New Bitcoin Whales May Be Capping BTC Breakout Near $110,000

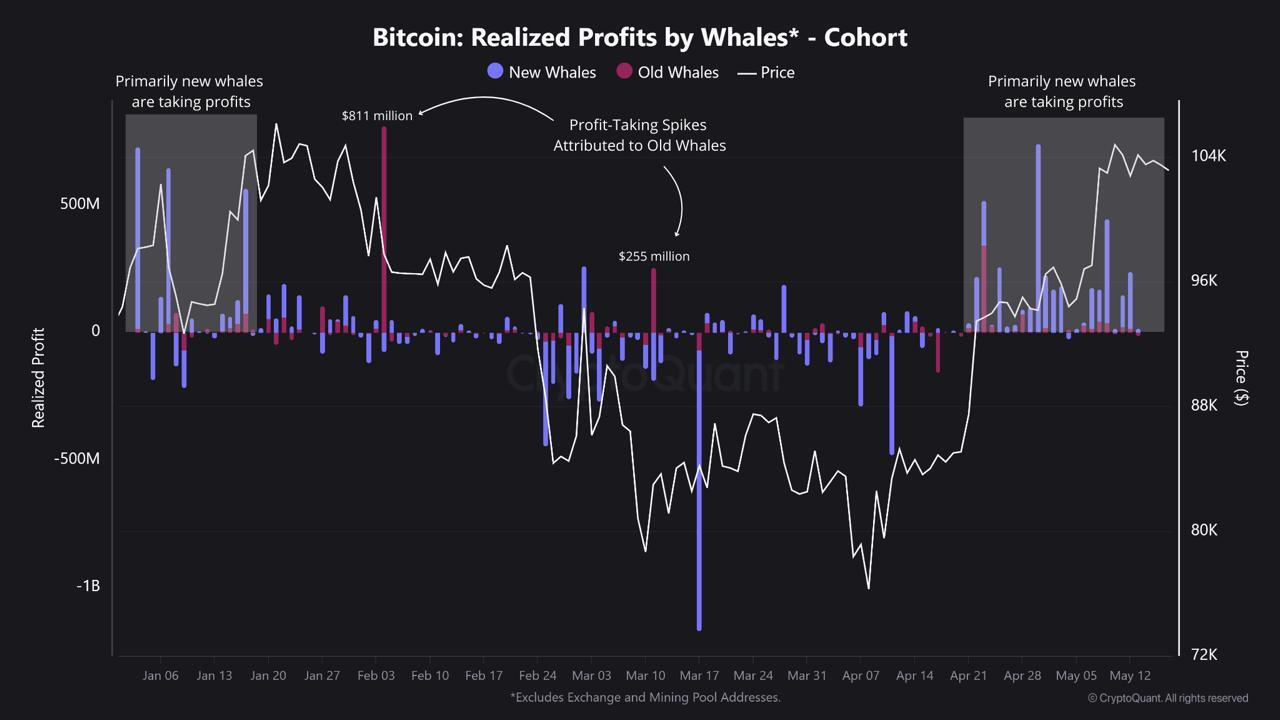

Bitcoin continues to fly over the $ 110,000 mark despite a new top of all time last week. The absence of an additional thrust is probably due to the profit taking by new whales, according to data on the chain.

Since April 20, the Bitcoin price has increased by more than 30% against $ 84,000. However, the rally has blocked since it reached a record peak of $ 111,970 on May 22. Analysts claim that the price set can be linked to the sales pressure from recently established whale addresses.

Do new whales restrict the price of Bitcoin?

The crypto cohort analysis shows a clear scheme. The majority of the profits in the last month have come from new whales, which took advantage of the gathering to lock the gains.

More specifically, it was investors who bought BTC at an average cost of $ 91,922.

“With such a rally, it is important to monitor whether the profits are made by new or old whales. Surprisingly, the data show that 82.5% of the realization since April 20 comes from new whales,” said Ja Maartunn de Cryptoant at Beincrypto.

The data also show that the new Bitcoin whales have carried out around $ 3.21 billion in profits. It is much larger of $ 679 million by older whale wallets.

This rotation of the earnings seems to exercise resistance just below the level of $ 112,000.

In addition, the following cryptocurrency graphic reflects how this trend was materialized before BTC reaches a top of all time last week. The blue bars, representing new whales, have dominated for -profit columns since the end of April.

The most recent shaded section highlights an increased activity of these new market players.

On the other hand, previous points in the profits made – such as the $ 811 million and $ 255 million in February and March – were allocated to the older whales.

Meanwhile, the tendency to take advantage continued this week.

This behavior change suggests that new whales grab recent tops to leave the positions they probably entered during the slowdown in Q1. These outputs create a sales pressure of persistent general costs, blocking more movement upwards.

At the same time, older whales remain largely inactive. Their reluctance to sell can report longer -term confidence in the Bitcoin trajectory, which potentially limits the risk of short -term decline.

Until this new sale of whales decreases, Bitcoin can find it difficult to overcome decisively above the current levels. The market observers will follow closely if this cohort continues to unload or take a break, allowing the price to find a renewed momentum.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.