Bitcoin Hovers Over $80,000 as Whale Activity Drops

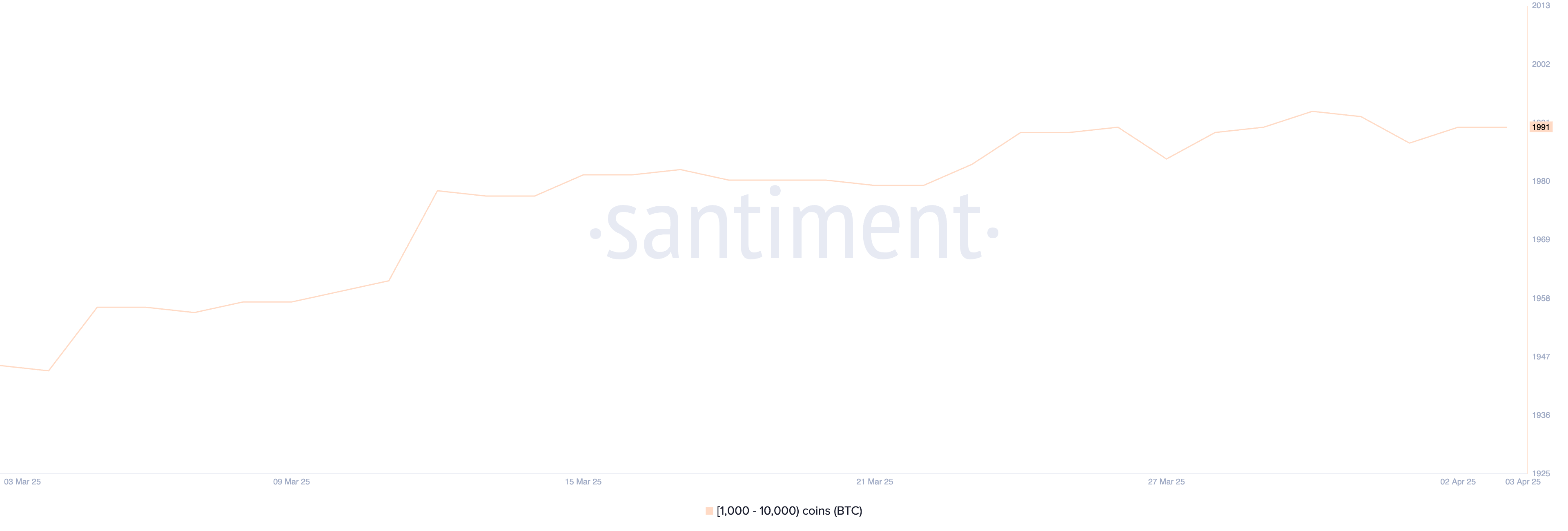

Bitcoin (BTC) continues to hover in a state of uncertainty, because both the activity of whales and technical indicators indicate a market without a strong conviction. The major holders remained inactive for more than a week, the number of whale portfolios holding between 1,000 and 10,000 BTC stable at 1,991 since March 24.

Meanwhile, technical graphics such as the Ichimoku Cloud and Ema lines offer a mixed perspective, reflecting hesitation in optimistic and lowering directions. As BTC is negotiated near the levels of key support and resistance, the next few days could determine if April provides a deeper break or correction.

Bitcoin whales do not accumulate

The number of Bitcoin whales – the gang holders holding between 1,000 and 10,000 BTC – amounts to 1,991, a figure that has remained remarkably stable since March 24.

This level of coherence in the great activity of holders suggests that major actors accumulate neither are accumulated aggressively nor unload their positions.

Given the size of these assets, even minor changes in whale behavior can have a significant impact on the market. This stability is particularly remarkable given the recent volatility on the wider market of cryptography.

The follow -up of Bitcoin whales is crucial because these major holders often have the power to influence prices thanks to their purchasing or sale decisions.

When the whales accumulate BTC, this can point out confidence in the future assessment of prices, while large -scale sale may indicate the downward pressure. The fact that the number of whales has remained stable in the past 11 days can suggest a consolidation period, where large investors are waiting for a clearer macro or market signal before making their next move.

This could imply that the main players consider the current BTC price as a fair value, potentially leading to a tightening of short -term price action before an escape in both directions.

