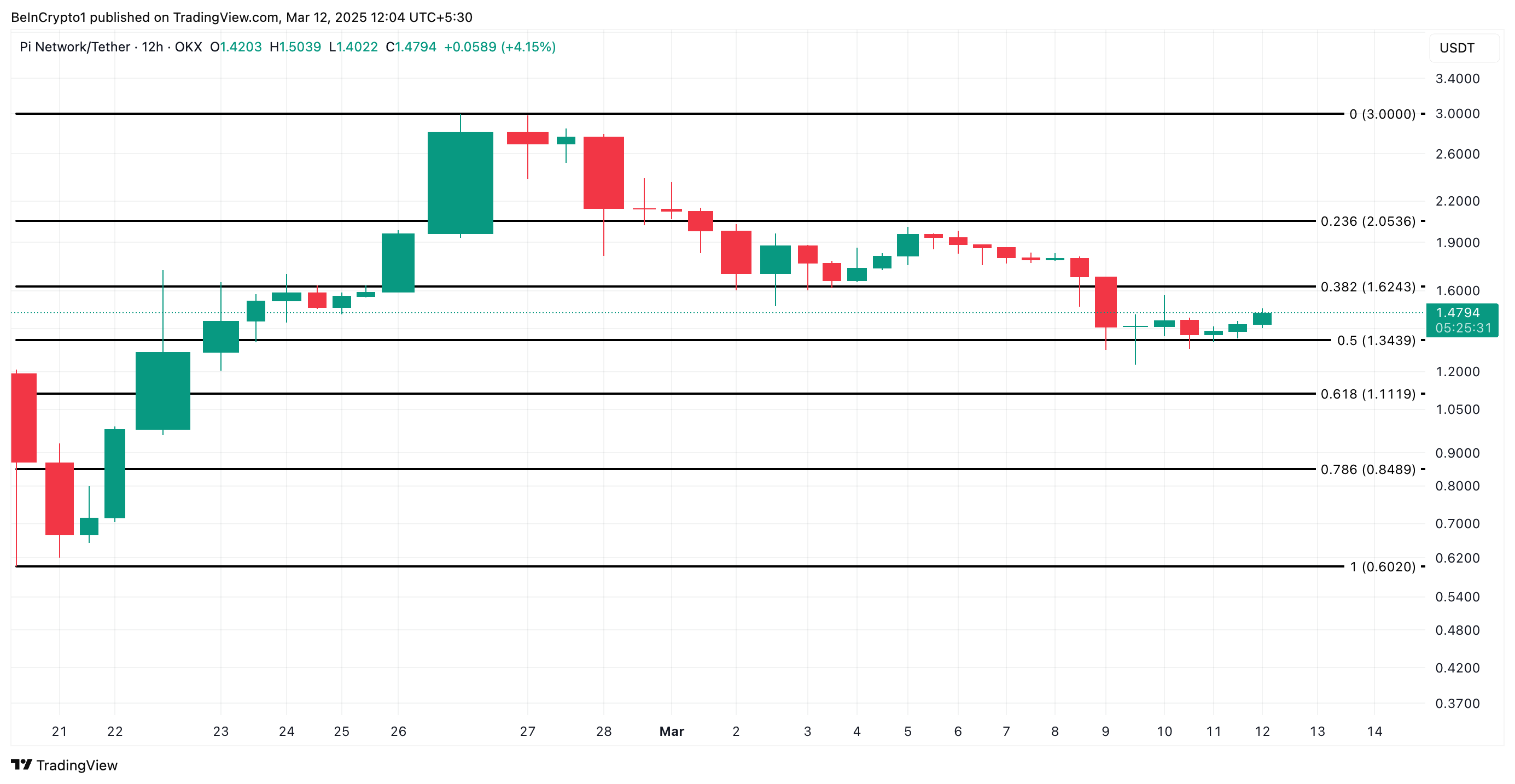

Can Pi Eyes Recovery after a steep fall – can he recover $ 2?

PI regularly decreased, falling by more than 19% last week. This pushed its price under a key price level of $ 1.62, which constitutes an important resistance. If the upward trend persists and the request for a pi rises, its price could try to violate this level.

A successful break above $ 1.62 could propel Pi above $ 2 and closer to its $ 3 summit.

On the other hand, an resurgence of the profit would invalidate this bullish projection. If the sellers increase again, the Pi price would resume its downward trend and fall to $ 1.34.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.