Why ETF Issuers are Buying Bitcoin Despite Recession Fears

According to new data from Arkham Intelligence, three main Bitcoin ETF transmitters now acquires huge amounts of BTC. Yesterday, the ETFs had $ 220 million at net entries, and the issuers potentially expect a peak of demand.

Although Bitcoin has experienced wild fluctuations in the past two days, institutional investors could show more confidence in the leading cryptocurrency than the Tradfi market.

Why do the emitters ETF buy Bitcoin?

The cryptography market has experienced broader liquidations today, and fears of a wider recession circulate strongly. Since President Trump has imposed much higher than expected rates, Crypto reflects the Tradfi stock market with notable slowdowns.

However, the American FNB Bitcoin Spot market shows that institutional demand could bounce back in the short term.

“Donald Trump has just priced the whole world. So? Grayscale buys Bitcoin, Fidelity buys Bitcoin, Ark Invest buys Bitcoin,” noted Arkham Intelligence on social networks.

Arkham Intelligence, a prominent blockchain analysis platform, is not the only one to notice this trend in the Bitcoin ETF. Although the Bitcoin price has been very volatile in the past two days, it has always managed to return to a raw base.

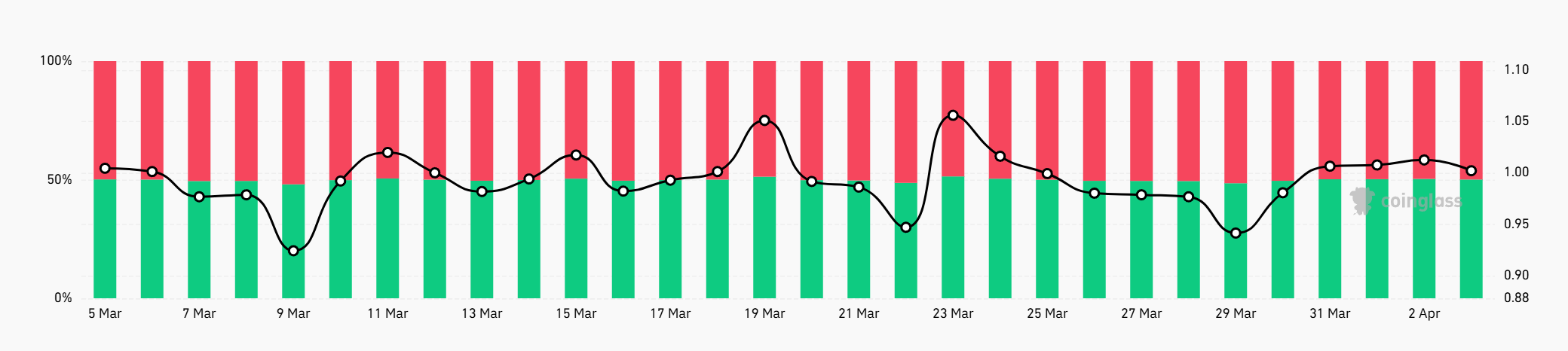

The long -term ratio of the assets was 0.94 last week and it went to 1 today. This signals an evolution towards the positioning of more balanced investors.

Previously, with 48.5% long positions against 51.5% of short positions, the market had a slight downward tilt. Today, the equal division – with 50.5% long positions – signals that investors have neutralized their position, reducing the lower bias.

This balanced positioning suggests that the feeling of the market has stabilized, potentially reflecting increased uncertainty on short -term price movements. Bitcoin investors can now wait for clearer market signals before engaging in a more directional bias.

In addition, the Bitcoin ETF worked well in another key area. According to Soso Value data, the entire asset category had 220 million dollars net entries yesterday.

Admittedly, Trump made his announcements of the Liberation Day after closing the stock market yesterday, but it is still very impressive growth.

It is currently not known what impact today’s market disorders have had Bitcoin ETF as a category of assets. However, Arkham’s data suggest that these issuers make significant investments in the BTC.

If nothing else, it suggests that these companies anticipate an increase in demand in the near future. There are still many unanswered questions about prices, cryptographic markets and the world economy as a whole.

If FNB entries continue throughout this week, this will reflect the bets of institutional investors on the BTC to remain more stable and durable than the commercial markets in the midst of recession problems.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.