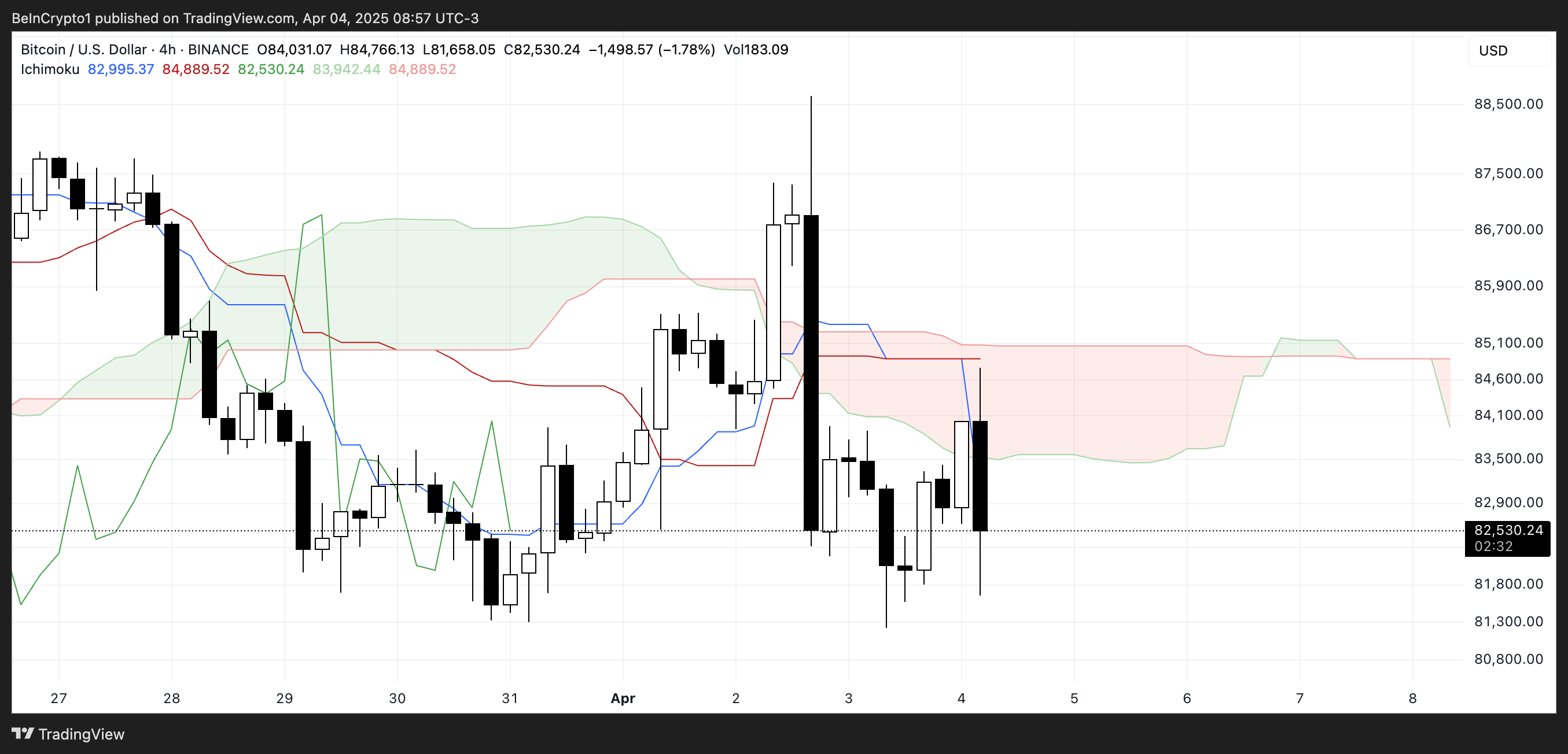

The BTC Ichimoku cloud shows a mixed image

The current configuration of the Ichimoku cloud for Bitcoin shows a mixed but slightly careful feeling.

The price recently dropped below the red basic line (Kijun -Sen), and despite a brief push in the cloud, it was rejected and fell below – indicating that this bullish momentum lacked follow -up.

The blue conversion line (Tenkan-Sen) is now trendy down and has crossed the basic line, which often reflects the short-term lower momentum. Meanwhile, the scope of leader A (Green Cloud Frontier) begins to flatten itself, while the range of range B (red limit) remains relatively horizontal, forming a slim and neutral cloud to come.

This type of fine and flat cloud suggests an indecision on the market and a lack of momentum with a high trend. The price hovering just below the cloud further reinforces the idea that BTC is in the consolidation phase rather than a clear trend.

If the price can break above the cloud and maintain this level, it could point out a renewed bullish force.

However, continuous rejection to the cloud and the pressure of the fall of Tenkan-Sen could maintain the BTC in a corrective or lateral structure. For the moment, the configuration of Ichimoku reflects uncertainty, without any dominant tendency confirmed in both directions.

