No Short-term Rally, Bitcoin Bull Cycle is Over: CryptoQuant CEO Issues Warning

The Bitcoin price was blocked in a range, with its latest exchange greater than $ 90,000 on March 7. At the end of the previous year, Bitcoin had exceeded the $ 100,000 mark, but this step was short -lived as the price quickly dropped. Since then, Bitcoin has been on a downward trend, even below $ 80,000.

Adding to the market difficulties, the price announcement of President Trump has exerted additional pressure on cryptographic space, which makes most cryptocurrencies suffer alongside Bitcoin.

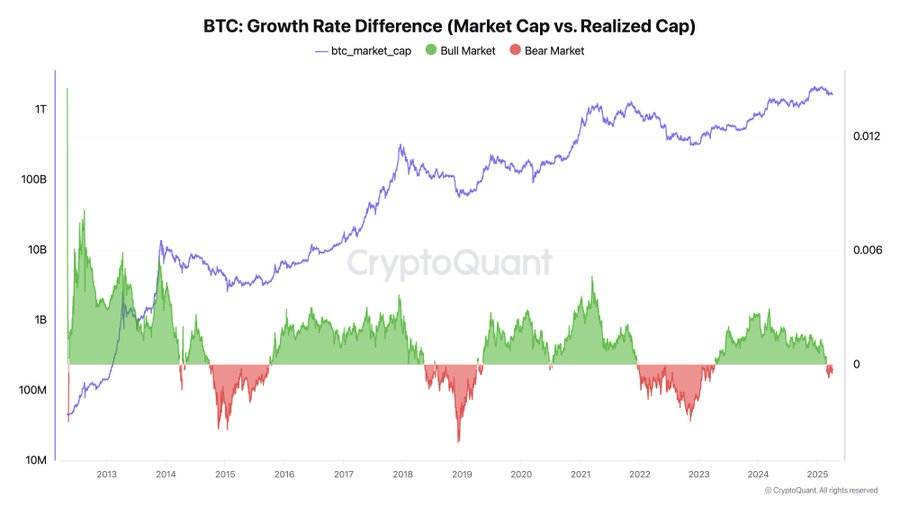

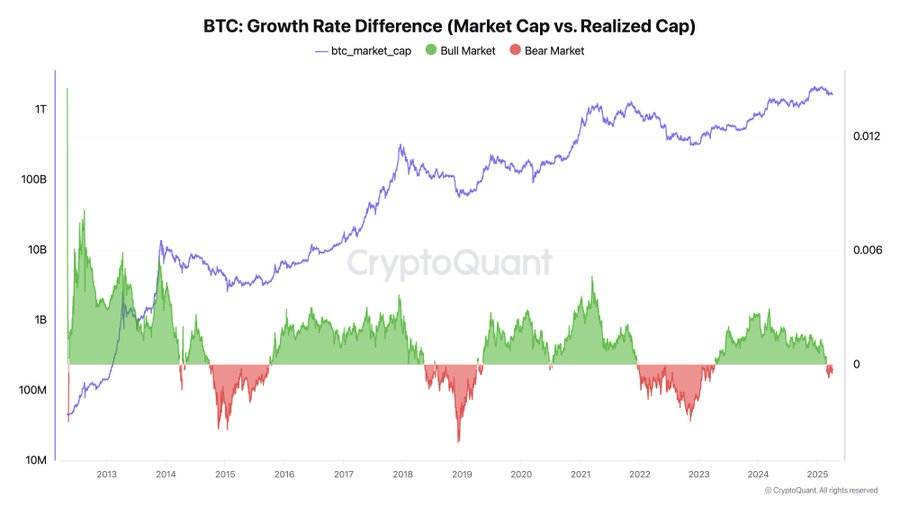

According to the CEO of Tecryptoan Ki Young Ju, the Haussier Bitcoin market seems to be finished, based on chain data analysis. The key metric is the ceiling carried out, which measures the real capital incoming on the market by following when BTC is purchased (entered a wallet) and sold (which has left a wallet).

“But when the sales pressure is high, even significant purchases fail to move the price. There are simply too many sellers. For example, when Bitcoin was negotiated nearly $ 100,000, the market experienced massive volumes, but the price has barely evolved,” he said.

When the ceiling carried out increases but the market capitalization (depending on the last negotiation price) remains stable or decreased, it indicates that money circulates, but prices do not respond – it is a lower sign. Right now, that’s exactly what’s going on.

On the other hand, if small amounts of new capital prices increase prices, it is a bull market. But currently, even large quantities of capital are not sufficient to pass the price of Bitcoin, indicating a lower market. Historically, real market reversions take at least six months, so rapid recovery is unlikely.

“In short: when the small capital increases prices, it is a bullish market. When even important capital cannot push prices upwards, it is a bear. Current data clearly point to the latter. The sales pressure could relax at any time, but historically, real reversions take at least six months-so a short-term rally seems unlikely”, he concluded.