Trading Activity Surges While SEI Price Drops Sharply— Are investors Turning Bearish on the SEI price rally?

Sei, the native token of the Blockchain SEI, recently witnessed a trend on the paradoxical market: increasing commercial activity in parallel with a sharp drop in prices. This divergence between growth on the chain and market assessment raises critical questions about the feeling of investors and the future orientation of prices. While the use of networks increases and the volumes derivatives soar, the lower time continues to weigh heavily on the token.

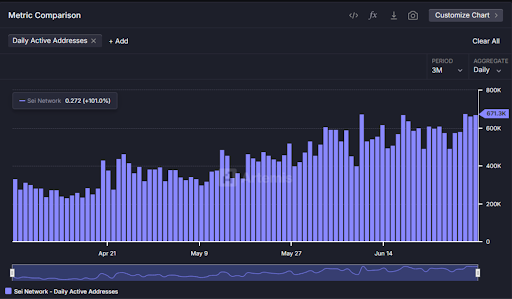

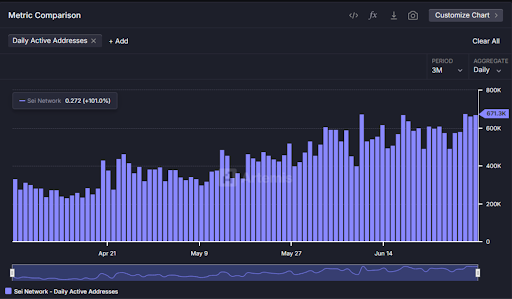

Active address surge while the price drops

The SEI price has been watched closely in recent days because the token was one of the trendy tokens in the last days of June. Consequently, the commercial activity on the platform began to increase, which had a positive impact on the value of the token. However, the Bears seem to have started to gain profits and, therefore, the price has been lower since the beginning of the month.

The daily active address of SEI has reached a summit recently, which suggests a strong trading activity on the platform. On the other hand, the SEI price has dropped sharply and, therefore, this disconnects indicates the speculative feeling on the wider market remains lower. However, active addresses are expected to climb next week with the news of the Japanese Financial Services Agency (JFSA) approving the List of SEI on Japanese exchanges. Consequently, volatility should climb highly, but it would be interesting to monitor the impact on the price.

Price prediction SEI: Will it exceed $ 0.5?

The growing momentum of the SEI Prize had a positive impact on the token, which had pushed the price above the 200-day MA. In addition, the Gaussian canal had also become bullish, referring to a change of downward trend. Meanwhile, after reaching the local peak above $ 0.3, the Bears jumped into the action while the volume fell and reached its initial range, placing the price at a crucial stadium. The token now tests central support for 20 days control and a drop below the beach may not be healthy for the SEI prices rally.

The sei prize seems to be optimistic in the daily graphic because it is stuck in a bullish flag; However, the techniques do not point to an escape. Although the price is higher than the cloud of Ichimoku, which could be a bullish indicator, the conversion line has shown a downward divergence, referring to the growing domination of bears. In addition, the MacD shows a drop in upward pressure and this will be supported by the next Bearish crossover.

Consequently, the lower clouds continue to hover during the SEI prices rally, because a drop below the support area between $ 0.2683 and $ 0.2,517 could push the token almost $ 0.21. On the contrary, a rebound could raise levels above $ 0.4, which could open the doors for $ 0.5.