Market Sentiment Turns Bullish in April as Whale Accumulation

The cryptocurrency market is experiencing a significant change in the feeling of investors this month. The resumption of Bitcoin prices has sparked a training effect on demand, from large investors to the little ones.

Bitcoin rebounded 25% from its stockings at the beginning of April. Chain data and updated forecasts of industry experts offer a preview of the sustainability of this gathering.

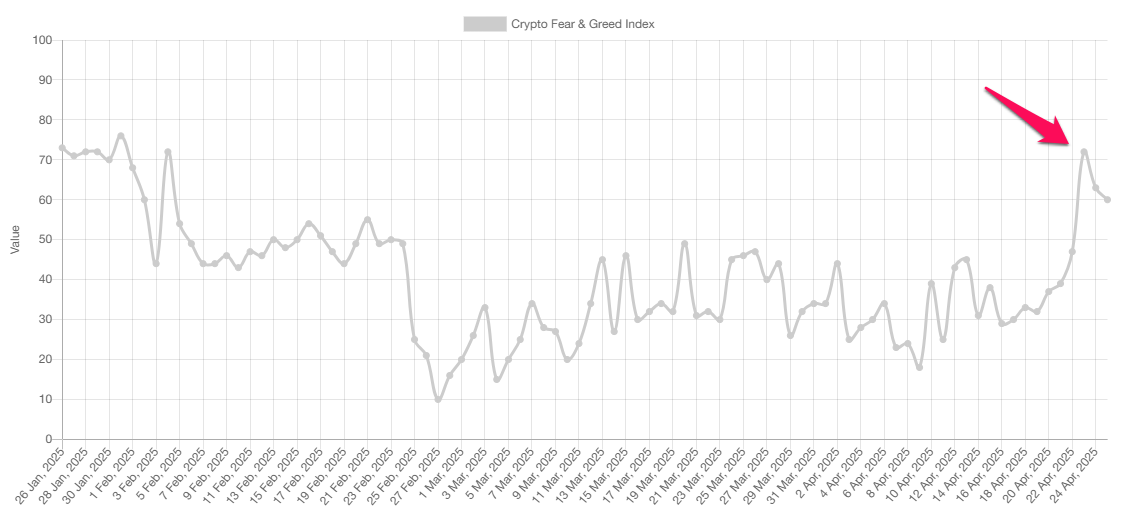

The feeling of the market goes from fear to greed

According to alternative data.me, the index of fear and greed increased from a minimum of 18 to a maximum of 72 in April. It is the highest level since February and marks a clear passage from fear to greed.

Meanwhile, the indexing coinmarketcap version shows a slightly different image. It went from 15 to 52 points, going from extreme fear to a neutral state. Although the two clues differ, the two confirm a notable change in the feeling of investors. Investors have exceeded fear that often triggers the sale of panic.

This neutral or gourmet state of mind lays the foundations for greater optimism. If it continues, the market can reach a state of extreme greed before any major correction occurs. This change of feeling has led to five signals of divergence which support the potential continuation of recovery for bitcoin and altcoins.

Bitcoin accumulation spreads from large to smaller wallets, indicating a positive perspective

Chain data show that the accumulation of whales has helped Bitcoin over $ 93,000 in the last week of April.

A Glassnod graph reveals a clear transition from a distribution phase (marked in red) to an accumulation phase (marked in green) in April. This timing lines up with the bitcoin rebound of its monthly hollow.

More specifically, Bitcoin whales – the wallets holding more than 10,000 BTC – have accumulated at almost perfect levels. Their trend accumulation score is about 0.9.

Following whales, portfolios from 1,000 to 10,000 BTC gradually increased their accumulation score in the second half. Their score reached 0.7, as shown in the passage of the color of the graphic from yellow to blue. Other wallet levels also show signs of accumulation, reflecting the feeling of changing among the smallest whales.

“So far, the big players have bought this rally,” said Glassnode.

In addition, a recent Beincrypto report underlines that the Bitcoin ETF recorded $ 2.68 billion in entries last week. These ETFs experienced five consecutive days of positive entries. These measures confirm that the demand is coming back and throws the basics of continuous price winnings.

