No Rate Cut Soon, Crypto Banking Rules to Ease

The president of the federal reserve, Jerome Powell, reported Tuesday that cryptographic banking regulations will be partially softened. He also clearly indicated that a short -term interest rate drop remains unlikely.

Speaking at the Chicago Economic Club, Powell tackled the growing uncertainty resulting from commercial policy and has strengthened the prudent position of the Central Bank.

Powell by Fed Maitains A Help perspective

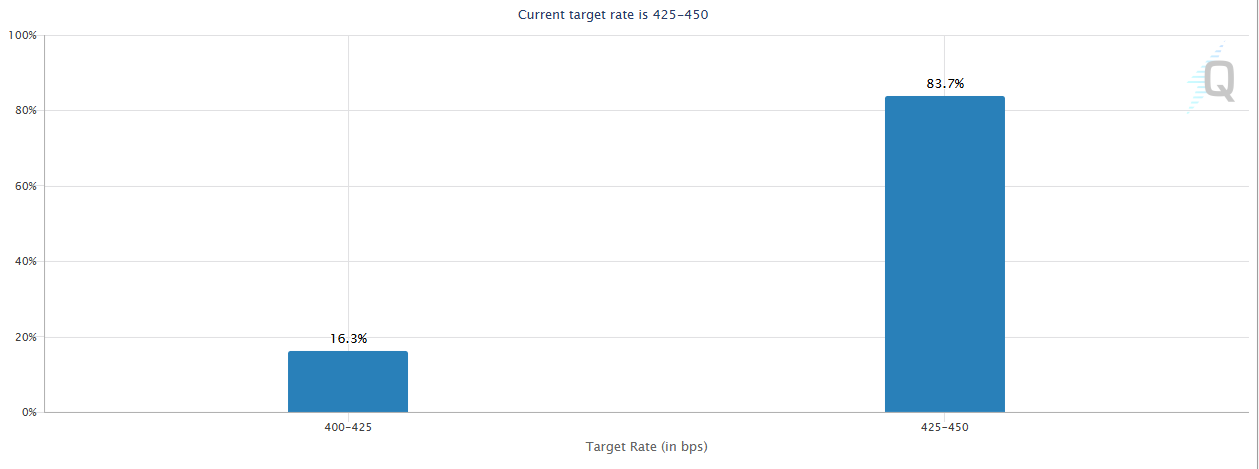

Powell’s remarks occur while market expectations for a drop in the May rate have collapsed, with the price of CME Fedwatch data in just 16%. American actions have lowered modestly after the speech. The equity market is currently reflecting the disappointment of investors concerning the lack of dominant signals.

“We must not rush to reduce interest rates,” said Powell. “We have every reason to wait more clarity before considering the modifications of the Fed policy.”

The cryptography market, however, remained relatively stable. The rate reduction optimism had already been evaluated after the Fomc Belliciennes minutes last week and CPI printing colder than expected.

Powell also offered direct comments on digital assets.

“Cryptocurrency is becoming more and more popular. A legal framework for Stablecoins is a good idea. ”

He added that the federal reserve supports the relaxation of certain banking regulations on the crypto. The federals agree that the sector ripens and requires more defined monitoring rather than a constraint.

The double message – no imminent policy, but a positive perspective for the regulation of cryptography – has encountered a silent response on the digital asset markets.

Bitcoin oscillated nearly $ 84,500, showing resilience despite the feeling of risk in actions. Powell recognized that economic growth had probably slowed down at the beginning of 2025 and warned that Trump’s prices are a “key source of uncertainty”.

He also noted that the Fed was not about to end the quantitative tightening and may need to make difficult political choices if inflation sounds.

While the Fed has reaffirmed its desire to provide liquidity in dollars to the world’s central banks if necessary, Powell rejected the idea of a Fed “put”. He said that the Central Bank’s independence is “a matter of law”.

For cryptographic markets, the regulatory tone was a silver lining in a macro environment that is also a herticalist.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.