MELANIA Crashes to All-Time Low Amid $14.7 Million Insider Sales

A wave of strong sales linked to the team behind the Melania same Coin (Melania) has raised new concerns concerning the activity of initiates in the project.

These activities contributed to the drop in the value of the token to a hollow of all time, 97% down compared to its summit of all time on the day of the inauguration of Trump in January.

The sale of heavy initiates sends Melania to a historic bottom

On April 19, the EMBCN chain analyst reported that portfolios linked to the project unloaded nearly 3 million melania tokens.

In return, the team received around 9,009 soil, worth around 1.2 million dollars. The tokens were sold through unilateral liquidity provisions added to the Melania / Sol Trading pair on Meteora.

This transaction is part of a larger model. In the past three days, Melania’s team has moved 7.64 million tokens, worth around $ 3.21 million, both liquidity and community portfolios.

The team systematically added these tokens to the same liquidity pool and sold them for soil in a predefined price range. Of the total, they sold 2.95 million tokens just a few hours before the disclosure of the embellished.

“In the past 3 days, the Melania $ project team has continued to transfer 7.643 million melania tokens ($ 3.21 million) to liquidity and community addresses, then added them to Melania / Sol, unilateral liquidity on Meteora, selling $ Melania in a sex beach. Of which 2.95 million Melania tons were sold 7 hours ago for 9.009 soil ”.

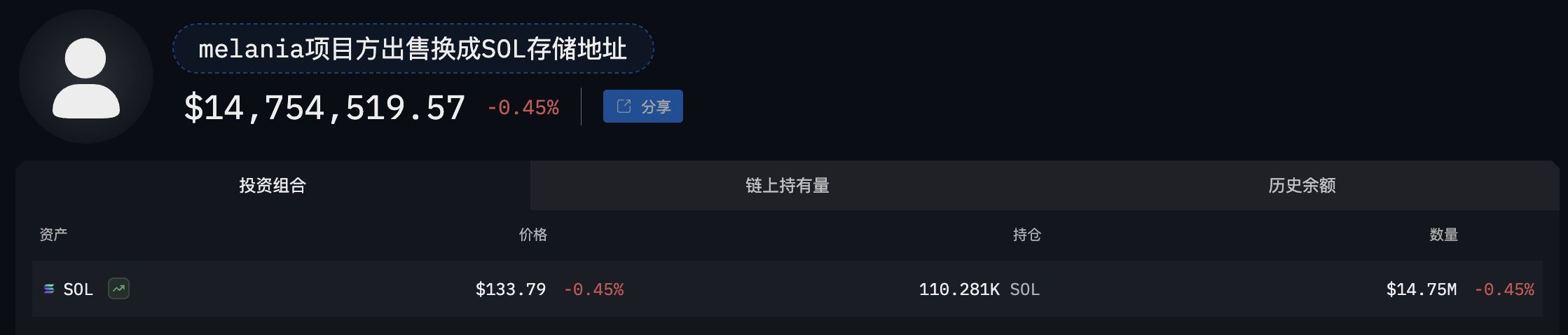

Embercn also pointed out that the project team had sold more than 23 million melania tokens in the last month. The tokens were worth around $ 14.75 million.

These repeated sales added weight to concerns about internal dumping – USPions that emerged for the first time in March.

At the time, the Bobblemaps blockchain analysis company reported unusual movements of more than $ 30 million in Melania tokens. Originally in the community’s allowance, tokens seemed to be gradually transferred to exchanges without explanation.

The company linked these transactions to Hayden Davis, co-founder of the memes play. Davis previously worked on another controversial token, the balance, which briefly increased after Argentinian president Javier Milei approved it, then quickly collapsed.

Bubblemaps also revealed that the portfolios linked to the control of the Melania team control approximately 92% of the total supply of the token. Critics argue that this level of centralization increases red flags on potential market manipulation.

Following these concerns, Melania saw her price collapse. After reaching a summit of more than $ 13 earlier this year, the token fell by more than 96% to a minimum of $ 0.38, according to Beincrypto data.

However, the steep decline reflects both internal disorders and a wider weakness in the meter parts sector. The appetite of investors for high -risk tokens seems to disappear in the middle of global uncertainty and a more prudent market feeling

Non-liability clause

All the information contained on our website is published in good faith and for general purposes only. Any action that the reader undertakes on the information found on our website is strictly at their own risk.