Fidelity and Ark Invest Update Bitcoin Prévisions

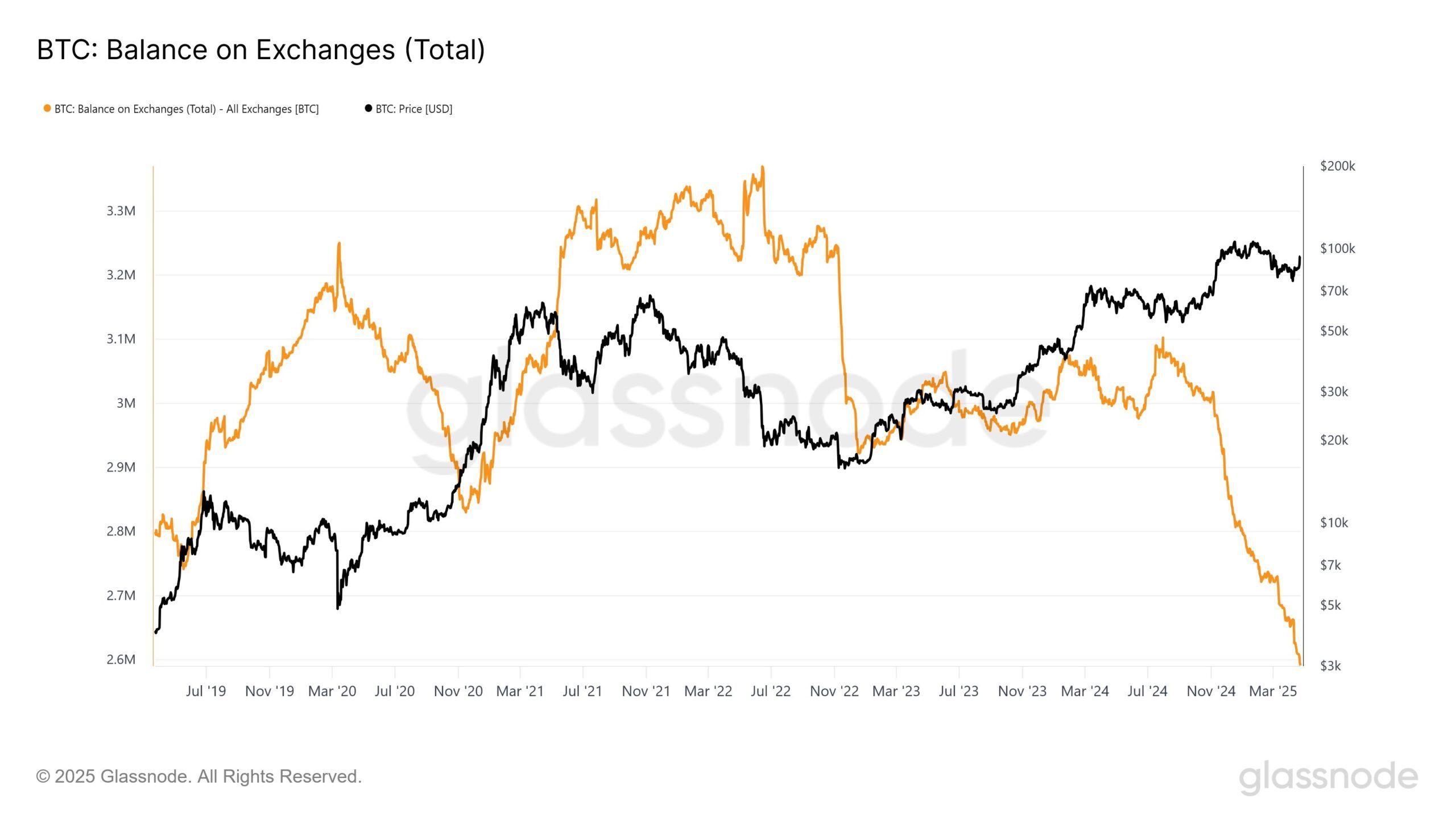

Fidelity Digital Assets, a branch of the active giant of $ 5.8 billions of dollars, Fidelity Investments, reports that the bitcoin supply on exchanges fell to its lowest level since 2018, with only around 2.6 million BTC to play.

Fidelity also noted that more than 425,000 BTCs have left exchanges since November 2024. Public companies have added nearly 350,000 BTC since the US elections and buy more than 30,000 BTC per month in 2025. Fidelity is expecting this trend.

“We have seen the supply of Bitcoin down discussions due to purchases of public companies – something that we plan to accelerate in the near future,” said Fidelity Digital Assets.

