MicroStrategy Buys No Bitcoin, Breaking 12-Week Streak

According to Michael Saylor, Microstrategy finally broke his sequence of 12 weeks of consecutive weekly Bitcoin. The company has not sold any ordinary class actions this week, and it did not use the product to buy BTC.

The company may have billions of taxes on its unpaid earnings, and the Bitcoin price is extremely volatile due to American prices and political instability. However, Saylor has given very little indication of the next microstrategy movement.

Microstrategy stops buying bitcoin

Since Michael Saylor began directing Microstrategy to acquire Bitcoin, the company has become one of the biggest BTC holders in the world.

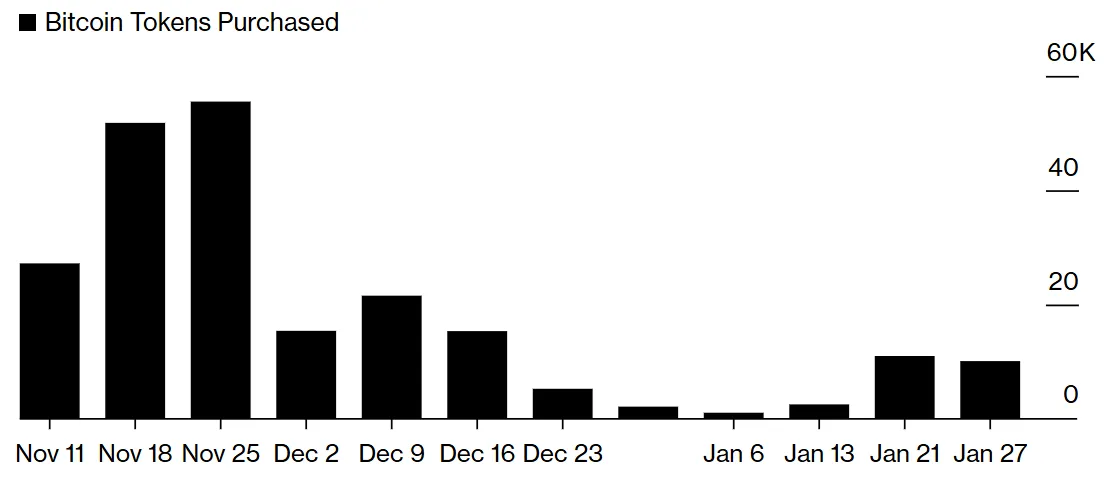

Since the end of October, the company has made at least one purchase each week, going from immense purchases to slowly reduce the acquisition sizes. Microstrategy began to issue more actions to increase acquisitions, but Saylor has just announced a general break:

“Last week, Microstrategy did not have any class actions ordinary as part of its market stock program and did not buy Bitcoin. As of February 2, 2025, we hold 471,107 BTC acquired for ~ $ 30.4 billion dollars at around $ 64,511 per Bitcoin, “said Saylor.

This announcement left the community somewhat confused. In December, there were credible rumors that Microstrategy could suspend his Bitcoin purchases in January.

However, this break did not occur and the acquisitions of the company in fact increased towards the end of the month. It is therefore surprising that the company interrupted its purchases, apparently when the BTC price presented notable purchase opportunities last week.

Some factors may have contributed to this change in tactics. On the one hand, the value of Bitcoin is in a difficult situation. Since the threat of American prices against Mexico, Canada and China, IT and the wider cryptography market have taken a nose.

With another economic chaos looming on the horizon, microstrategy can adopt a conservative approach to Bitcoin investment.

There is also another factor. Although BTC has plunged today, he was in a bullish market supported otherwise. Microstrategy may have billions of unpublished earnings regarding its Bitcoin prices, which would add more complexity to a delicate situation.

For the moment, it is difficult to predict where the company will go from here.

An important consideration is the break on sales sales alongside BTC purchases. Microstrategy used them to finance its accumulation of bitcoin, and the company can stop committing so much to the asset.

Michael Saylor has not given any direct indication of knowing if he will resume these purchases soon. Many factors are in the air at the moment, but the company remains attached to its Bitcoin strategy first.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.