Centralized Exchanges Trading Volume Plunges in June 2025

Binance, Kucoin, Upbit and several other major centralized exchanges simultaneously recorded significant drops, painting a contrasting image of the cryptocurrency market in the summer of 2025.

Although this can only be a temporary adjustment, it also reflects a more prudent investment landscape, accompanied by changes in the behavior of modern cryptography users.

CEX gradually lose spotlights

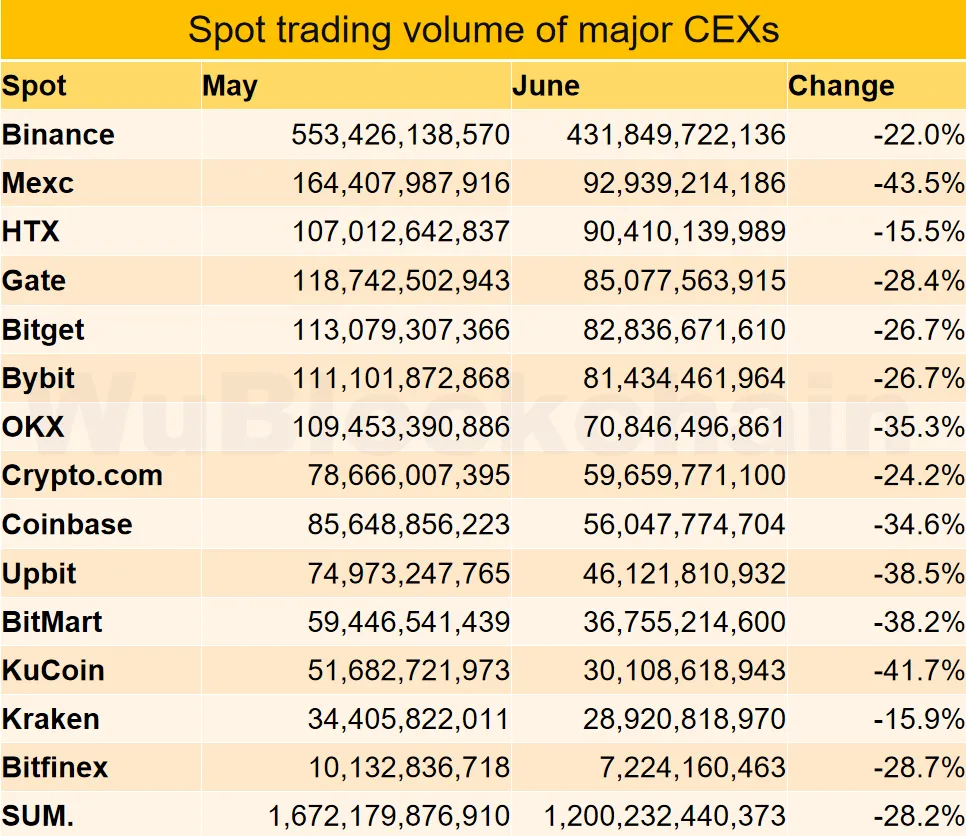

In the midst of a volatile cryptography market shaped by problems of liquidity and the transition of investors, a recent report by Wu Blockchain reveals a disturbing trend. Trading volumes on centralized scholarships (CEX) fell sharply in June 2025.

According to the report, most of the major centralized scholarships experienced a significant drop in negotiation volumes last month. The three platforms with the most steep drops were Mexc (-44%), Kucoin (-42%) and Upbit (-39%).

These exchanges are widely used by retail users in Asia, in particular in South Korea and Southeast Asia. This trend may indicate the decline of speculative capital in these regions.

At the other end of the spectrum, the three exchanges with more moderate declines were HTX (-15%), Kraken (-16%) and Binance (-22%). Although Binance remains one of the largest platforms by market capitalization and systematically leads to liquidity, the drop of more than 20% of the negotiation volume suggests increasing prudence of investors.

The drop in wide commercial volume based in June can be assigned to several factors.

First, after the high growth phase at the beginning of 2025, the cryptography market entered a correction period. The absence of solid catalysts such as Bitcoin Spot ETF also led to a significant drop in market participation.

Second, the ongoing geopolitical conflicts exert pressure on risk assets such as cryptocurrencies. Investors are increasingly retaining market funds looking for safer instruments such as bonds, deposit certificates or gold.

A user behavior change?

