Messari Sees XRP Beat Rivals on Market Cap, Network Growth

According to Messari’s latest report, the growth of the Bitcoin market capitalization of XRP (XRP) has surpassed the combined market capitalization of Bitcoin (BTC), Ethereum (ETH) and Solana (soil), which decreased during the same period.

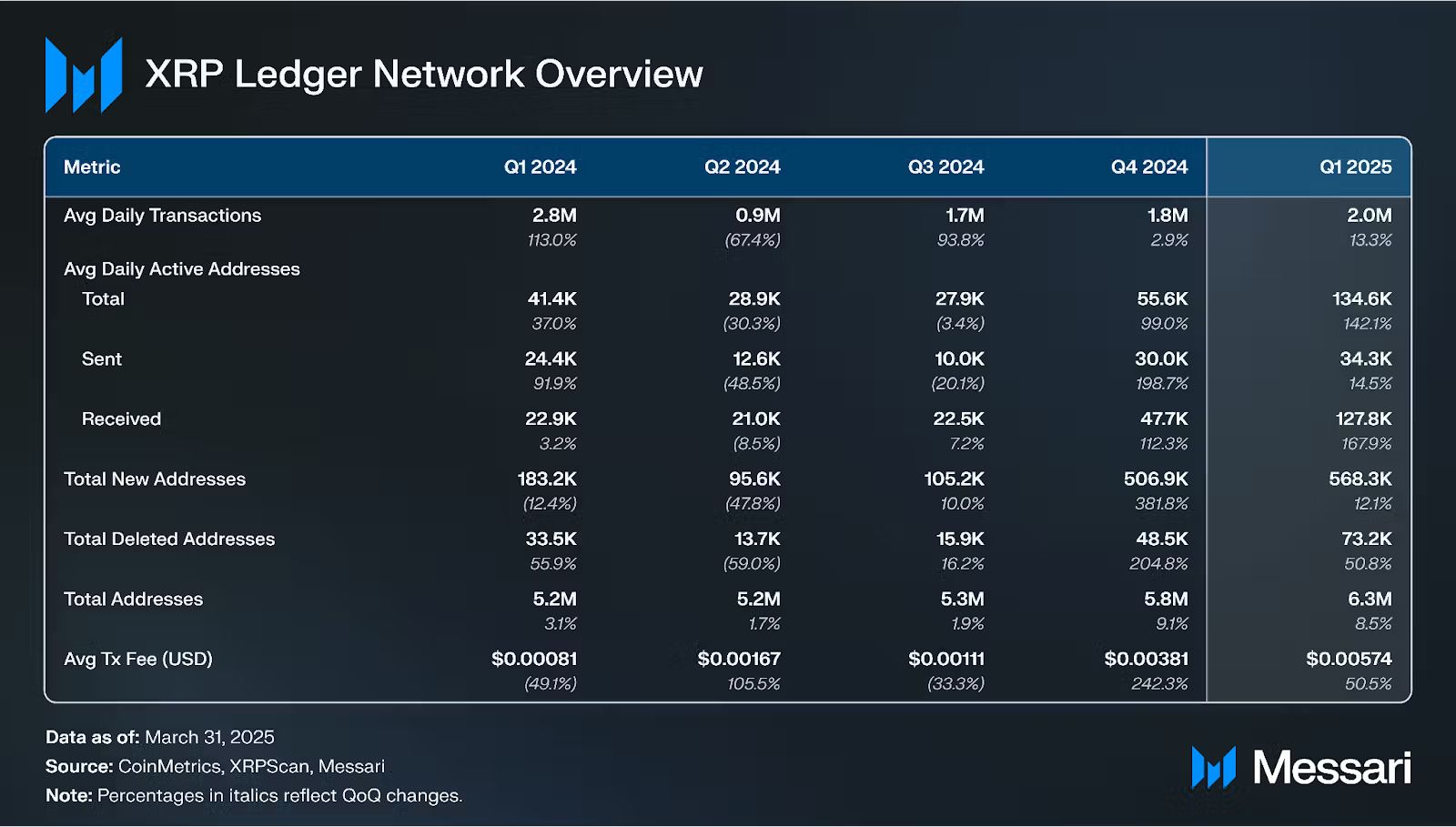

In addition, all metrics in the XRPL network have shown growth for the second consecutive quarter. The most important of them was an increase of 142% of the daily active daily addresses, highlighting the expansion and the continuous adoption of the Grand Book XRP.

XRP surpasses BTC, ETH and Sol in Q1 2025

The report revealed that in the first quarter of 2025, the market capitalization of XRP increased by 1.9% compared to the previous quarter, reaching 121.6 billion dollars. In comparison, the combined market capitalization of BTC, ETH and Sol fell by 22%.

In addition, the circulating market capitalization of XRP increased by 252% from one year to the next (annual shift). Despite the increase in market capitalization, the price of XRP increased only by 0.5%. This was awarded to an increase of 1.4% of the supply of XRP.

XRP’s growth has extended beyond its market capitalization. Network measures have also shown significant improvement.

“In Q1, all the measured network measures increased for a second consecutive quarter. In particular, the fourth quarter of 2024 and the first quarter of 2025 have been the only times since Messari began to cover the XRPL in T1 2023,” noted Matt Kreiser de Messari, Matt Kreiser.

The average daily active addresses increased to 134,600, an appreciation of 142%. This reported an increase in the commitment of new and existing users. In addition, the total of new addresses increased by 210% compared to T1 2024 and 12% QOQ to 568,300.

Messari stressed that active receiver addresses have exceeded sender for the fourth consecutive quarter. Daily receivers jumped 168% to 127,800, against an increase of 14.5% of daily shipowners to 34,300.

“When the recipients exceed the sender, this indicates that more inactive portfolios receive tokens distributed by shippers that the shippers distributing these tokens. A common reason for this dynamic is ardrops,” wrote Kreiser.

Average total daily transactions increased by 13% QOQ to 2.04 million. In particular, payment transactions rebounded 36% qoq to 1.12 million after a drop of 8% in the fourth quarter 2024.

In addition, the number of active nodes increased significantly by 969%, compared to 886 to T4 2024 to 9,498 by the end of T1 2025. This reflects substantial growth in the network infrastructure.

In the first quarter, the network also celebrated the launch of the XRPL EVM Sidechain Testnet on March 31. It aims to bring the compatibility of the Ethereum virtual machine (EVM) to the XRP Ledger. The Sidechain is defined for the launch of Mainnet at T2 2025.

Beyond network developments, Ripple has also continued to extend its footprint thanks to strategic movements. On April 8, the company acquired Hidden Road for $ 1.25 billion. With this acquisition, Ripple has become the first Crypto company to have a main brokerage platform.

The acquisition also stimulates the adoption of XRPL and USD Ripple (Rlusd). Hidden Road plans to integrate XRPL for post-exchange operations and adopt the stablecoin to support USD de Ripple, Rlusd, as guaranteed.

Rlusd, the largest stablecoin of the network, has already experienced significant growth in the first quarter of 2025. Its market capitalization on XRPL reached $ 44.2 million, reflecting an increase of 304% compared to the fourth quarter 2024. This new utility opens the ground for a new expansion.

In addition, the institutional interest in Ripple also increases. Zand Bank, based on water and mamo, has integrated undulation payments to rationalize cross -border payments. These integrations highlight the growing role of Ripple in the facilitation of global financial services.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.