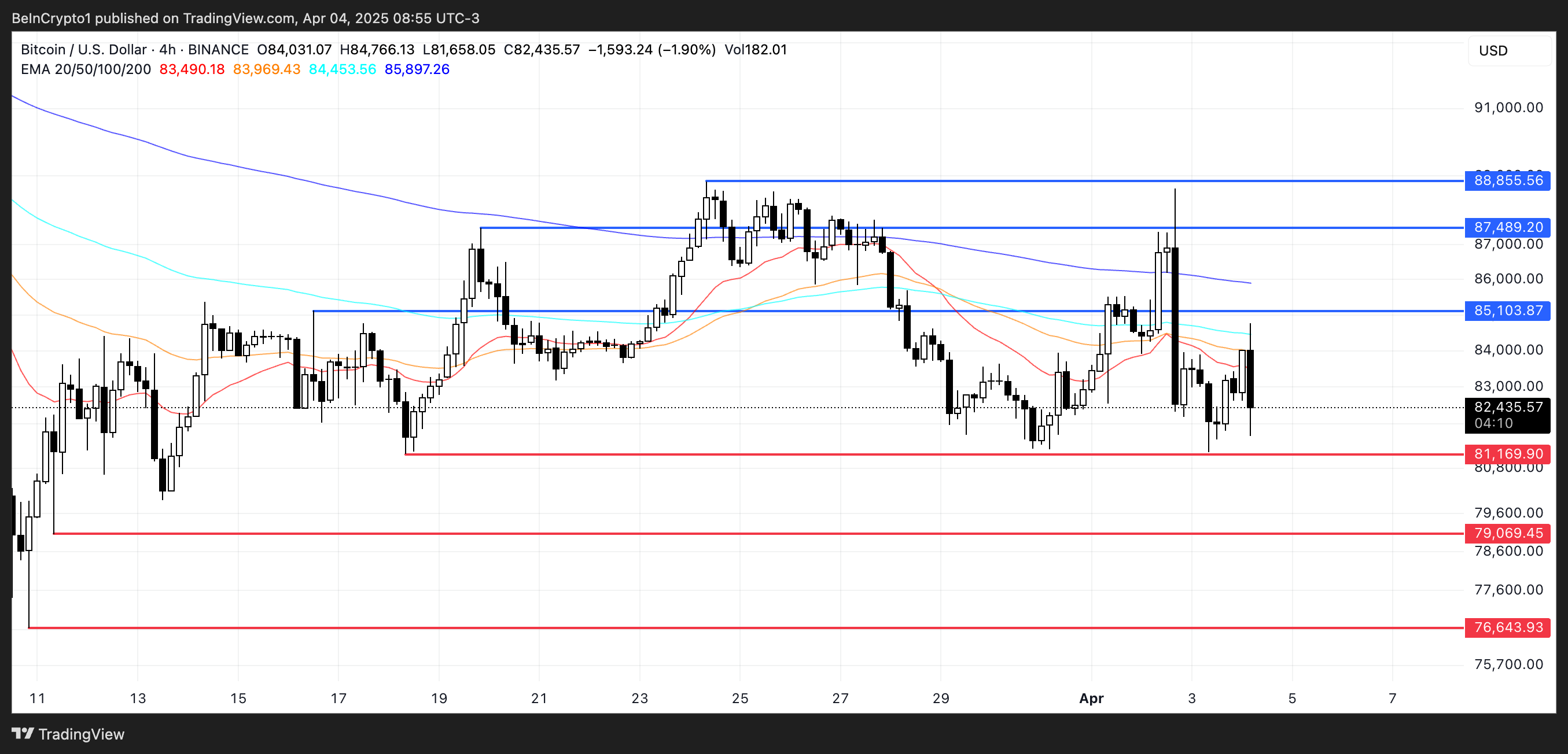

Will Bitcoin return to $ 88,000 in April?

The EMA structure of Bitcoin always leans overall, with longer term EMA positioned above those in the short term. However, the recent ascending movement in the short -term EMA suggests that a rebound could form.

If this short -term resistance turns into a sustained decision, Bitcoin could first test resistance at $ 85,103. A successful break above this level can point out a change of momentum, opening the door to higher targets at $ 87,489. Recently, Standard Charted predicted that BTC should break $ 88,500 this weekend.

If the upward pressure remains strong beyond this point, the price of Bitcoin could push even further to challenge $ 88,855, a level that would mark a more convincing recovery of the recent decline.

“(…) After the volatility of Wednesday, the BTC rebounded more than 4% and remains firmly greater than $ 79,000, with a level of key support forming $ 80,000 and slightly higher daily exchange volumes, which is a positive sign. Office, said Beincrypto.

However, if Bitcoin fails to create enough momentum for this rebound, downward risks remain. The first key level to watch is the support at $ 81,169.

While the trade war between China and the United States degenerates, a drop below this level could see the BTC falling under the psychological bar of $ 80,000, with the following target around $ 79,069. If this area is also lost, the downward trend could intensify, sending BTC below around $ 76,643.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.