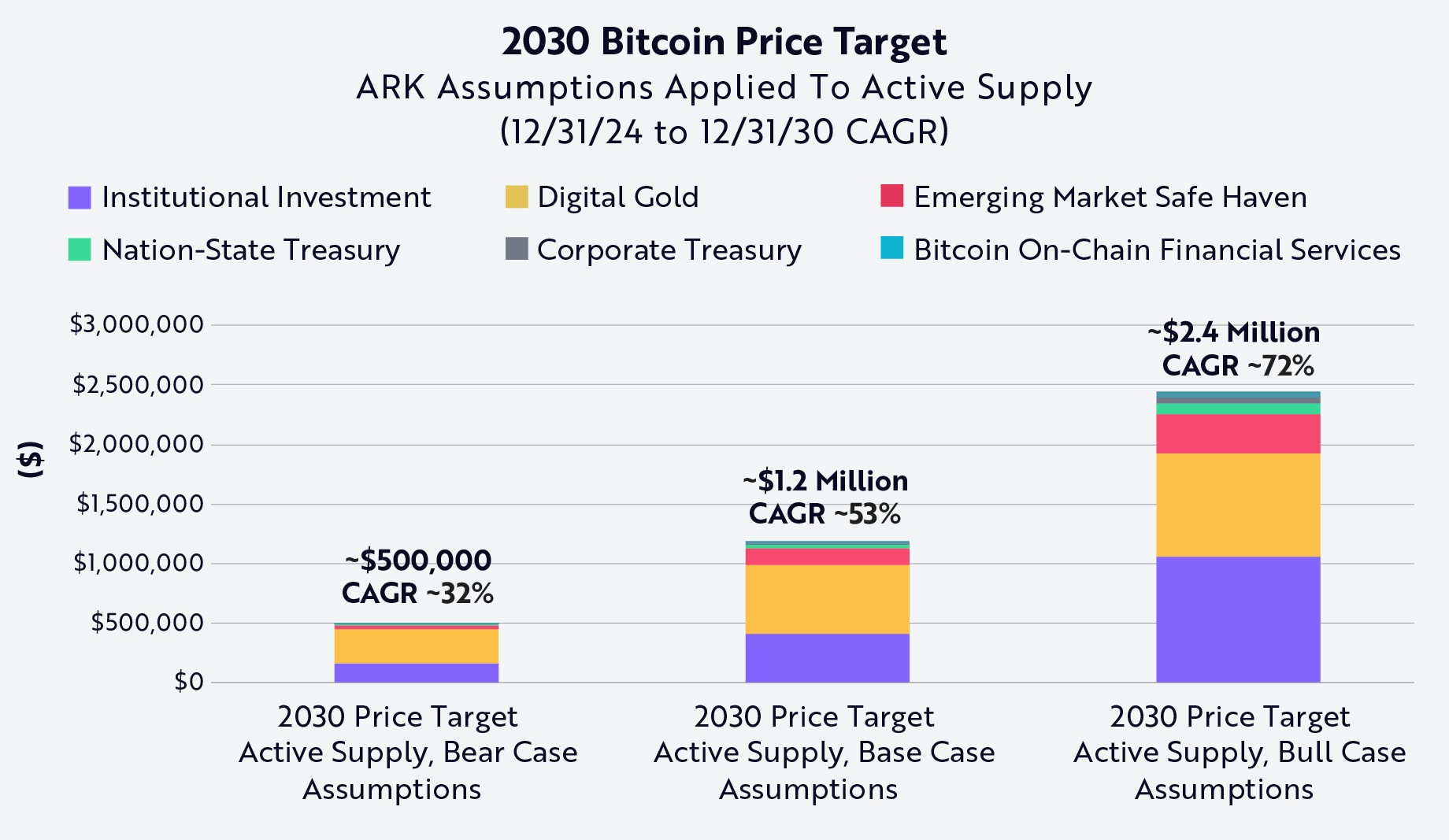

Meanwhile, Ark Invest has updated its Bitcoin price projection in the Big Ideas 2025 report. As part of its most optimistic scenario, Bitcoin could reach $ 2.4 million by 2030 – further from its previous $ 1.5 million forecasts.

This projection is based on several factors: the increase in institutional investment, the possibility that nations dealing with Bitcoin as a strategic reserve asset and its growing role in decentralized finance.

While fund managers like Fidelity and Ark Invest have a positive perspective for April, some retail investors are starting to express their prudence. The idea of ”selling in May” begins to surface, reflecting concern in the middle of unpredictable macroeconomic factors, such as tariffs and interest rate changes, which could strongly have an impact on the market in the near future.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.