Meme Coin Sector Surges 16% — Is the Supercycle Finally Here?

The parts market even has just published a daily overvoltage of 16%, signaling a major cycle. Momentum resumed after Bonk appeared in the reshuffle of the Graycale Q3 Fund, discreetly validating the parts even within the framework of the larger market structure.

In the past 24 hours, Capital has started to move as if he were running in a real sector. From growing volumes to synchronized eruptions, signs align. So now, the question is back on the table: is the same money supercycle finally in progress?

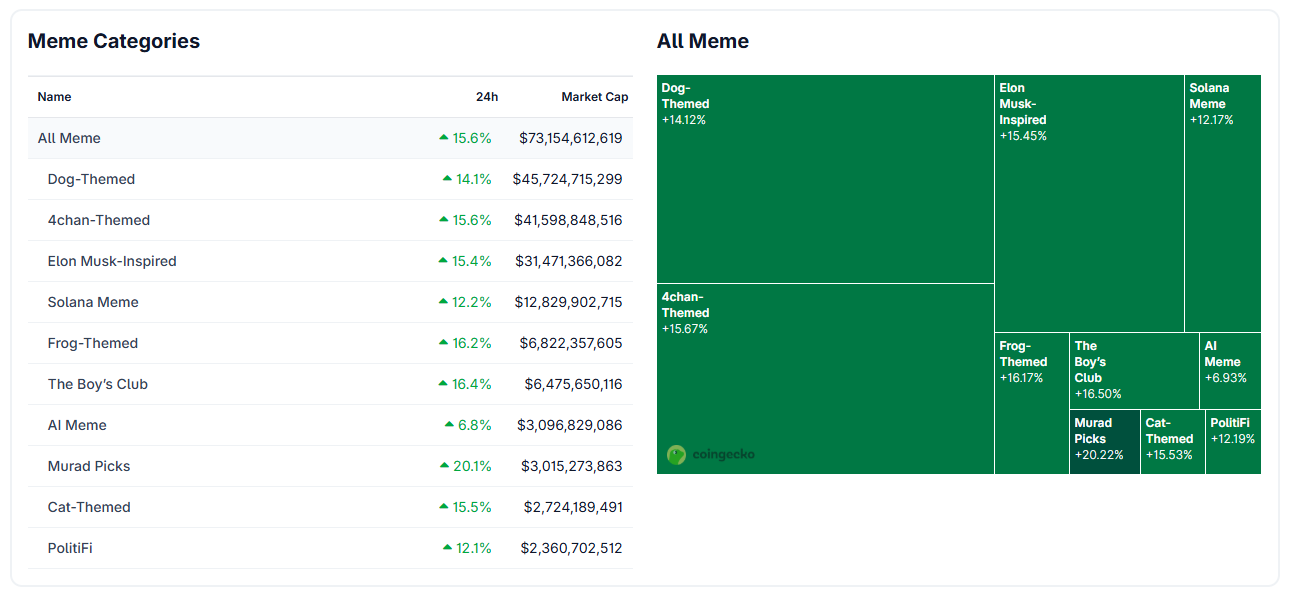

The market capitalization of the same corner exceeds $ 73 billion

In the past 24 hours, total market capitalization increased to $ 73 billion, with a gain of 16% and 26 billion dollars in negotiation volume; Numbers not seen since the rotations of Pic Altcoin in early 2024.

But beyond the total, it is the spread that signals the structural momentum.

The solara memes like Bonk and WIF earned more than 12%. Giants on the theme of dogs like Doge and Shib have rallied in synchronization. Even marginal verticals such as 4chan tokens and speculative “Murad Picks” gains recorded two figures.

Even Murad Mahmudov, formerly a little maximalist of Bitcoin, now supports memes pieces like the next border of speculative attention. Its current “murad” choices – such as followed on Coingecko – include SPX6900, MOG, POPCAT, Gigachad and APU, each being “purely memetical exposure” in the cultural cycle.

PEPE, supported by whale purchases and volume tips, led a negotiation activity with $ 1.37 billion in volume 24 hours a day.

The statistics suggest coordinated rotation on a market scale, the capital dealing with the assets of the same as being part of a shared story.

SPX6900 emerges like the Bellwether token

In the middle of the coordinated rally, SPX6900 positioned itself as the token that traders use to follow the health of the sector.

Although it is not a basket or a formal index, SPX has come to symbolize exposure to meta-mets, a graphic that many traders are now referring when the feeling of larger same.

SPX6900 is a jet-native of the meme sector which has become the unofficial reference of the market to follow the momentum of the same.

Two key signals are distinguished:

- The enumeration of the holders exceeded 43,400 beyond, marking a local summit

- Exchange entries have dropped, pointing to a reduction in sales pressure and increased conviction

This combination, no more portfolios, fewer tokens sent to the scholarships, suggests that the capital runs with an intention halfway through. And as the SPX graphic often moves on tokens like Pepe, WIF and Bonk, it is now treated as an indicator of feeling for the entire sector.

Although SPX does not represent a basket, its behavior shapes the narrative structure of the same money supercycle.

SPX Action Price and BTC Fuel Decreases Supercycle Talk

While the feeling and wallet data have prepared the terrain, the Table of SPX6900 prices could trigger the next stage of the same money rally.

The token is currently negotiated at $ 1.67, or 1.7% below its $ 1.74 summit – a level that we do not see in more than six months. Above all, SPX has already overturned $ 1.55 in support, showing that the rally is not only reactionary; He has a structure behind her.

If the graph holds above this area, traders will look at $ 1.739 and more like the level of rupture which confirms the continuation of the sector.

The invalidator is also clear. A sustained drop below $ 1.45 would break the upward structure and could block the wider memes rally.

This makes SPX one of the cleanest risk reward graphs in the same space, and its techniques are increasingly used to assess the health of the entire sector.

What adds even more weight to the thesis is the Bitcoin spx decoupling.

During last week, SPX surpassed the BTC in relative terms, which is rarely seen in the cycles even, which historically follow the volatility of Bitcoin.

This first leadership suggests that the room sector even may no longer need BTC to break first. Instead, memes merchants look at SPX as a chomentum chief in the sector, using its structure as a confirmation.

If the escape above $ 1.77 occurs, it could trigger a new wave of entries, not only in SPX but throughout the ecosystem of the same piece, forgotten tokens and speculative forks.

In short, SPX6900 could be the graphic that confirms if this season of memes is only a brief rally or the real start of a memel coin.

The part of the same post increases by 16% – is the supercycle finally here? appeared first on Beincrypto.