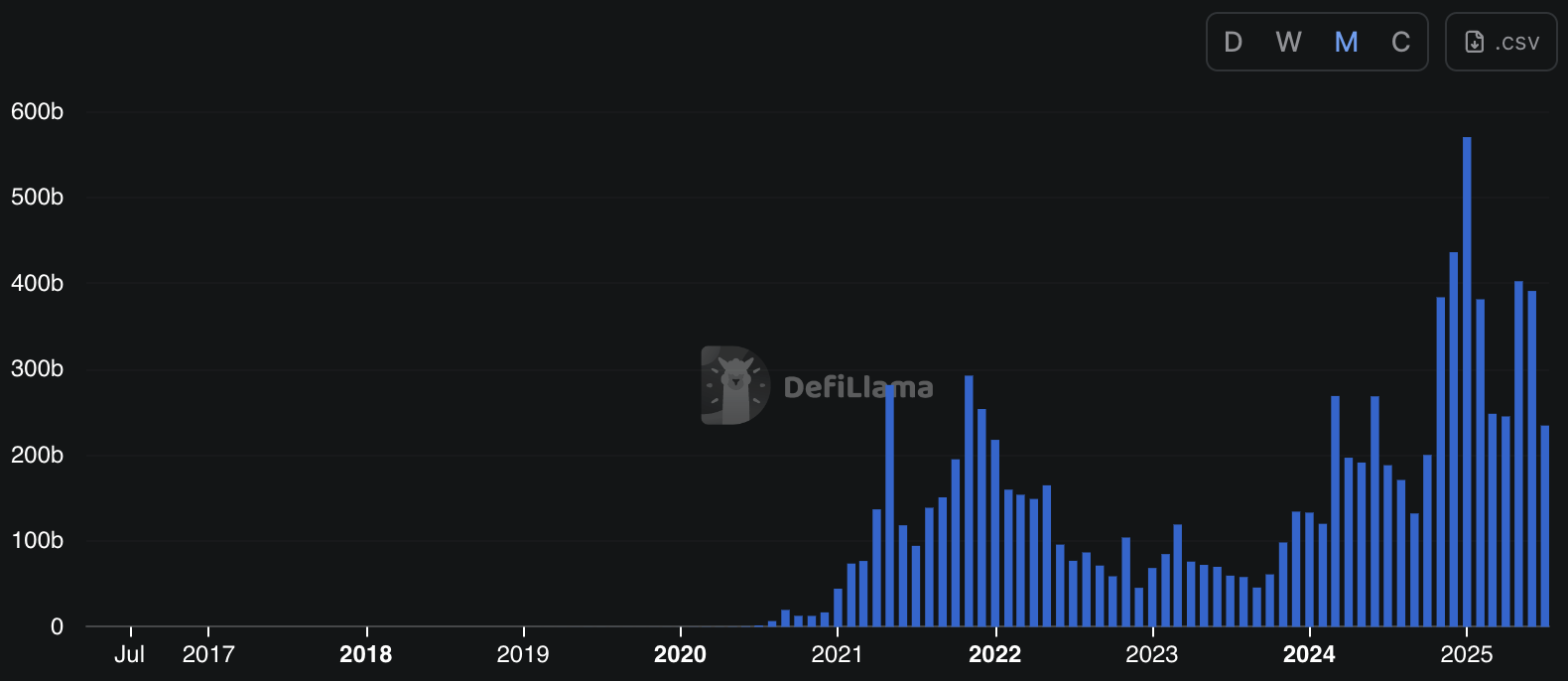

Another notable factor is the change in increasing capital to decentralized exchanges (DEX). A Defillama graph shows that the DEX negotiation volume in June 2025 reached around $ 391 billion. Although he recorded a slight decline compared to May ($ 402 billion), he also showed impressive growth compared to 2024.

In addition, Dexs characteristics also show many advantages for users who like confidentiality in transactions. As proposed by CZ, the dark pool model for perpetual term contracts should reshape the confidentiality and security of DEX.

However, it is important to emphasize that the drop in the volume of trading does not necessarily point out the appearance of a “cryptographic winter” as in 2022.

In addition, a large part of traders prefer decentralized trading platforms such as hyperliquid.

The last months of the third quarter and the beginning of the fourth quarter will be essential, in particular when the events for unlocking tokens, updates to the layer 2 project and the political developments of the United States and Europe are gradually entering.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.